Hello I need help with the following questions e Chegg Study

Hello, I need help with the following question(s):

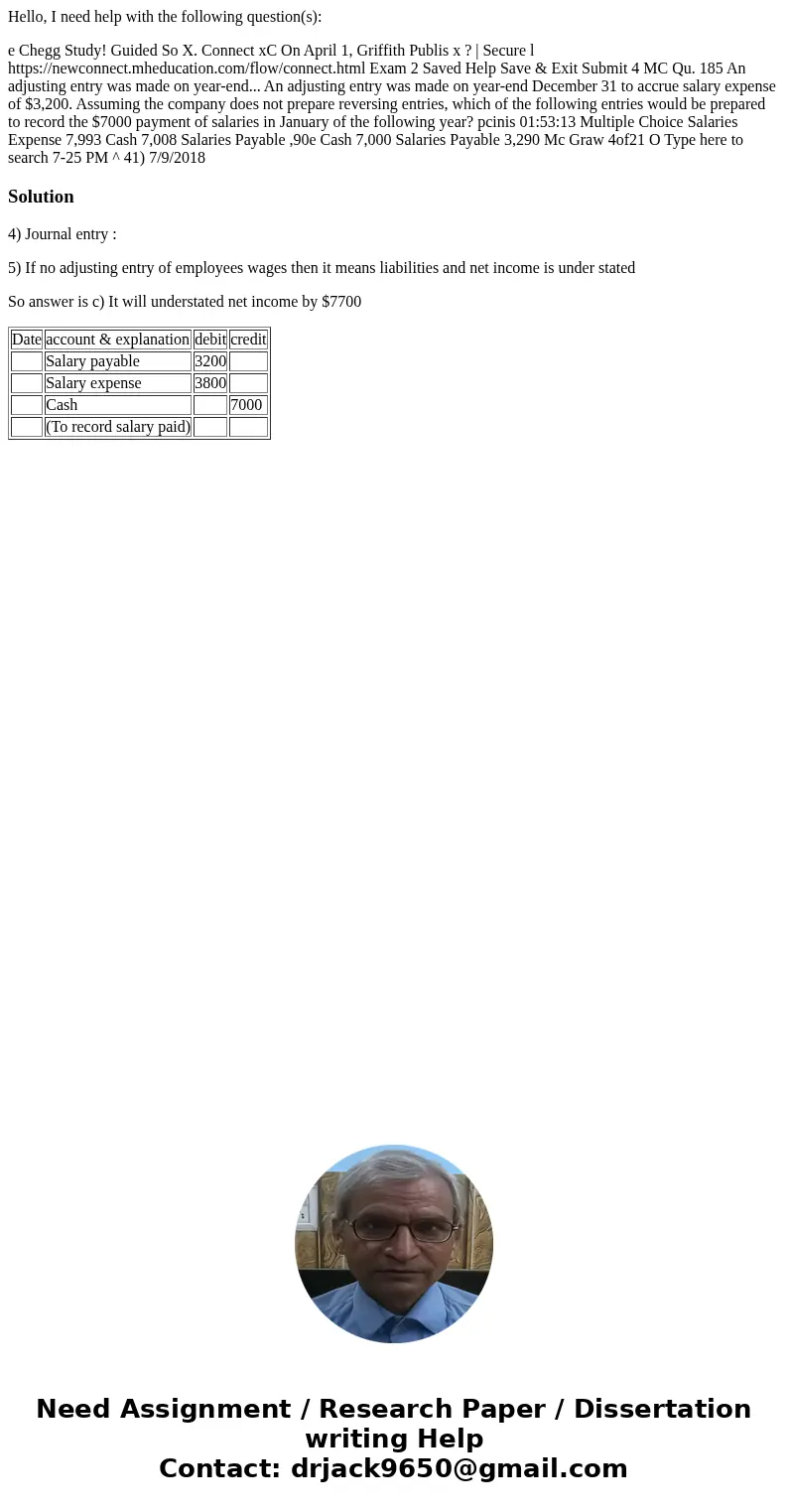

e Chegg Study! Guided So X. Connect xC On April 1, Griffith Publis x ? | Secure l https://newconnect.mheducation.com/flow/connect.html Exam 2 Saved Help Save & Exit Submit 4 MC Qu. 185 An adjusting entry was made on year-end... An adjusting entry was made on year-end December 31 to accrue salary expense of $3,200. Assuming the company does not prepare reversing entries, which of the following entries would be prepared to record the $7000 payment of salaries in January of the following year? pcinis 01:53:13 Multiple Choice Salaries Expense 7,993 Cash 7,008 Salaries Payable ,90e Cash 7,000 Salaries Payable 3,290 Mc Graw 4of21 O Type here to search 7-25 PM ^ 41) 7/9/2018Solution

4) Journal entry :

5) If no adjusting entry of employees wages then it means liabilities and net income is under stated

So answer is c) It will understated net income by $7700

| Date | account & explanation | debit | credit |

| Salary payable | 3200 | ||

| Salary expense | 3800 | ||

| Cash | 7000 | ||

| (To record salary paid) |

Homework Sourse

Homework Sourse