4 Questions The financial statement amounts are in millions

4 Questions: The financial statement amounts are in millions

1. It is January 2nd and senior management of Digby meets to determine their investment plan for the year. They decide to fully fund a plant and equipment purchase by issuing 75,000 shares of stock plus a new bond issue. Assume the stock can be issued at yesterday’s stock price ($33.61) and leverage changes to 2.8. Which of the following statements are true?

Select all that apply. Select: 3

Equity will be $80,726,008

The total investment for Digby will be $207,925,114

Working capital will remain the same at $10,234,523

Total Assets will rise to $218,974,723

Digby will issue stock totaling $2,520,750

Total liabilities will be $124,678,356

2. Next year Baldwin plans to include an additional performance bonus of 0.25% in its compensation plan. This incentive will be provided in addition to the annual raise, if productivity goals are reached. Assuming the goals are reached, how much will Baldwin pay its employees per hour?

$28.15 $31.04 $28.22 $29.63

3. Suppose the Chester company begins to compete through good designs, high awareness and easy accessibility for their existing products, what strategy would they be implementing?

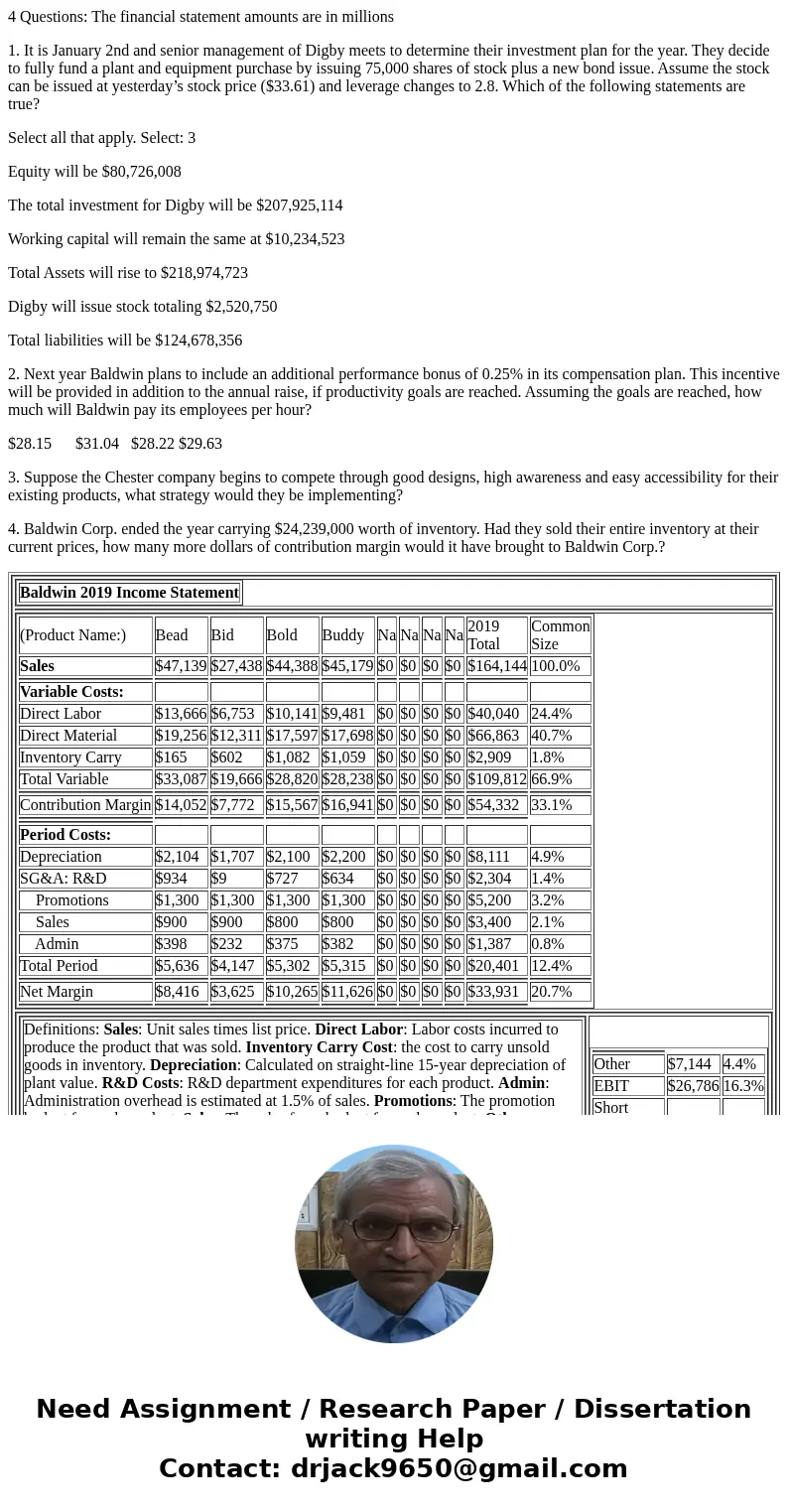

4. Baldwin Corp. ended the year carrying $24,239,000 worth of inventory. Had they sold their entire inventory at their current prices, how many more dollars of contribution margin would it have brought to Baldwin Corp.?

|

Solution

Answer -

1.

Total assets - Total Liabilities = Total stockholders’ Equity

218,974,723 - 124,678,356 = 94,296,367

New stock Issued = 75,000 *33.61 = 2,520,750

Total Stockholders\' Equity (above) - New stock issued (above) = Old Stock

$94,296,367 - $2,520,750 = $91,775,617

Leverage = total assets/ Total stockholders’ equity

=218,974,723/94,296,367 = 2.32

Since this doesn\'t gives us the desired leverage figure, we can\'t be confident of TA, TSE, and TL

Following Statements are correct

2.

Total raise = 5% + 0.25% = 5.25%

Present wages = $28.15

Baldwin will pay = $28.15 (1.0525) = $29.63

3. If chester Company Expand to other market with Good design, High Awarness and easy accessiblity than company should go for Broad Differentiation Because it will help the comany to charge the premium price, company can earn consumer loyalty due to the good and unique design, High awarness and good quilty will help to better sales due to the service provided.

4.

Assuming inventory is sold at the amount valued, Baldwin corp. will generate the revenue equivalent to the worth of inventory. i.e. $24,239,000

Hence, correct option is $24,239,000.

Homework Sourse

Homework Sourse