The following transactions and adjusting entries were comple

Solution

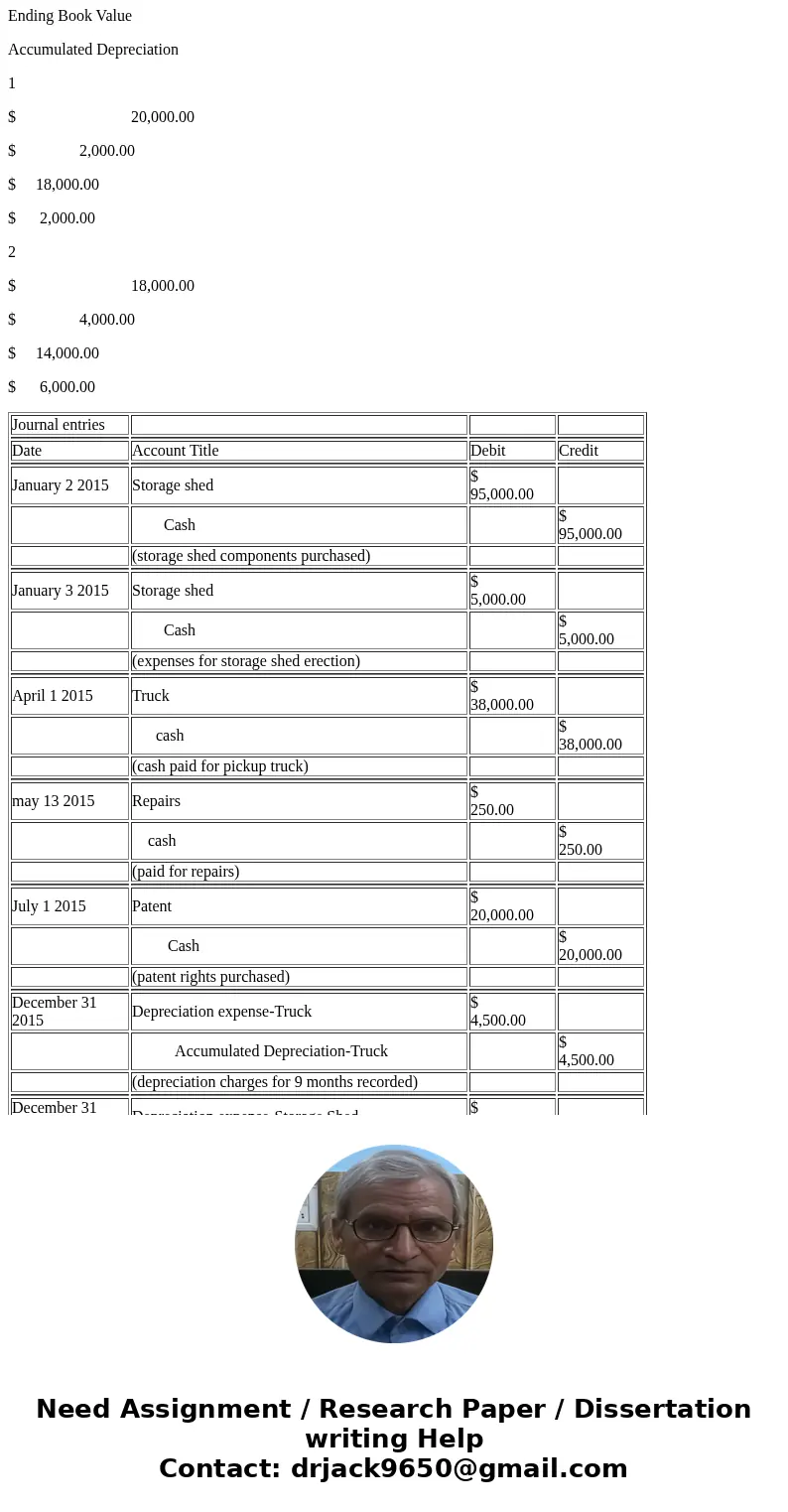

Journal entries

Date

Account Title

Debit

Credit

January 2 2015

Storage shed

$ 95,000.00

Cash

$ 95,000.00

(storage shed components purchased)

January 3 2015

Storage shed

$ 5,000.00

Cash

$ 5,000.00

(expenses for storage shed erection)

April 1 2015

Truck

$ 38,000.00

cash

$ 38,000.00

(cash paid for pickup truck)

may 13 2015

Repairs

$ 250.00

cash

$ 250.00

(paid for repairs)

July 1 2015

Patent

$ 20,000.00

Cash

$ 20,000.00

(patent rights purchased)

December 31 2015

Depreciation expense-Truck

$ 4,500.00

Accumulated Depreciation-Truck

$ 4,500.00

(depreciation charges for 9 months recorded)

December 31 2015

Depreciation expense-Storage Shed

$ 20,000.00

Accumulated Depreciation-Storage Shed

$ 20,000.00

(depreciation on shed)

December 31 2015

Depreciation expense-Patent

$ 2,000.00

Accumulated Depreciation-Patent

$ 2,000.00

(depreciation on Patent)

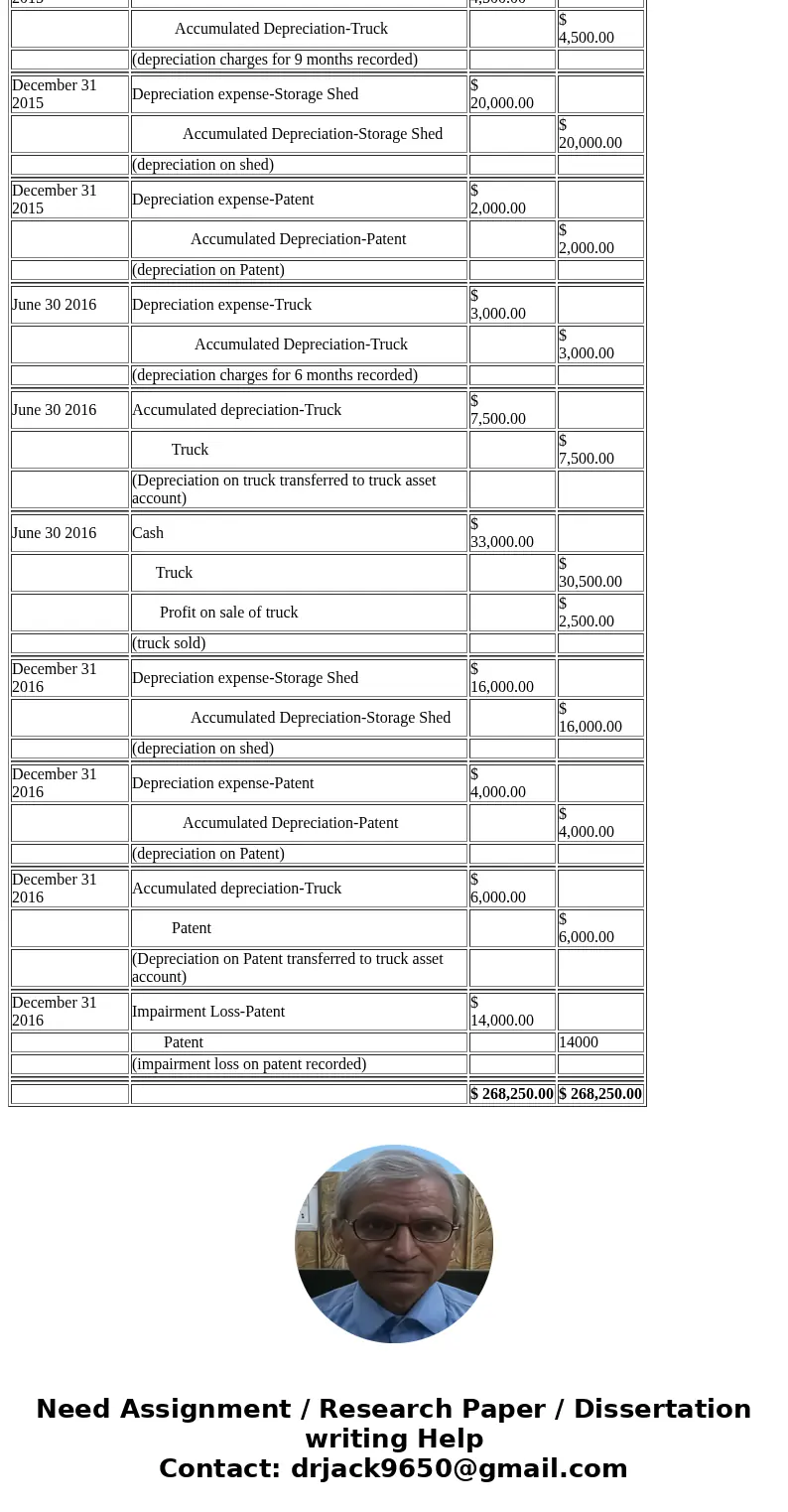

June 30 2016

Depreciation expense-Truck

$ 3,000.00

Accumulated Depreciation-Truck

$ 3,000.00

(depreciation charges for 6 months recorded)

June 30 2016

Accumulated depreciation-Truck

$ 7,500.00

Truck

$ 7,500.00

(Depreciation on truck transferred to truck asset account)

June 30 2016

Cash

$ 33,000.00

Truck

$ 30,500.00

Profit on sale of truck

$ 2,500.00

(truck sold)

December 31 2016

Depreciation expense-Storage Shed

$ 16,000.00

Accumulated Depreciation-Storage Shed

$ 16,000.00

(depreciation on shed)

December 31 2016

Depreciation expense-Patent

$ 4,000.00

Accumulated Depreciation-Patent

$ 4,000.00

(depreciation on Patent)

December 31 2016

Accumulated depreciation-Truck

$ 6,000.00

Patent

$ 6,000.00

(Depreciation on Patent transferred to truck asset account)

December 31 2016

Impairment Loss-Patent

$ 14,000.00

Patent

14000

(impairment loss on patent recorded)

$ 268,250.00

$ 268,250.00

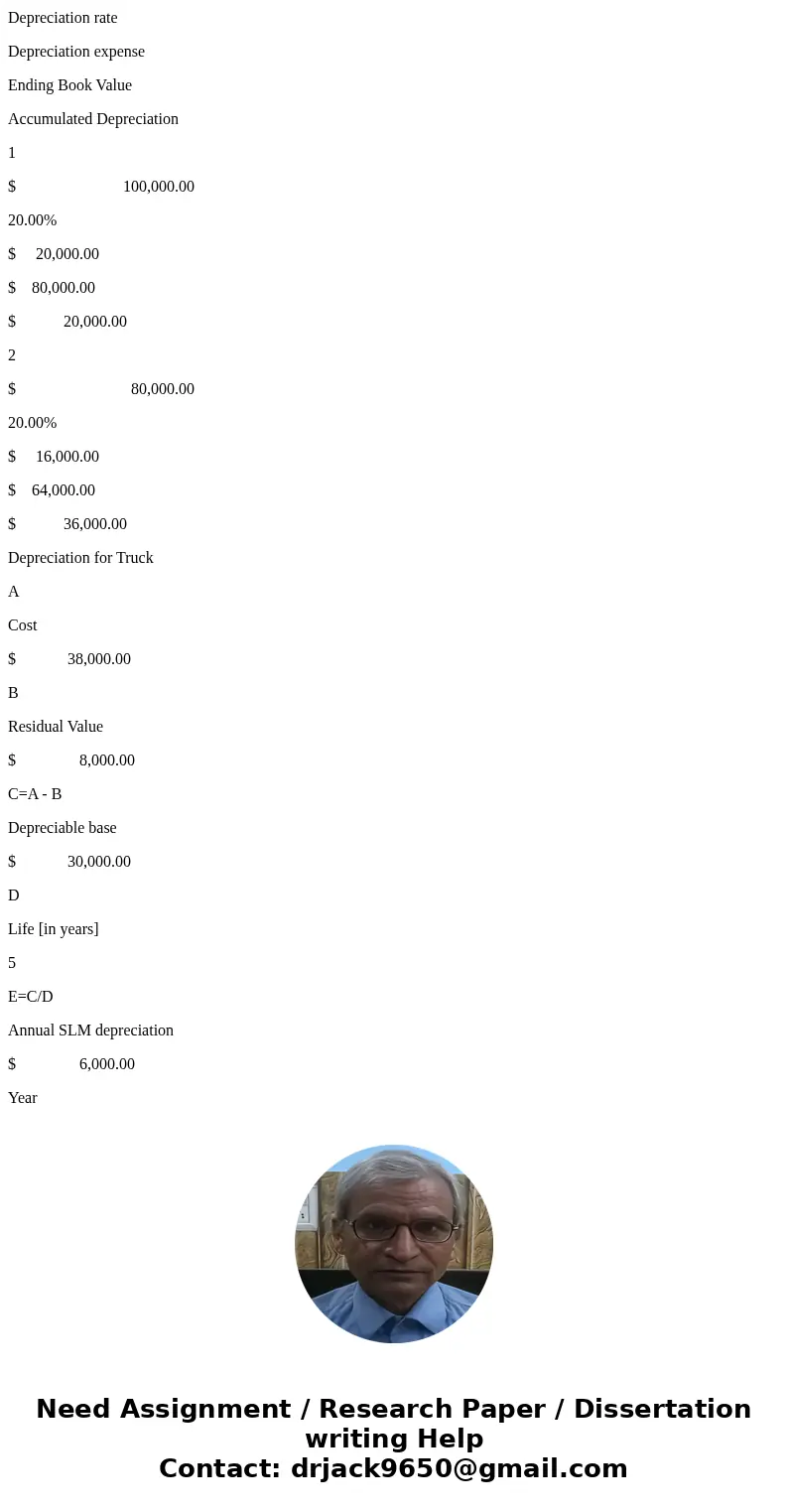

Depreciation for Shed

A

Cost

$ 100,000.00

B

Residual Value

$ 10,000.00

C=A - B

Depreciable base

$ 90,000.00

D

Life [in years]

10

E=C/D

Annual SLM depreciation

$ 9,000.00

F=E/C

SLM Rate

10.00%

G=F x 2

DDB Rate

20.00%

Year

Beginning Book Value

Depreciation rate

Depreciation expense

Ending Book Value

Accumulated Depreciation

1

$ 100,000.00

20.00%

$ 20,000.00

$ 80,000.00

$ 20,000.00

2

$ 80,000.00

20.00%

$ 16,000.00

$ 64,000.00

$ 36,000.00

Depreciation for Truck

A

Cost

$ 38,000.00

B

Residual Value

$ 8,000.00

C=A - B

Depreciable base

$ 30,000.00

D

Life [in years]

5

E=C/D

Annual SLM depreciation

$ 6,000.00

Year

Book Value

Depreciation expense

Ending Book Value

Accumulated Depreciation

1

$ 38,000.00

$ 4,500.00

$ 33,500.00

$ 4,500.00

2

$ 33,500.00

$ 3,000.00

$ 30,500.00

$ 7,500.00

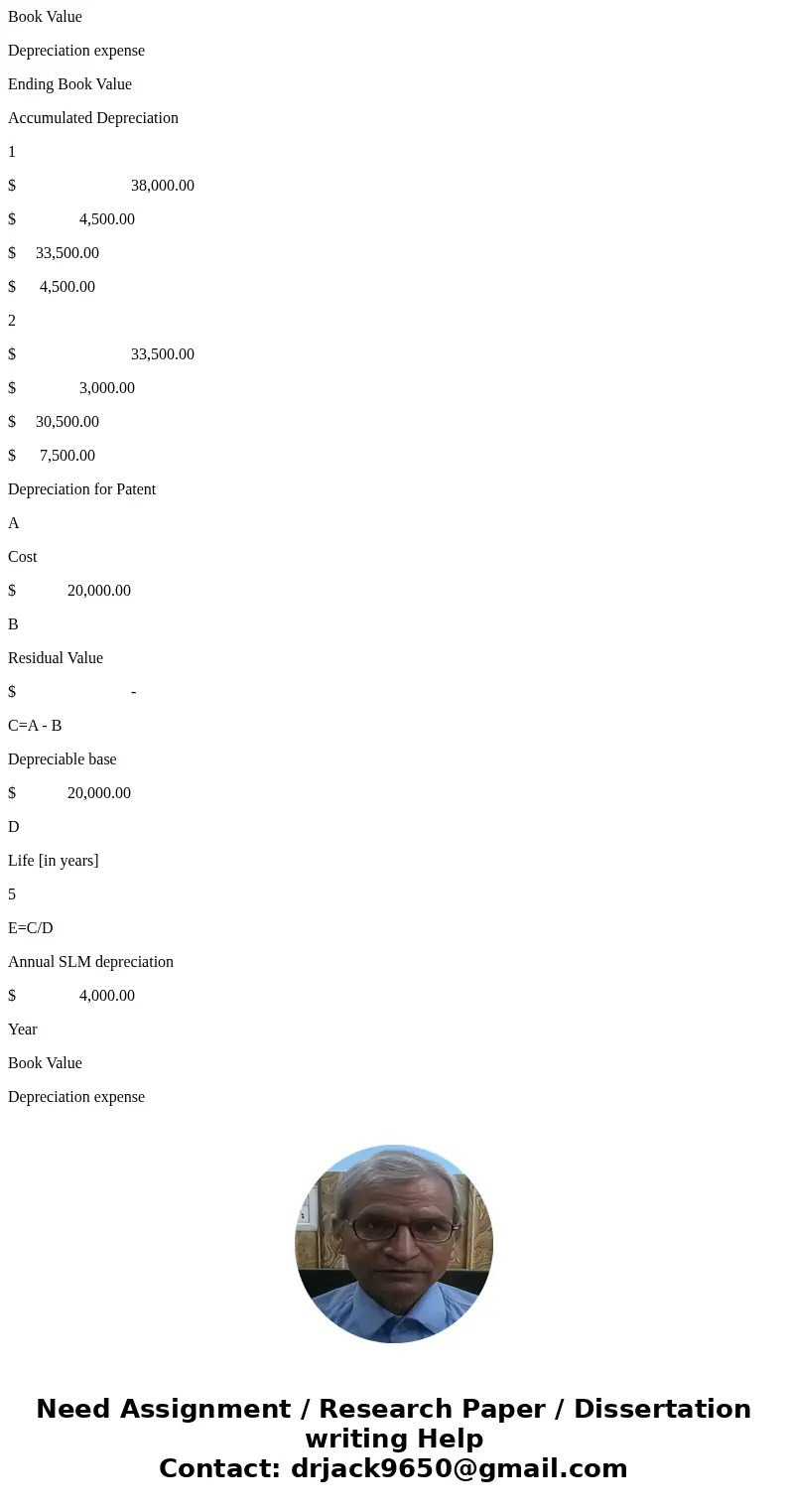

Depreciation for Patent

A

Cost

$ 20,000.00

B

Residual Value

$ -

C=A - B

Depreciable base

$ 20,000.00

D

Life [in years]

5

E=C/D

Annual SLM depreciation

$ 4,000.00

Year

Book Value

Depreciation expense

Ending Book Value

Accumulated Depreciation

1

$ 20,000.00

$ 2,000.00

$ 18,000.00

$ 2,000.00

2

$ 18,000.00

$ 4,000.00

$ 14,000.00

$ 6,000.00

| Journal entries | |||

| Date | Account Title | Debit | Credit |

| January 2 2015 | Storage shed | $ 95,000.00 | |

| Cash | $ 95,000.00 | ||

| (storage shed components purchased) | |||

| January 3 2015 | Storage shed | $ 5,000.00 | |

| Cash | $ 5,000.00 | ||

| (expenses for storage shed erection) | |||

| April 1 2015 | Truck | $ 38,000.00 | |

| cash | $ 38,000.00 | ||

| (cash paid for pickup truck) | |||

| may 13 2015 | Repairs | $ 250.00 | |

| cash | $ 250.00 | ||

| (paid for repairs) | |||

| July 1 2015 | Patent | $ 20,000.00 | |

| Cash | $ 20,000.00 | ||

| (patent rights purchased) | |||

| December 31 2015 | Depreciation expense-Truck | $ 4,500.00 | |

| Accumulated Depreciation-Truck | $ 4,500.00 | ||

| (depreciation charges for 9 months recorded) | |||

| December 31 2015 | Depreciation expense-Storage Shed | $ 20,000.00 | |

| Accumulated Depreciation-Storage Shed | $ 20,000.00 | ||

| (depreciation on shed) | |||

| December 31 2015 | Depreciation expense-Patent | $ 2,000.00 | |

| Accumulated Depreciation-Patent | $ 2,000.00 | ||

| (depreciation on Patent) | |||

| June 30 2016 | Depreciation expense-Truck | $ 3,000.00 | |

| Accumulated Depreciation-Truck | $ 3,000.00 | ||

| (depreciation charges for 6 months recorded) | |||

| June 30 2016 | Accumulated depreciation-Truck | $ 7,500.00 | |

| Truck | $ 7,500.00 | ||

| (Depreciation on truck transferred to truck asset account) | |||

| June 30 2016 | Cash | $ 33,000.00 | |

| Truck | $ 30,500.00 | ||

| Profit on sale of truck | $ 2,500.00 | ||

| (truck sold) | |||

| December 31 2016 | Depreciation expense-Storage Shed | $ 16,000.00 | |

| Accumulated Depreciation-Storage Shed | $ 16,000.00 | ||

| (depreciation on shed) | |||

| December 31 2016 | Depreciation expense-Patent | $ 4,000.00 | |

| Accumulated Depreciation-Patent | $ 4,000.00 | ||

| (depreciation on Patent) | |||

| December 31 2016 | Accumulated depreciation-Truck | $ 6,000.00 | |

| Patent | $ 6,000.00 | ||

| (Depreciation on Patent transferred to truck asset account) | |||

| December 31 2016 | Impairment Loss-Patent | $ 14,000.00 | |

| Patent | 14000 | ||

| (impairment loss on patent recorded) | |||

| $ 268,250.00 | $ 268,250.00 |

Homework Sourse

Homework Sourse