The partnership of Ace Jack and Spade has been in business f

The partnership of Ace, Jack, and Spade has been in business for 25 years. On December 31, 20X5, Spade decided to retire. The partnership balance sheet reported the following capital balances for each partner at December 31, 20X5: Ace, Capital Jack, Capital Spade, Capital $151,100 201,400 120,5ee The partners allocate partnership income and loss in the ratio 20:30:50, respectively. Required: Record Spade\'s withdrawal under each of the following independent situations g. Because of limited cash in the partnership, Spade received land with a fair value of $101,800 and a partnership note payable for $50,900. The land\'s carrying amount on the partnership books was $60,400. Capital of the partnership after Spade\'s retirement was $361,700. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field.)

Solution

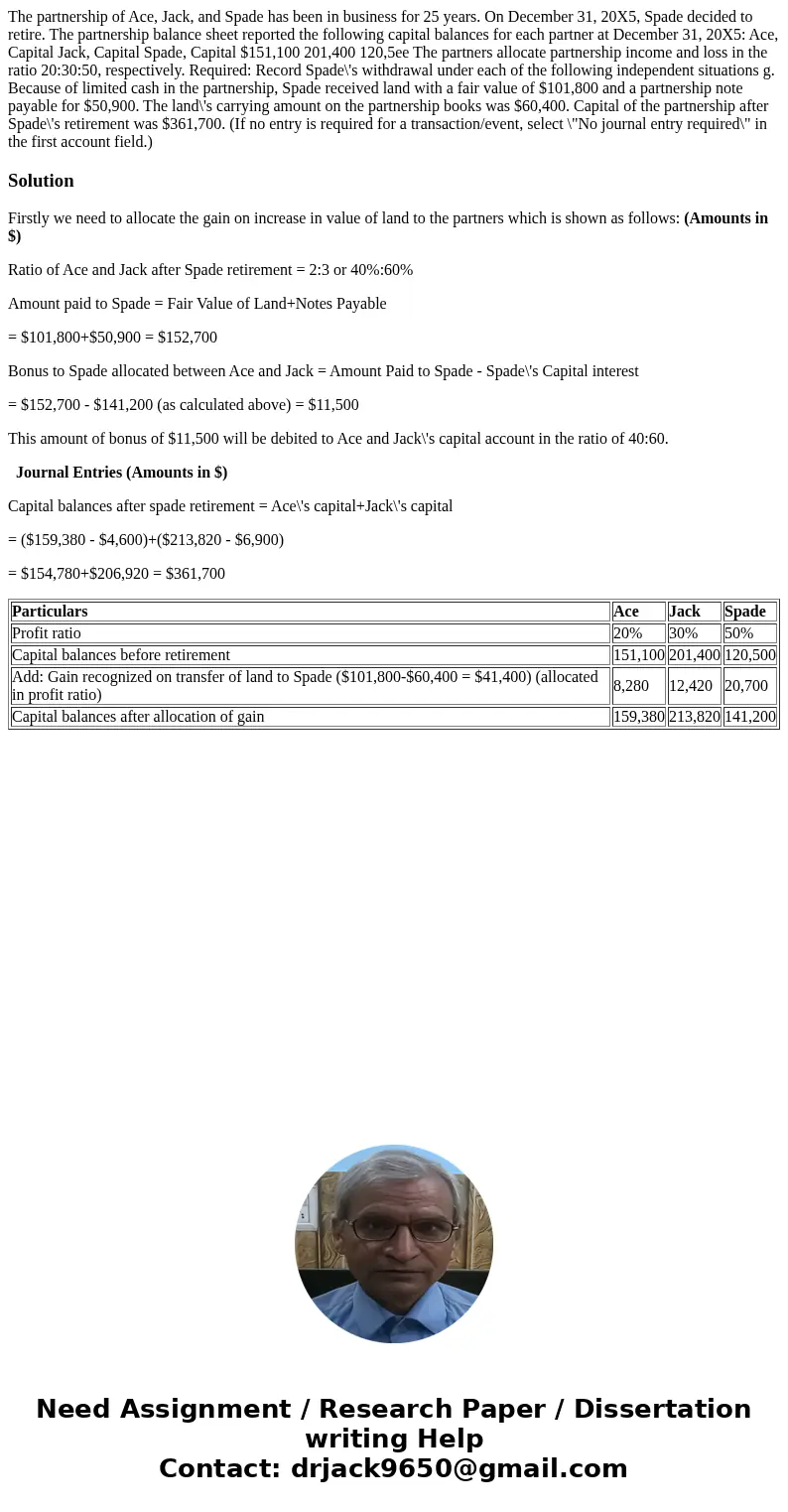

Firstly we need to allocate the gain on increase in value of land to the partners which is shown as follows: (Amounts in $)

Ratio of Ace and Jack after Spade retirement = 2:3 or 40%:60%

Amount paid to Spade = Fair Value of Land+Notes Payable

= $101,800+$50,900 = $152,700

Bonus to Spade allocated between Ace and Jack = Amount Paid to Spade - Spade\'s Capital interest

= $152,700 - $141,200 (as calculated above) = $11,500

This amount of bonus of $11,500 will be debited to Ace and Jack\'s capital account in the ratio of 40:60.

Journal Entries (Amounts in $)

Capital balances after spade retirement = Ace\'s capital+Jack\'s capital

= ($159,380 - $4,600)+($213,820 - $6,900)

= $154,780+$206,920 = $361,700

| Particulars | Ace | Jack | Spade |

| Profit ratio | 20% | 30% | 50% |

| Capital balances before retirement | 151,100 | 201,400 | 120,500 |

| Add: Gain recognized on transfer of land to Spade ($101,800-$60,400 = $41,400) (allocated in profit ratio) | 8,280 | 12,420 | 20,700 |

| Capital balances after allocation of gain | 159,380 | 213,820 | 141,200 |

Homework Sourse

Homework Sourse