Problem 1 Making Money Inc MMI a US company is involved in

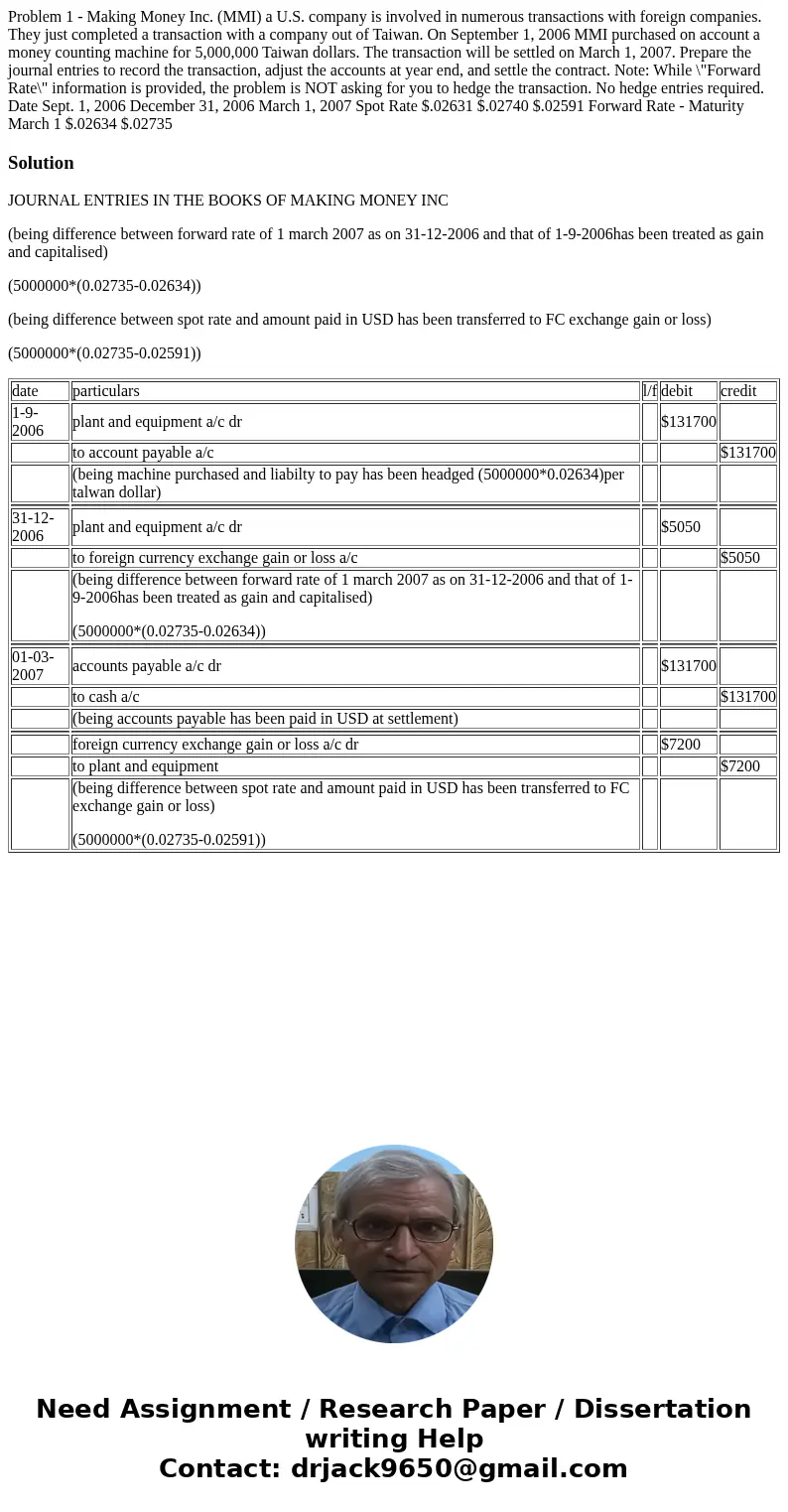

Problem 1 - Making Money Inc. (MMI) a U.S. company is involved in numerous transactions with foreign companies. They just completed a transaction with a company out of Taiwan. On September 1, 2006 MMI purchased on account a money counting machine for 5,000,000 Taiwan dollars. The transaction will be settled on March 1, 2007. Prepare the journal entries to record the transaction, adjust the accounts at year end, and settle the contract. Note: While \"Forward Rate\" information is provided, the problem is NOT asking for you to hedge the transaction. No hedge entries required. Date Sept. 1, 2006 December 31, 2006 March 1, 2007 Spot Rate $.02631 $.02740 $.02591 Forward Rate - Maturity March 1 $.02634 $.02735

Solution

JOURNAL ENTRIES IN THE BOOKS OF MAKING MONEY INC

(being difference between forward rate of 1 march 2007 as on 31-12-2006 and that of 1-9-2006has been treated as gain and capitalised)

(5000000*(0.02735-0.02634))

(being difference between spot rate and amount paid in USD has been transferred to FC exchange gain or loss)

(5000000*(0.02735-0.02591))

| date | particulars | l/f | debit | credit |

| 1-9-2006 | plant and equipment a/c dr | $131700 | ||

| to account payable a/c | $131700 | |||

| (being machine purchased and liabilty to pay has been headged (5000000*0.02634)per talwan dollar) | ||||

| 31-12-2006 | plant and equipment a/c dr | $5050 | ||

| to foreign currency exchange gain or loss a/c | $5050 | |||

| (being difference between forward rate of 1 march 2007 as on 31-12-2006 and that of 1-9-2006has been treated as gain and capitalised) (5000000*(0.02735-0.02634)) | ||||

| 01-03-2007 | accounts payable a/c dr | $131700 | ||

| to cash a/c | $131700 | |||

| (being accounts payable has been paid in USD at settlement) | ||||

| foreign currency exchange gain or loss a/c dr | $7200 | |||

| to plant and equipment | $7200 | |||

| (being difference between spot rate and amount paid in USD has been transferred to FC exchange gain or loss) (5000000*(0.02735-0.02591)) |

Homework Sourse

Homework Sourse