CALCULATOR STANDARD VIEW PRINTER VERSION BACK NEXT Problem 1

Solution

Answer- A

No.

Account Titles and Explanation

Debit

Credit

1

No Journal Entry Required

2

Cash

204880

Discount on Bonds Payable

7880

Bonds Payable

197000

Paid in Capital - Stock Warrants

15760

(To record the issue of bonds along with stock warrants)

3

Cash (9500 * 33)

313500

Common Stock (9500 * 10)

95000

Paid in Capital in Excess of Par (9500 * 23)

218500

(To record the exercise of right issue)

4

Paid in Capital-Stock Warrants (15760 * 80%)

12608

Cash (1576 *31)

48856

common Stock (1576 * 10)

15760

Paid in Capital in Excess of Par

45704

(To record the exercise of warrants issued)

5

Compensation Expense

98000

Paid in capital-Stock Option

98000

(To record the stock options granted to company executives)

6a

Cash (8820 * 31)

273420

Paid in capital-Stock Option (90% of 98000)

88200

Common Stock (8820 * 10)

88200

Paid in Capital in Excess of Par

273420

(To record the options exercised by company executives)

6b

Paid in capital-Stock Option (10% of 98000)

9800

Compensation Expense

9800

(To record the options expired due to executives failure)

Answer- B:

Swifty Inc.

Balance Sheet

Paid in capital

Common Stock, $10 par share

1,000,000 shares, 346,896 shares issued and outstanding

3468960

Paid in Capital in Excess of Par

1194624

Paid in Capital- Stock warrants

3152

4666736

Retained earnings

624000

Total Stockholders\' Equity

5290736

Working Notes:

Journal Entry 1:

When rights are issued, the corporations do not record any journal entry because the rights are issued without any consideration.

Journal Entry 2:

Number of Bonds Issue = Face Value /100 = 197,000 / 100 = 1970

Amount Raised Through Issue = Number of Bonds * 104 = $ 204,880

Allocated to Bonds = 1970 * 96 = 189,120

Allocated to Warrants = 1970 * 8 = 15760

Discount on Bonds Payable = Face value of Bond Issue – Amount Raised =

= (1,970 * 100) – 189,120 = 7,880

Journal Entry 3:

Total Rights Issued = 100,000

Rights Exercised = 100,000 – 5,000 = 95000

Now 10 rights are needed to issue 1 share then Number of Share issued = 95,000/10 = 9500

9,500 shares of face value $10 per shares issued at $ 33 per share.

Journal Entry 4:

Number of stock Warrant issues at the time of Bond Issue = One stock warrant for one bond = 1970 stock warrants

Exercised = 1970 * 80% = 1576

Amount to be received = Warrant exercised * Exercised price = 1576 * 31 = 48,856

Journal Entry 5:

Number of stock options = 9,800

Worth of an stock option = $10

Total Worth = 9800 * 10 = 98,000

Calculation of Number of Shares Outstanding and Paid in capital in excess of Par

Common stock

Paid-in capital in excess of par

At the Beginning of the year

327000

657000

From Right Issue (Journal entry - 3)

9500

218500

From Stock Warrants (Journal entry - 4)

1576

45704

From Stock Warrants (journal Entry- 6)

8820

273420

Total at the end of year

346896

1194624

PLEASE, Rate the solution if its helpful to you ...

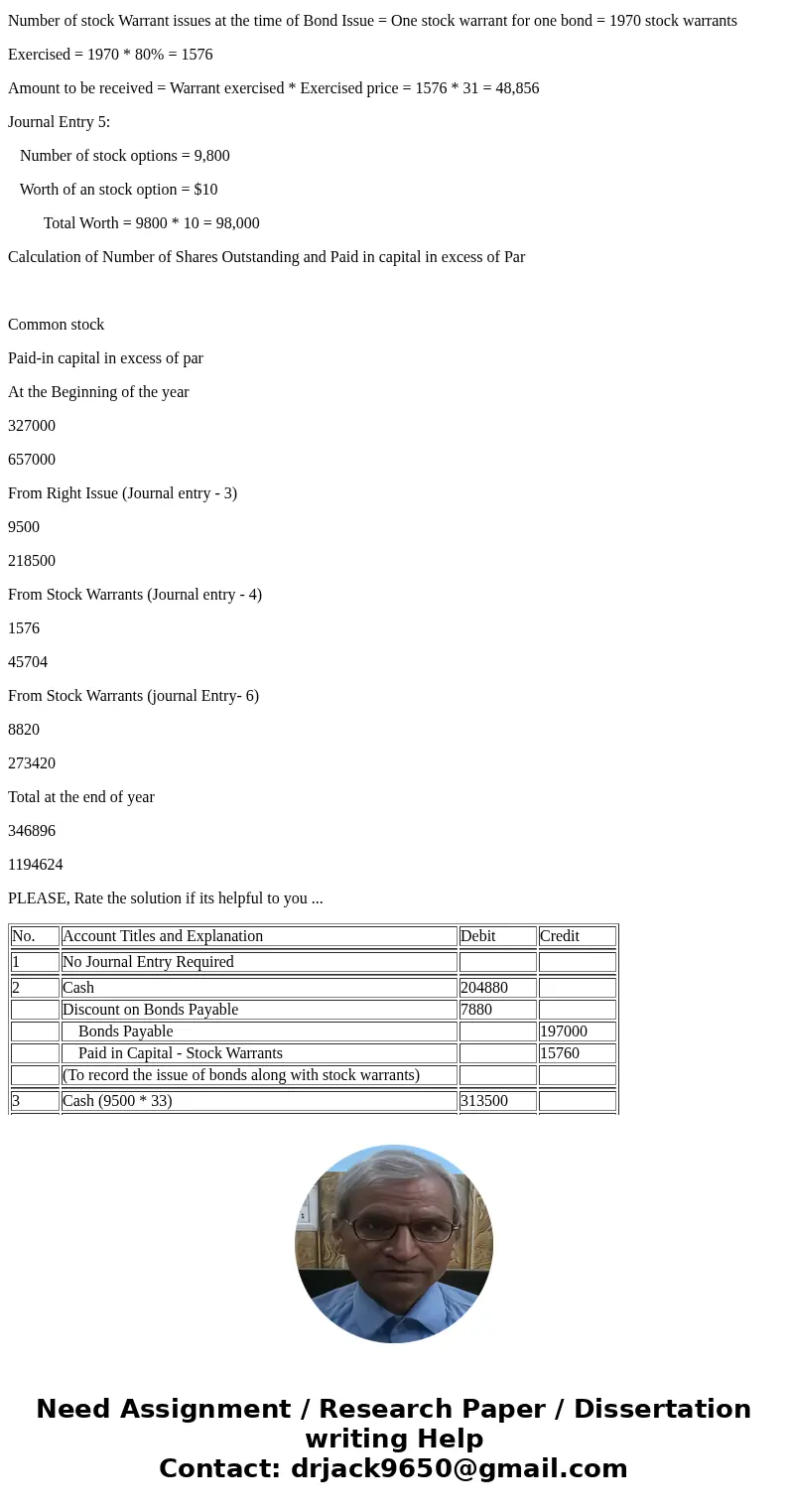

| No. | Account Titles and Explanation | Debit | Credit |

| 1 | No Journal Entry Required | ||

| 2 | Cash | 204880 | |

| Discount on Bonds Payable | 7880 | ||

| Bonds Payable | 197000 | ||

| Paid in Capital - Stock Warrants | 15760 | ||

| (To record the issue of bonds along with stock warrants) | |||

| 3 | Cash (9500 * 33) | 313500 | |

| Common Stock (9500 * 10) | 95000 | ||

| Paid in Capital in Excess of Par (9500 * 23) | 218500 | ||

| (To record the exercise of right issue) | |||

| 4 | Paid in Capital-Stock Warrants (15760 * 80%) | 12608 | |

| Cash (1576 *31) | 48856 | ||

| common Stock (1576 * 10) | 15760 | ||

| Paid in Capital in Excess of Par | 45704 | ||

| (To record the exercise of warrants issued) | |||

| 5 | Compensation Expense | 98000 | |

| Paid in capital-Stock Option | 98000 | ||

| (To record the stock options granted to company executives) | |||

| 6a | Cash (8820 * 31) | 273420 | |

| Paid in capital-Stock Option (90% of 98000) | 88200 | ||

| Common Stock (8820 * 10) | 88200 | ||

| Paid in Capital in Excess of Par | 273420 | ||

| (To record the options exercised by company executives) | |||

| 6b | Paid in capital-Stock Option (10% of 98000) | 9800 | |

| Compensation Expense | 9800 | ||

| (To record the options expired due to executives failure) | |||

Homework Sourse

Homework Sourse