Jacoby Corporation a merchandiser recently completed its cal

Jacoby Corporation, a merchandiser, recently completed its calendar year 2016 operations. For the year:

? All sales are credit sales

? All credits to Accounts Receivable reflect cash receipts from customers

? All purchases of inventory are on credit

? All debits to Accounts Payable reflect cash payments for inventory

? Other expenses are paid in advance and are initially debited to Prepaid Expenses.

? The company’s balance sheets and income statement follow.

Additional Information on Year 2011 Transactions

a. The loss on the cash sale of equipment was $2,100 (details in b).

b. Sold equipment costing $51,000, with accumulated depreciation of $20,850, for $28,050 cash.

c. Purchased equipment costing $113,250 by paying $38,250 cash and signing a long-term note

payable for the balance.

d. Borrowed $6,000 cash by signing a short-term note payable.

e. Paid$45,000cashtoreducethelong-termnotespayable.

f. Issued 3,000 shares of common stock for $11 cash per share.

g. Declaredandpaidcashdividendsof$63,000.

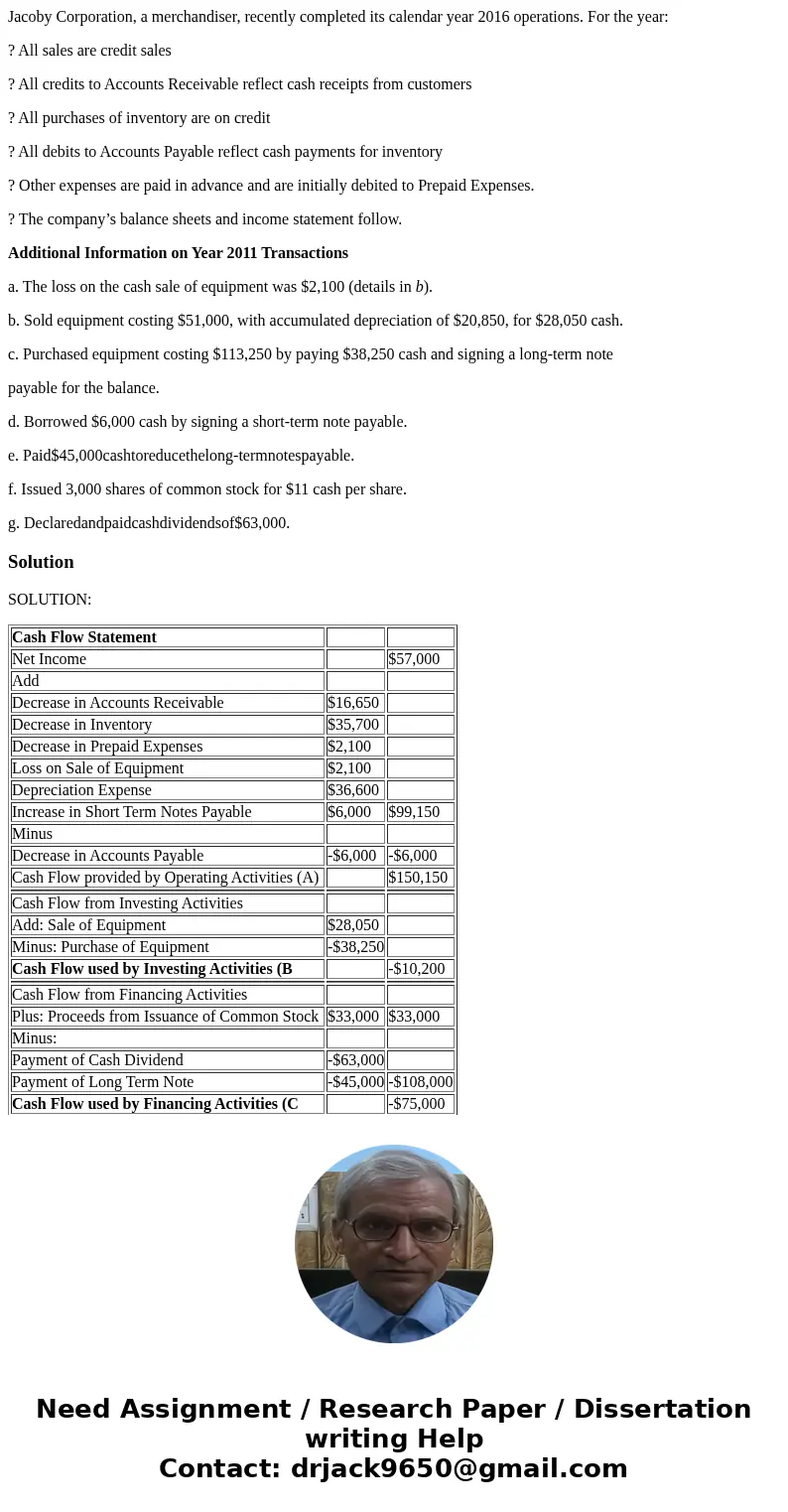

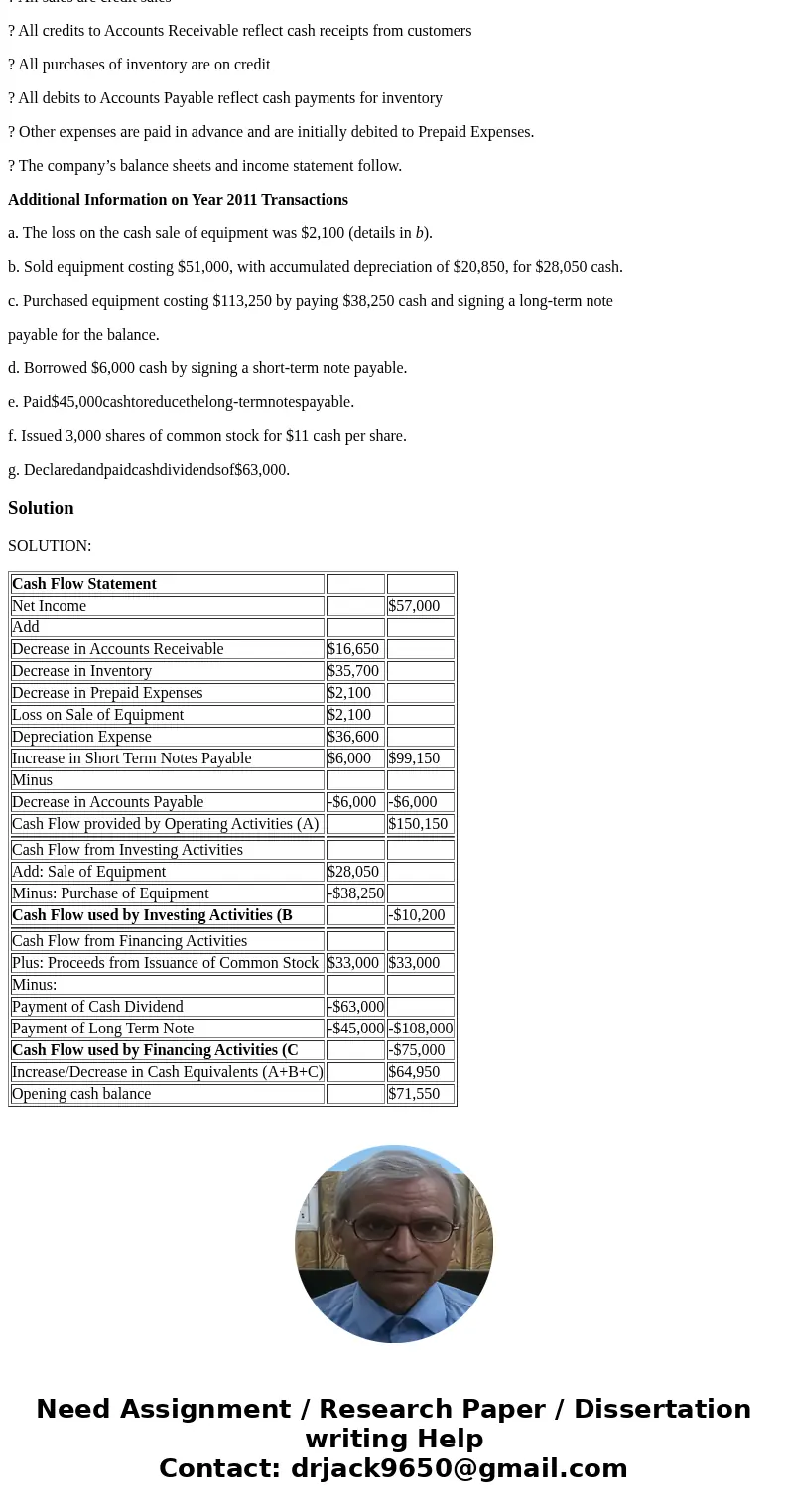

Solution

SOLUTION:

| Cash Flow Statement | ||

| Net Income | $57,000 | |

| Add | ||

| Decrease in Accounts Receivable | $16,650 | |

| Decrease in Inventory | $35,700 | |

| Decrease in Prepaid Expenses | $2,100 | |

| Loss on Sale of Equipment | $2,100 | |

| Depreciation Expense | $36,600 | |

| Increase in Short Term Notes Payable | $6,000 | $99,150 |

| Minus | ||

| Decrease in Accounts Payable | -$6,000 | -$6,000 |

| Cash Flow provided by Operating Activities (A) | $150,150 | |

| Cash Flow from Investing Activities | ||

| Add: Sale of Equipment | $28,050 | |

| Minus: Purchase of Equipment | -$38,250 | |

| Cash Flow used by Investing Activities (B | -$10,200 | |

| Cash Flow from Financing Activities | ||

| Plus: Proceeds from Issuance of Common Stock | $33,000 | $33,000 |

| Minus: | ||

| Payment of Cash Dividend | -$63,000 | |

| Payment of Long Term Note | -$45,000 | -$108,000 |

| Cash Flow used by Financing Activities (C | -$75,000 | |

| Increase/Decrease in Cash Equivalents (A+B+C) | $64,950 | |

| Opening cash balance | $71,550 |

Homework Sourse

Homework Sourse