Problem 45A A review of the ledger of Lewis Company at Decem

Solution

Answers

Working---

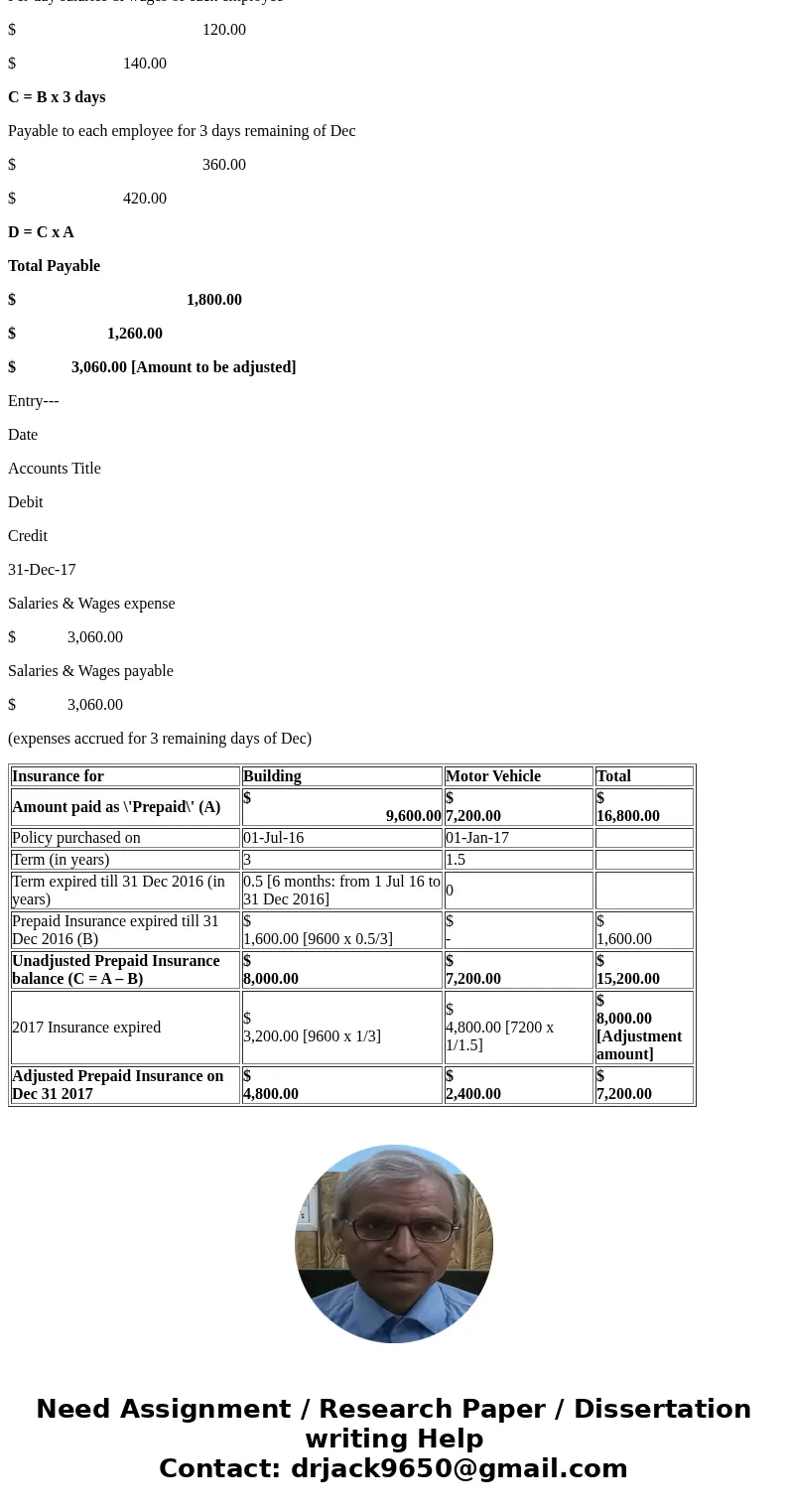

Insurance for

Building

Motor Vehicle

Total

Amount paid as \'Prepaid\' (A)

$ 9,600.00

$ 7,200.00

$ 16,800.00

Policy purchased on

01-Jul-16

01-Jan-17

Term (in years)

3

1.5

Term expired till 31 Dec 2016 (in years)

0.5 [6 months: from 1 Jul 16 to 31 Dec 2016]

0

Prepaid Insurance expired till 31 Dec 2016 (B)

$ 1,600.00 [9600 x 0.5/3]

$ -

$ 1,600.00

Unadjusted Prepaid Insurance balance (C = A – B)

$ 8,000.00

$ 7,200.00

$ 15,200.00

2017 Insurance expired

$ 3,200.00 [9600 x 1/3]

$ 4,800.00 [7200 x 1/1.5]

$ 8,000.00 [Adjustment amount]

Adjusted Prepaid Insurance on Dec 31 2017

$ 4,800.00

$ 2,400.00

$ 7,200.00

Entry---

Date

Accounts Title

Debit

Credit

31-Dec-17

Insurance Expense

$ 8,000.00

Prepaid Insurance

$ 8,000.00

(insurance expired for the period till 31 Dec)

Working---

Date

Term (in months)

Monthly rent

Number of Leases

Total Unearned revenue

Term expired till 31 Dec 2017

Unearned Revenue now Earned

[A]

[B]

[C]

[D = A x B x C]

[E]

[F = D x E/A]

Nov-01

9

$ 5,000.00

5

$ 2,25,000.00

2

$ 50,000.00

Dec-01

6

$ 8,500.00

4

$ 2,04,000.00

1

$ 34,000.00

Total

$ 13,500.00

$ 4,29,000.00

$ 84,000.00 [Adjustable amount]

Entry---

Date

Accounts Title

Debit

Credit

31-Dec-17

Unearned Rent Revenue

$ 84,000.00

Rent revenues

$ 84,000.00

(Unearned Revenue now earned till 31 Dec)

Working---

A

Notes Payable

$ 40,000.00

B

Annual Interest rate

7%

C = A x B

Annual Interest expense [12 months]

$ 2,800.00

D

Notes\' Term [months]

6

E

Date of Issue

01-Oct-17

F = Oct + Nov + Dec

No. of months till 31 Dec 2017

3

G = C x(3/12)

Interest expense to be adjusted

$ 700.00 [ 2800 x 3/12]

Entry---

Date

Accounts Title

Debit

Credit

31-Dec-17

Interest expense

$ 700.00

Interest payable

$ 700.00

(interest expense for 3 months accrued)

Working---

$600 per week

$700 per week

Total

A

No. of employees

5

3

8

B = Per week $ Salary / 5 days

Per day salaries & wages of each employee

$ 120.00

$ 140.00

C = B x 3 days

Payable to each employee for 3 days remaining of Dec

$ 360.00

$ 420.00

D = C x A

Total Payable

$ 1,800.00

$ 1,260.00

$ 3,060.00 [Amount to be adjusted]

Entry---

Date

Accounts Title

Debit

Credit

31-Dec-17

Salaries & Wages expense

$ 3,060.00

Salaries & Wages payable

$ 3,060.00

(expenses accrued for 3 remaining days of Dec)

| Insurance for | Building | Motor Vehicle | Total |

| Amount paid as \'Prepaid\' (A) | $ 9,600.00 | $ 7,200.00 | $ 16,800.00 |

| Policy purchased on | 01-Jul-16 | 01-Jan-17 | |

| Term (in years) | 3 | 1.5 | |

| Term expired till 31 Dec 2016 (in years) | 0.5 [6 months: from 1 Jul 16 to 31 Dec 2016] | 0 | |

| Prepaid Insurance expired till 31 Dec 2016 (B) | $ 1,600.00 [9600 x 0.5/3] | $ - | $ 1,600.00 |

| Unadjusted Prepaid Insurance balance (C = A – B) | $ 8,000.00 | $ 7,200.00 | $ 15,200.00 |

| 2017 Insurance expired | $ 3,200.00 [9600 x 1/3] | $ 4,800.00 [7200 x 1/1.5] | $ 8,000.00 [Adjustment amount] |

| Adjusted Prepaid Insurance on Dec 31 2017 | $ 4,800.00 | $ 2,400.00 | $ 7,200.00 |

Homework Sourse

Homework Sourse