PA54 Predicting Cost Behavior Calculating Contribution Margi

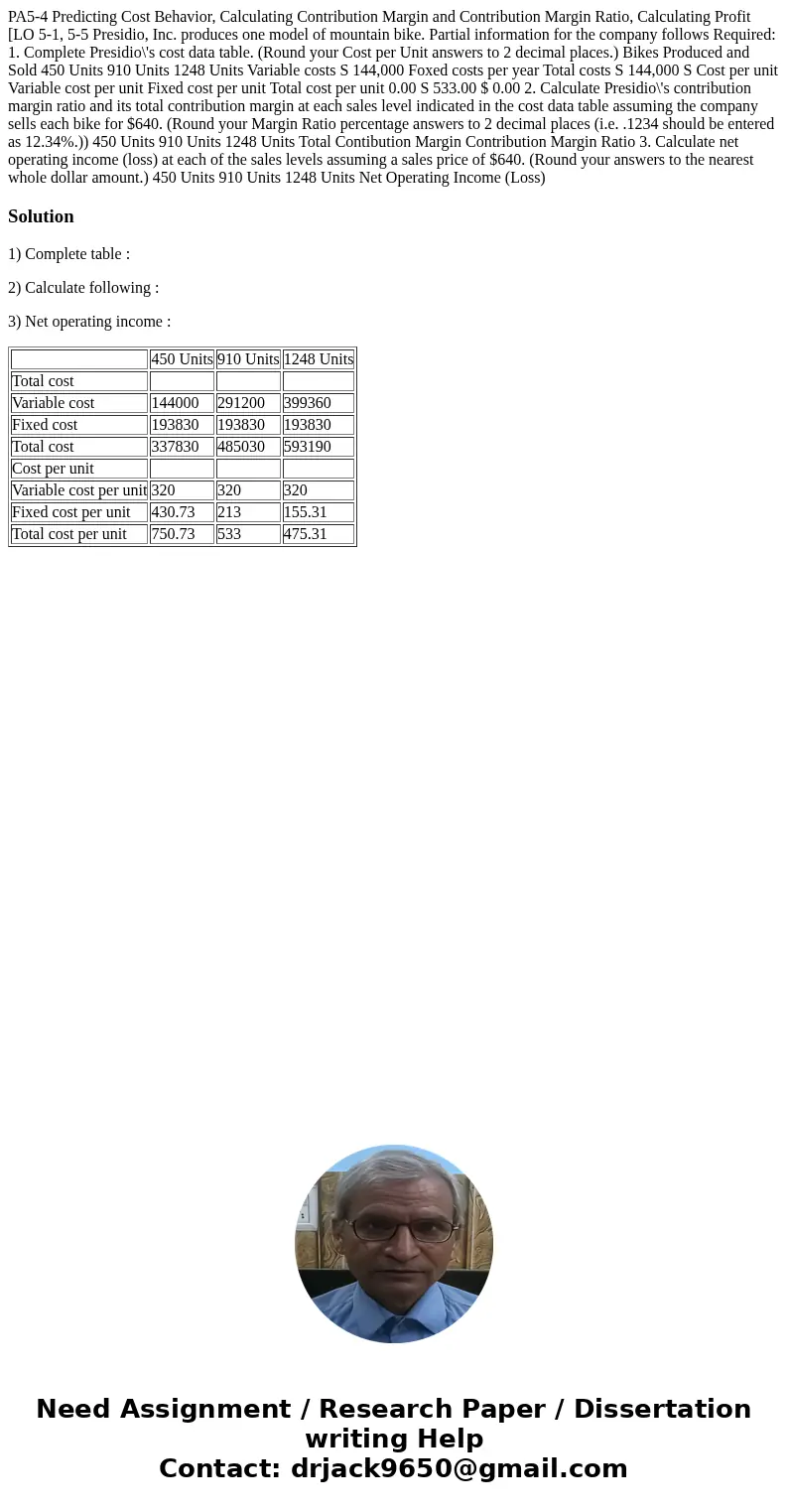

PA5-4 Predicting Cost Behavior, Calculating Contribution Margin and Contribution Margin Ratio, Calculating Profit [LO 5-1, 5-5 Presidio, Inc. produces one model of mountain bike. Partial information for the company follows Required: 1. Complete Presidio\'s cost data table. (Round your Cost per Unit answers to 2 decimal places.) Bikes Produced and Sold 450 Units 910 Units 1248 Units Variable costs S 144,000 Foxed costs per year Total costs S 144,000 S Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit 0.00 S 533.00 $ 0.00 2. Calculate Presidio\'s contribution margin ratio and its total contribution margin at each sales level indicated in the cost data table assuming the company sells each bike for $640. (Round your Margin Ratio percentage answers to 2 decimal places (i.e. .1234 should be entered as 12.34%.)) 450 Units 910 Units 1248 Units Total Contibution Margin Contribution Margin Ratio 3. Calculate net operating income (loss) at each of the sales levels assuming a sales price of $640. (Round your answers to the nearest whole dollar amount.) 450 Units 910 Units 1248 Units Net Operating Income (Loss)

Solution

1) Complete table :

2) Calculate following :

3) Net operating income :

| 450 Units | 910 Units | 1248 Units | |

| Total cost | |||

| Variable cost | 144000 | 291200 | 399360 |

| Fixed cost | 193830 | 193830 | 193830 |

| Total cost | 337830 | 485030 | 593190 |

| Cost per unit | |||

| Variable cost per unit | 320 | 320 | 320 |

| Fixed cost per unit | 430.73 | 213 | 155.31 |

| Total cost per unit | 750.73 | 533 | 475.31 |

Homework Sourse

Homework Sourse