value 100 points Engstrom Company makes a sale and collects

Solution

(39).

Answer is $520

Explanation;

As per information of the question it is given that total collection from sale = $572

Sales tax = 10%

Thus sales revenue account will be credited by ($572 / 1.10) = $520

(41).

Answer is Unearned Revenue.

Explanation;

As we know that when income received in advance then cash account is debited and uneraned revenue is credited that is why Unearned Revenue Account will be credited.

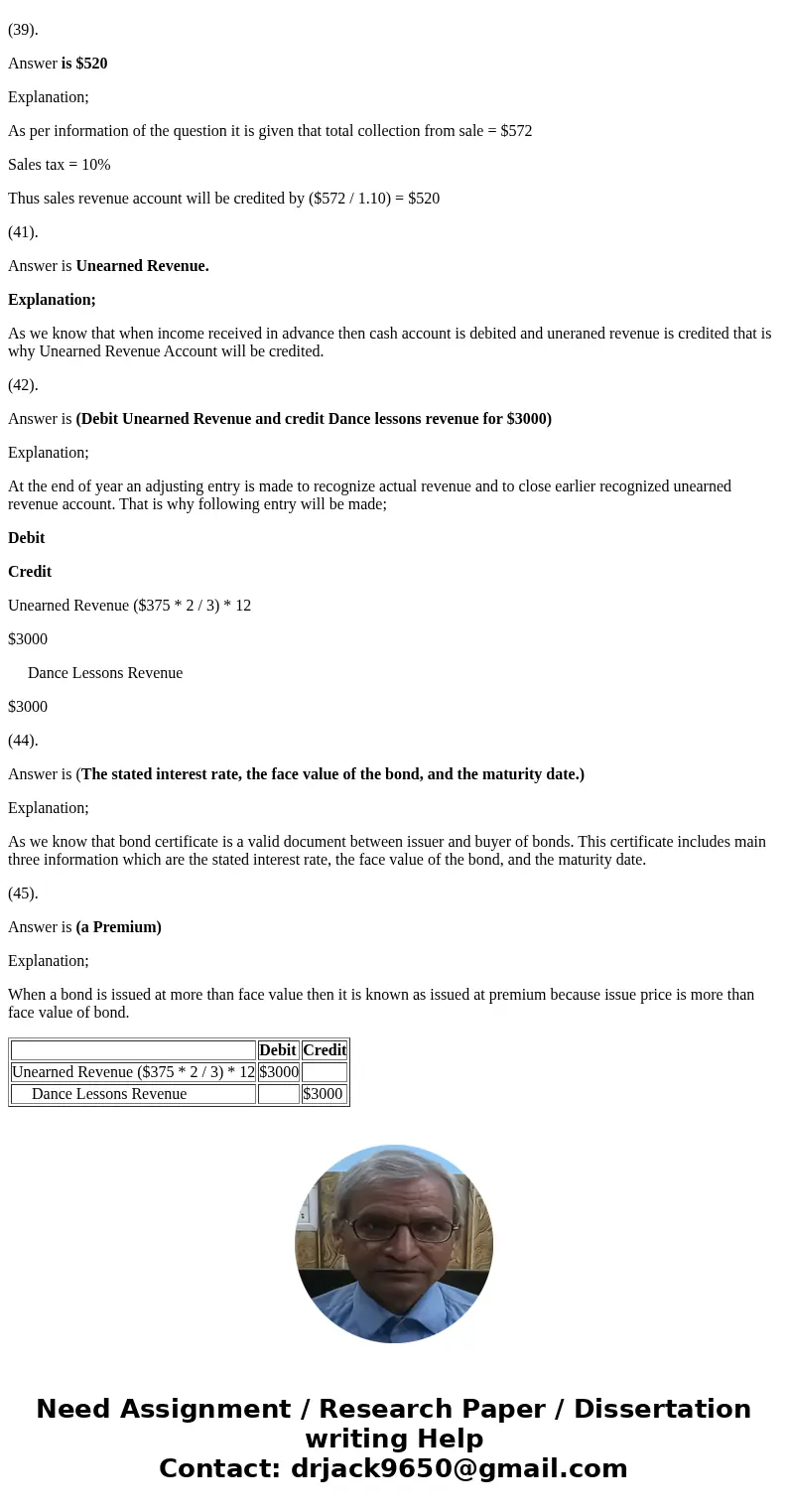

(42).

Answer is (Debit Unearned Revenue and credit Dance lessons revenue for $3000)

Explanation;

At the end of year an adjusting entry is made to recognize actual revenue and to close earlier recognized unearned revenue account. That is why following entry will be made;

Debit

Credit

Unearned Revenue ($375 * 2 / 3) * 12

$3000

Dance Lessons Revenue

$3000

(44).

Answer is (The stated interest rate, the face value of the bond, and the maturity date.)

Explanation;

As we know that bond certificate is a valid document between issuer and buyer of bonds. This certificate includes main three information which are the stated interest rate, the face value of the bond, and the maturity date.

(45).

Answer is (a Premium)

Explanation;

When a bond is issued at more than face value then it is known as issued at premium because issue price is more than face value of bond.

| Debit | Credit | |

| Unearned Revenue ($375 * 2 / 3) * 12 | $3000 | |

| Dance Lessons Revenue | $3000 |

Homework Sourse

Homework Sourse