2 value 166 points M78 Calculating Cost of Goods Available f

Solution

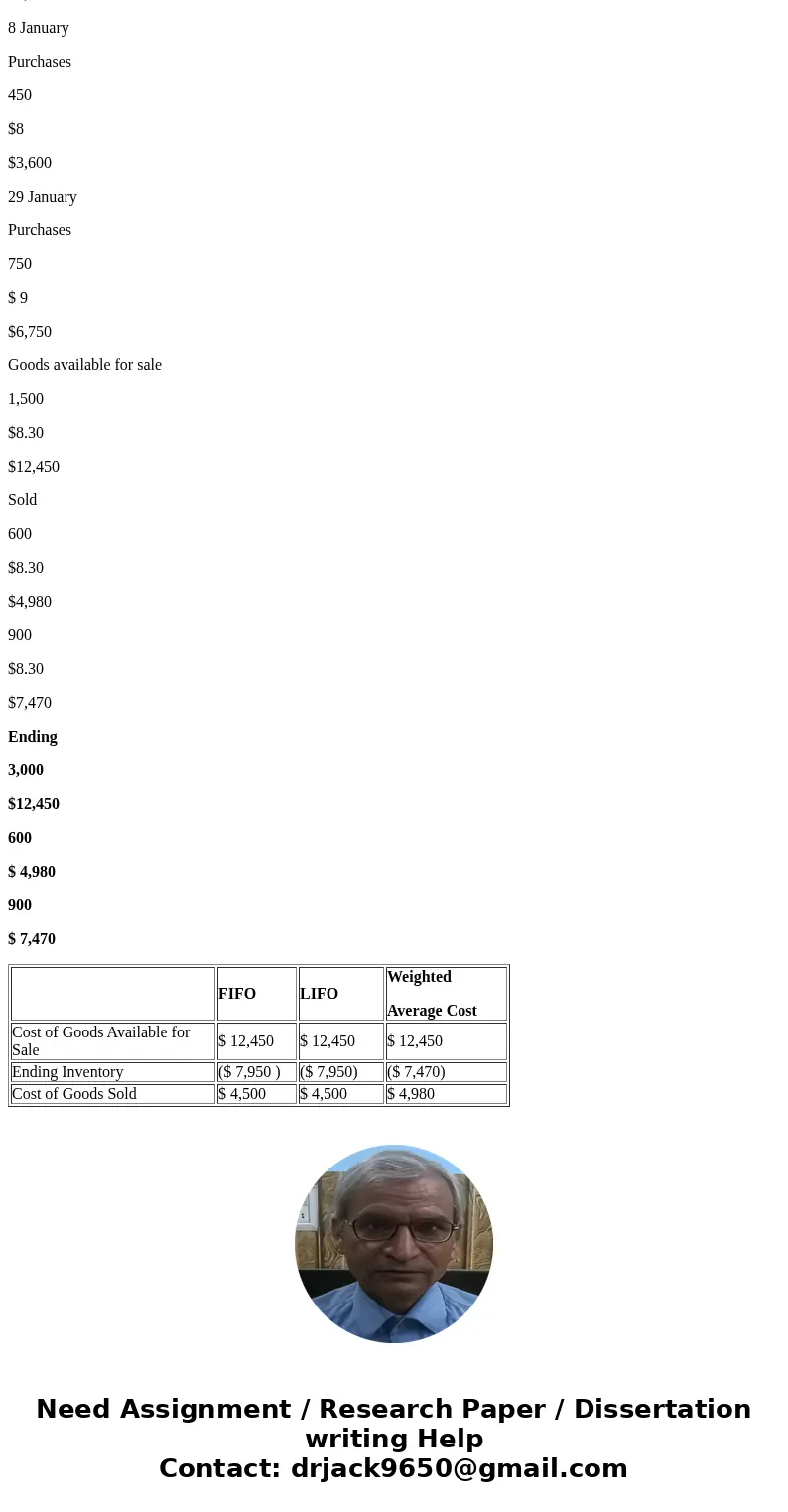

FIFO

LIFO

Weighted

Average Cost

Cost of Goods Available for Sale

$ 12,450

$ 12,450

$ 12,450

Ending Inventory

($ 7,950 )

($ 7,950)

($ 7,470)

Cost of Goods Sold

$ 4,500

$ 4,500

$ 4,980

Explanation:

FIFO (Periodic)

Receipts

Cost of Goods Sold

Balance

Description

Qty

Rate

Amount

Qty

Rate

Amount

Qty

Rate

Amount

1 January

Purchases

300

$7

$2,100

8 January

Purchases

450

$8

$3,600

29 January

Purchases

750

$9

$6,750

Sold

300

$7

$2,100

Sold

300

$8

$2,400

150

$8

$1,200

750

$9

$6,750

Ending

1,500

$12,450

600

$ 4,500

900

$ 7,950

LIFO (Periodic)

Receipts

Cost of Goods Sold

Balance

Description

Qty

Rate

Amount

Qty

Rate

Amount

Qty

Rate

Amount

1 January

Purchases

300

$7

$2,100

8 January

Purchases

450

$8

$3,600

29 January

Purchases

750

$9

$6,750

Sold

600

$ 9

$5,400

150

$9

$1,350

450

$8

$3,600

300

$7

$2,100

Ending

1,500

$12,450

600

$ 5,400

900

$ 7,050

Weighted average (Periodic)

Receipts

Cost of Goods Sold

Balance

Description

Qty

Rate

Amount

Qty

Rate

Amount

Qty

Rate

Amount

1 January

Purchases

300

$7

$2,100

8 January

Purchases

450

$8

$3,600

29 January

Purchases

750

$ 9

$6,750

Goods available for sale

1,500

$8.30

$12,450

Sold

600

$8.30

$4,980

900

$8.30

$7,470

Ending

3,000

$12,450

600

$ 4,980

900

$ 7,470

| FIFO | LIFO | Weighted Average Cost | |

| Cost of Goods Available for Sale | $ 12,450 | $ 12,450 | $ 12,450 |

| Ending Inventory | ($ 7,950 ) | ($ 7,950) | ($ 7,470) |

| Cost of Goods Sold | $ 4,500 | $ 4,500 | $ 4,980 |

Homework Sourse

Homework Sourse