018 20 231994 2012026 6Ih 931550 37420161120 5351631 5323bO

Solution

Cash Flow from operating Activities:-

Net Income/Loss (326318 - 288922)

-37396

Adjustments:-

Loss on sale of Truck (18000-8000)

10000

Depreciation (5000 + 8000 + 2000)

15000

Goodwill Amortise

6000

Increase Account receivable

-76130

Increase Inventory

-3311

Increase Supplies

-1360

Increase Allowance for Doubtful Debt

1598

Increase A/c Payable

30750

Decrease Payroll Tax payable

-2398

Decrease Income Tax payable

-1000

Increase Bank line of credit

15000

Increase Int Payable

23261

Cash Flow from operating Activities (A)

-19986

-19986

Cash Flow from Investing Activities:-

Purchase Equipment

-31100

Sale Truck

8000

Cash Flow from Investing Activities (B)

-23100

-23100

Cash Flow from Financing Activities:-

Decrease Notes Payable

-5000

Cash Flow from Financing Activities (C)

-5000

-5000

Total cash Flow (A+B+C)

-48086

(+) Beginning cash balance

280080

Ending cash balance

231994

Information regarding Dividend paid is not given. Hence we assume that no dividend paid during the year

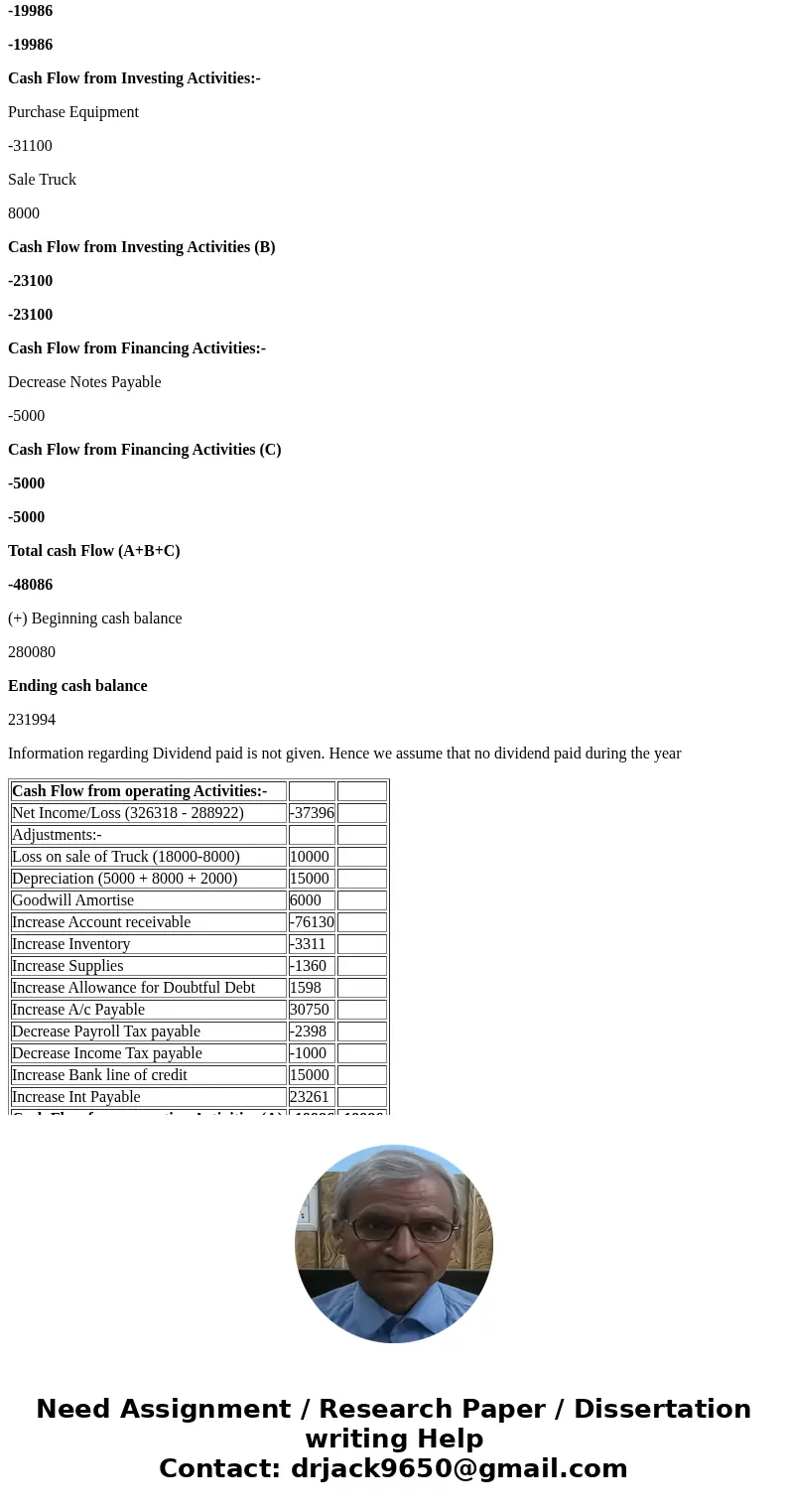

| Cash Flow from operating Activities:- | ||

| Net Income/Loss (326318 - 288922) | -37396 | |

| Adjustments:- | ||

| Loss on sale of Truck (18000-8000) | 10000 | |

| Depreciation (5000 + 8000 + 2000) | 15000 | |

| Goodwill Amortise | 6000 | |

| Increase Account receivable | -76130 | |

| Increase Inventory | -3311 | |

| Increase Supplies | -1360 | |

| Increase Allowance for Doubtful Debt | 1598 | |

| Increase A/c Payable | 30750 | |

| Decrease Payroll Tax payable | -2398 | |

| Decrease Income Tax payable | -1000 | |

| Increase Bank line of credit | 15000 | |

| Increase Int Payable | 23261 | |

| Cash Flow from operating Activities (A) | -19986 | -19986 |

| Cash Flow from Investing Activities:- | ||

| Purchase Equipment | -31100 | |

| Sale Truck | 8000 | |

| Cash Flow from Investing Activities (B) | -23100 | -23100 |

| Cash Flow from Financing Activities:- | ||

| Decrease Notes Payable | -5000 | |

| Cash Flow from Financing Activities (C) | -5000 | -5000 |

| Total cash Flow (A+B+C) | -48086 | |

| (+) Beginning cash balance | 280080 | |

| Ending cash balance | 231994 |

Homework Sourse

Homework Sourse