ment CALCULATOR PILL SCREEN PR Problem 151 Part Level Submis

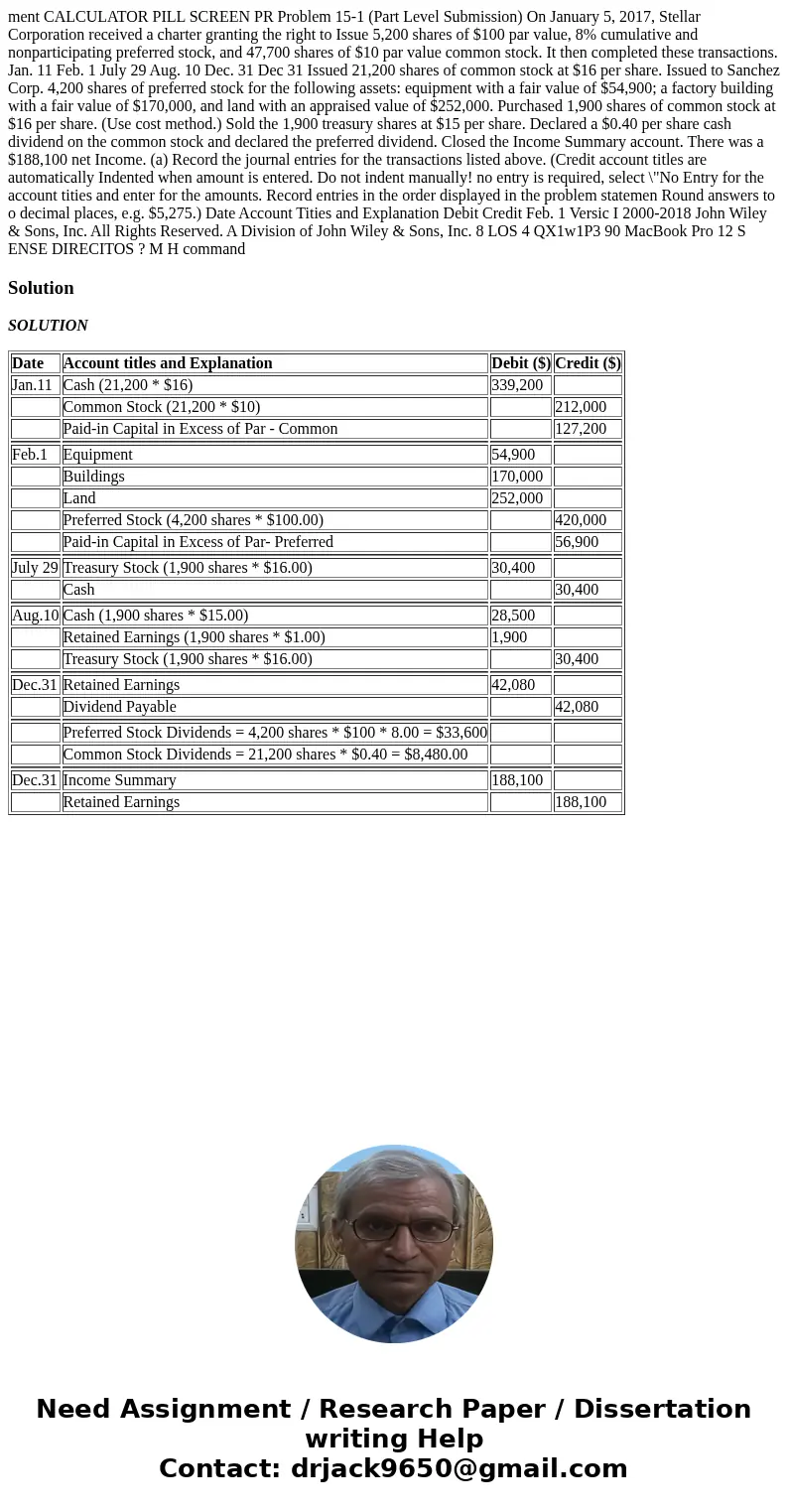

ment CALCULATOR PILL SCREEN PR Problem 15-1 (Part Level Submission) On January 5, 2017, Stellar Corporation received a charter granting the right to Issue 5,200 shares of $100 par value, 8% cumulative and nonparticipating preferred stock, and 47,700 shares of $10 par value common stock. It then completed these transactions. Jan. 11 Feb. 1 July 29 Aug. 10 Dec. 31 Dec 31 Issued 21,200 shares of common stock at $16 per share. Issued to Sanchez Corp. 4,200 shares of preferred stock for the following assets: equipment with a fair value of $54,900; a factory building with a fair value of $170,000, and land with an appraised value of $252,000. Purchased 1,900 shares of common stock at $16 per share. (Use cost method.) Sold the 1,900 treasury shares at $15 per share. Declared a $0.40 per share cash dividend on the common stock and declared the preferred dividend. Closed the Income Summary account. There was a $188,100 net Income. (a) Record the journal entries for the transactions listed above. (Credit account titles are automatically Indented when amount is entered. Do not indent manually! no entry is required, select \"No Entry for the account tities and enter for the amounts. Record entries in the order displayed in the problem statemen Round answers to o decimal places, e.g. $5,275.) Date Account Tities and Explanation Debit Credit Feb. 1 Versic I 2000-2018 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. 8 LOS 4 QX1w1P3 90 MacBook Pro 12 S ENSE DIRECITOS ? M H command

Solution

SOLUTION

| Date | Account titles and Explanation | Debit ($) | Credit ($) |

| Jan.11 | Cash (21,200 * $16) | 339,200 | |

| Common Stock (21,200 * $10) | 212,000 | ||

| Paid-in Capital in Excess of Par - Common | 127,200 | ||

| Feb.1 | Equipment | 54,900 | |

| Buildings | 170,000 | ||

| Land | 252,000 | ||

| Preferred Stock (4,200 shares * $100.00) | 420,000 | ||

| Paid-in Capital in Excess of Par- Preferred | 56,900 | ||

| July 29 | Treasury Stock (1,900 shares * $16.00) | 30,400 | |

| Cash | 30,400 | ||

| Aug.10 | Cash (1,900 shares * $15.00) | 28,500 | |

| Retained Earnings (1,900 shares * $1.00) | 1,900 | ||

| Treasury Stock (1,900 shares * $16.00) | 30,400 | ||

| Dec.31 | Retained Earnings | 42,080 | |

| Dividend Payable | 42,080 | ||

| Preferred Stock Dividends = 4,200 shares * $100 * 8.00 = $33,600 | |||

| Common Stock Dividends = 21,200 shares * $0.40 = $8,480.00 | |||

| Dec.31 | Income Summary | 188,100 | |

| Retained Earnings | 188,100 |

Homework Sourse

Homework Sourse