ork E1011 Supplement 10A Recording the Effects of a Premium

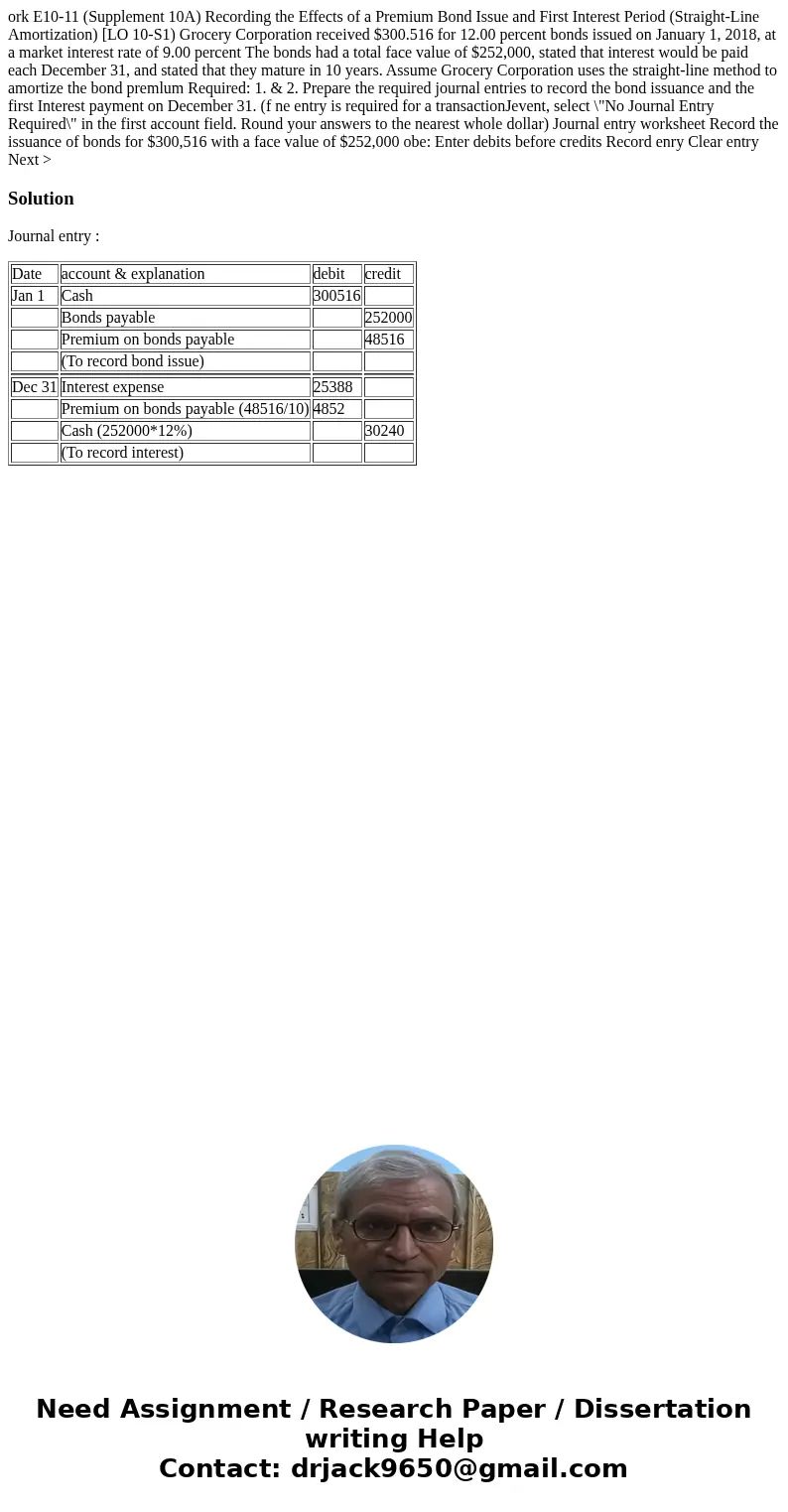

ork E10-11 (Supplement 10A) Recording the Effects of a Premium Bond Issue and First Interest Period (Straight-Line Amortization) [LO 10-S1) Grocery Corporation received $300.516 for 12.00 percent bonds issued on January 1, 2018, at a market interest rate of 9.00 percent The bonds had a total face value of $252,000, stated that interest would be paid each December 31, and stated that they mature in 10 years. Assume Grocery Corporation uses the straight-line method to amortize the bond premlum Required: 1. & 2. Prepare the required journal entries to record the bond issuance and the first Interest payment on December 31. (f ne entry is required for a transactionJevent, select \"No Journal Entry Required\" in the first account field. Round your answers to the nearest whole dollar) Journal entry worksheet Record the issuance of bonds for $300,516 with a face value of $252,000 obe: Enter debits before credits Record enry Clear entry Next >

Solution

Journal entry :

| Date | account & explanation | debit | credit |

| Jan 1 | Cash | 300516 | |

| Bonds payable | 252000 | ||

| Premium on bonds payable | 48516 | ||

| (To record bond issue) | |||

| Dec 31 | Interest expense | 25388 | |

| Premium on bonds payable (48516/10) | 4852 | ||

| Cash (252000*12%) | 30240 | ||

| (To record interest) |

Homework Sourse

Homework Sourse