A business borrowed 60430 on March 1 of the current year by

A business borrowed $60,430 on March 1 of the current year by signing a 30 day, 9% interest bearing note. Assuming a 360-day year, when the note is paid on March 31, the entry to record the payment should include a

debit to Interest Payable for $453

debit to Interest Expense for $453

credit to Cash for $60,430

credit to Cash for $65,869

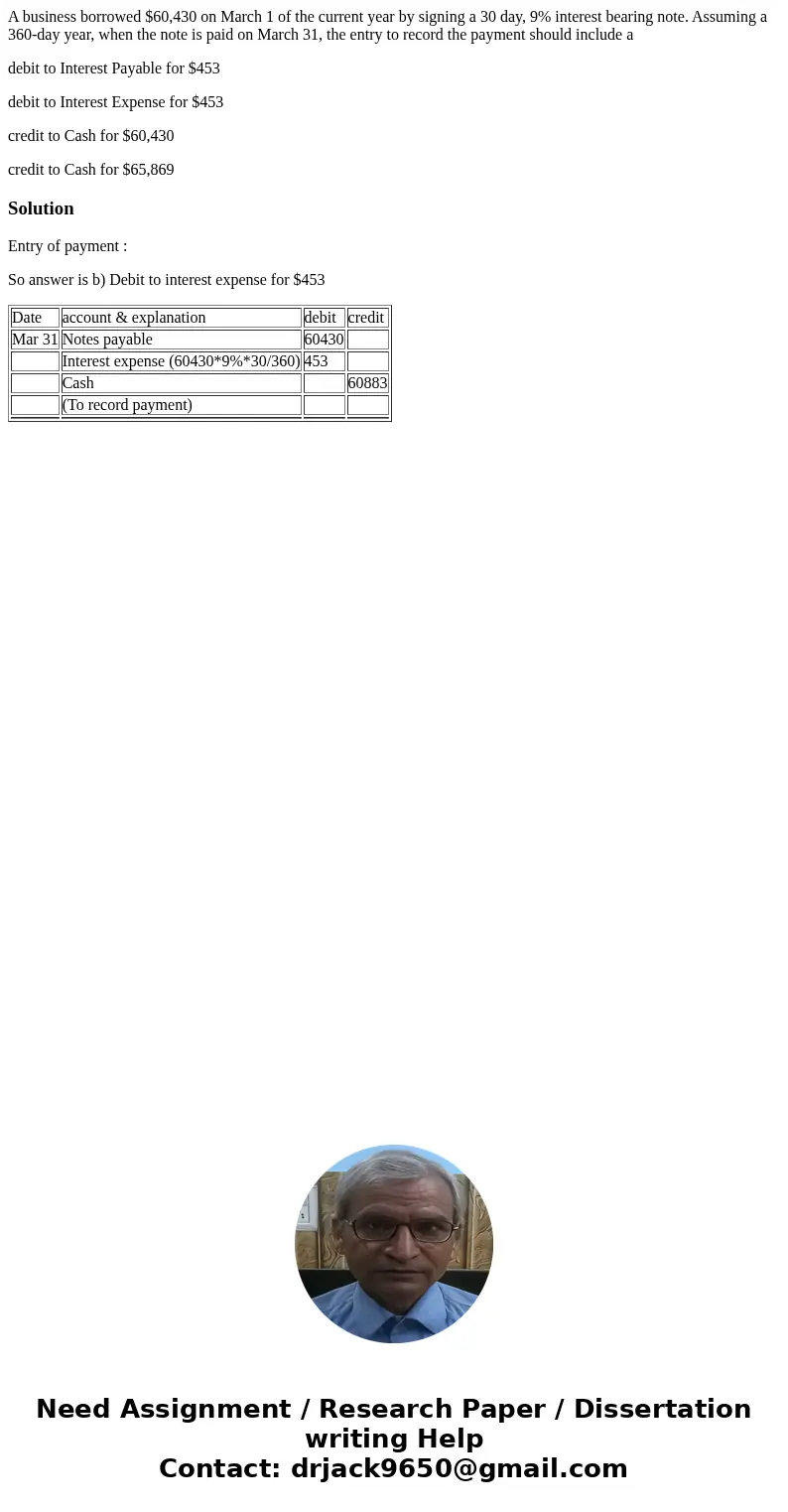

Solution

Entry of payment :

So answer is b) Debit to interest expense for $453

| Date | account & explanation | debit | credit |

| Mar 31 | Notes payable | 60430 | |

| Interest expense (60430*9%*30/360) | 453 | ||

| Cash | 60883 | ||

| (To record payment) | |||

Homework Sourse

Homework Sourse