SOS Please please please help on this problem Closing Entri

SOS Please please please help on this problem!!!!!!!!!!!!!!!!!!!!!! :)

Closing Entries and the Postclosing Trial Balance 192 CHAPTER 6 Mini-Practice Set 1 Service Business Accounting Cycle Eli\'s Consulting Services ing principles and This project will give you an opportunity to apply your knowledge of accounting principles and procedures by handling all the accounting work of Eli\'s Consulting Services for the month o January 2020. Assume that you are the chief accountant for Eli\'s Consulting Services, During January, the busi ness will use the same types of records and procedures that you learned about in Chapters 1 through 6. The chart of accounts for Eli\'s Consulting Services has been expanded to include a few new accounts. Follow the instructions to complete the accounting records for the month of January. INTRODUCTION Eli\'s Consulting Services Chart of Accounts Revenue 401 Fees Income Assets 101 Cash 111 Accounts Receivable 121 Supplies 134 Prepaid Insurance 137 Prepaid Rent 141 Equipment 142 Accumulated Depreciation Equipment Liabilities 202 Accounts Payable Expenses 511 Salaries Expense 514 Utilities Expense 517 Supplies Expense 520 Rent Expense 523 Depreciation Expense-Equipment 526 Advertising Expense 529 Maintenance Expense 532 Telephone Expense 535 Insurance Expense Owner\'s Equity 301 Trayton Eli, Capital 302 Trayton Eli, Drawing 309 Income Summary INSTRUCTIONS 1. Open the general ledger accounts and enter the balances for January 1, 2020. Obtain the necessary figures from the postclosing trial balance prepared on December 31, 2019, which appears in Figure 6.3. 2. Analyze each transaction and record it in the general journal. Use page 3 to begin January\'s transactions. 3. Post the transactions to the general ledger accounts. 4. Prepare the Trial Balance section of the worksheet. 5. Prepare the Adjustments section of the worksheet. a. Compute and record the adjustment for supplies used during the month. An inventory taken on January 31 showed supplies of $5,200 on hand. b. Compute and record the adjustment for expired insurance for the month. c. Record the adjustment for one month of expired rent of $4,000. d. Record the adjustment for depreciation of $183 on the old equipment for the month. The first adjustment for depreciation for the new equipment will be recorded in February, 6. Complete the worksheet. 7. Prepare an income statement for the month. 8. Prepare a statement of owner\'s equity.Solution

Journal Entries

Date

Account Title

Debit

Credit

2-Jan

Supplies

7000

Cash

7000

7-Jan

Cash

20000

Accounts receivable

5000

Fees Income

25000

2-Jan

Insurance expense

8400

Cash

8400

12-Jan

Cash

4000

Accounts receivable

4000

Advertising expense

3600

Cash

3600

Cash

20700

Accounts receivable

2300

Fees Income

23000

13-Jan

Cash

4500

Accounts receivable

4500

14-Jan

Cash

750

Supplies

750

20-Jan

Supplies

5000

Accounts Payable

5000

20-Jan

Cash

12500

Accounts receivable

3500

Fees Income

16000

20-Jan

Cash

5600

Accounts receivable

5600

21-Jan

Maintenance expense

7065

Cash

7065

22-Jan

Advertising expense

3600

Cash

3600

23-Jan

Telephone expense

1025

Cash

1025

26-Jan

Cash

1600

Accounts Receivables

1600

27-Jan

Account payable

3000

Cash

3000

28-Jan

Utilities Expense

2675

Cash

2675

29-Jan

Cash

19000

Accounts receivable

2750

Fees Income

21750

31-Jan

Salaries expense

32800

Cash

32800

Trayton Eli,Drawings

12000

Cash

12000

Maintenance expense

4150

Cash

4150

Equipment

15000

Cash

10000

Account payable

5000

Cash

7600

Accounts Receiavble

1620

Fees Income

9220

Adjusting Entries

Supplies expense

6050

Supplies

6050

(7000+5000-750-5200)

Prepaid Insurance

7700

Insurance Expense

7700

8400-(8400/12)

Rent expense

4000

Accounts payable

4000

Depreciation expense

183

Accumulated depreciation-Equipment

183

234668

234668

NET LEDGER BALANCE

LEDGER ACCOUNTS

Debit

Credit

Debit

Credit

27-Jan

Account payable

3000

31-Jan

Account payable

5000

20-Jan

Accounts Payable

5000

31-Jan

Accounts payable

4000

11000

31-Jan

Accounts Receiavble

1620

7-Jan

Accounts receivable

5000

12-Jan

Accounts receivable

4000

12-Jan

Accounts receivable

2300

13-Jan

Accounts receivable

4500

20-Jan

Accounts receivable

3500

20-Jan

Accounts receivable

5600

29-Jan

Accounts receivable

2750

26-Jan

Accounts Receivables

1600

-530

31-Jan

Accumulated depreciation-Equipment

183

183

12-Jan

Advertising expense

3600

22-Jan

Advertising expense

3600

7200

2-Jan

Cash

7000

7-Jan

Cash

20000

2-Jan

Cash

8400

12-Jan

Cash

4000

12-Jan

Cash

3600

12-Jan

Cash

20700

13-Jan

Cash

4500

14-Jan

Cash

750

20-Jan

Cash

12500

20-Jan

Cash

5600

21-Jan

Cash

7065

22-Jan

Cash

3600

23-Jan

Cash

1025

26-Jan

Cash

1600

27-Jan

Cash

3000

28-Jan

Cash

2675

29-Jan

Cash

19000

31-Jan

Cash

32800

31-Jan

Cash

12000

31-Jan

Cash

4150

31-Jan

Cash

10000

31-Jan

Cash

7600

935

31-Jan

Depreciation expense

183

183

31-Jan

Equipment

15000

15000

7-Jan

Fees Income

25000

12-Jan

Fees Income

23000

20-Jan

Fees Income

16000

29-Jan

Fees Income

21750

31-Jan

Fees Income

9220

94970

2-Jan

Insurance expense

8400

31-Jan

Insurance Expense

7700

700

21-Jan

Maintenance expense

7065

31-Jan

Maintenance expense

4150

11215

31-Jan

Prepaid Insurance

7700

7700

31-Jan

Rent expense

4000

4000

31-Jan

Salaries expense

32800

32800

2-Jan

Supplies

7000

14-Jan

Supplies

750

20-Jan

Supplies

5000

31-Jan

Supplies

6050

5200

31-Jan

Supplies expense

6050

6050

23-Jan

Telephone expense

1025

1025

31-Jan

Trayton Eli,Drawings

12000

12000

28-Jan

Utilities Expense

2675

2675

234668

234668

106153

106153

Trial balance

Debit

Credit

Cash

935

Accounts Receiavble

530

Prepaid Insurance

7700

Supplies

5200

Account payable

11000

Equipment

15000

Accumulated depreciation-Equipment

183

Trayton Eli,Drawings

12000

Fees Income

94970

Advertising expense

7200

Depreciation expense

183

Insurance expense

700

Maintenance expense

11215

Rent expense

4000

Salaries expense

32800

Supplies expense

6050

Telephone expense

1025

Utilities Expense

2675

106683

106683

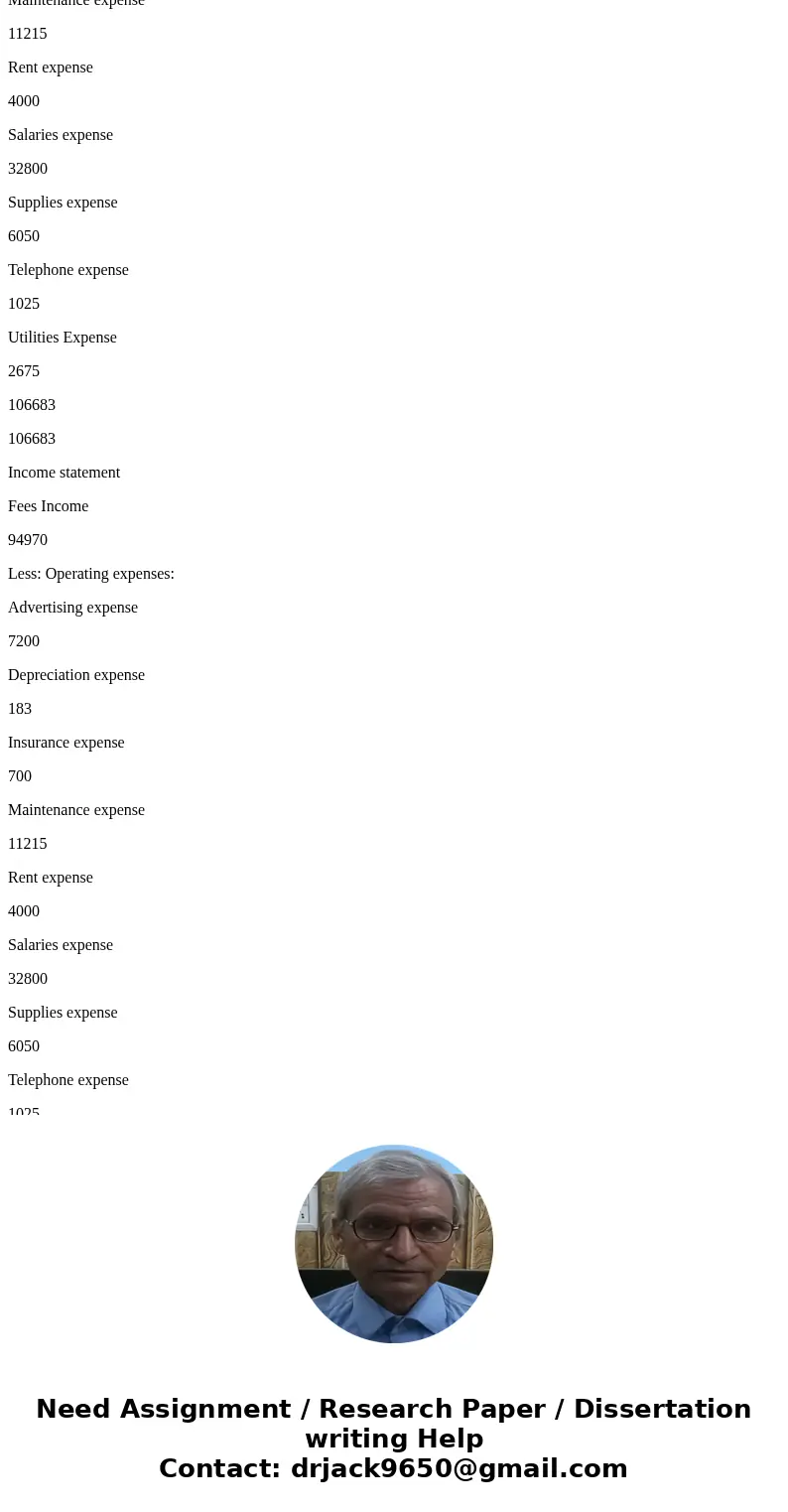

Income statement

Fees Income

94970

Less: Operating expenses:

Advertising expense

7200

Depreciation expense

183

Insurance expense

700

Maintenance expense

11215

Rent expense

4000

Salaries expense

32800

Supplies expense

6050

Telephone expense

1025

Utilities Expense

2675

65848

Operating Income

29122

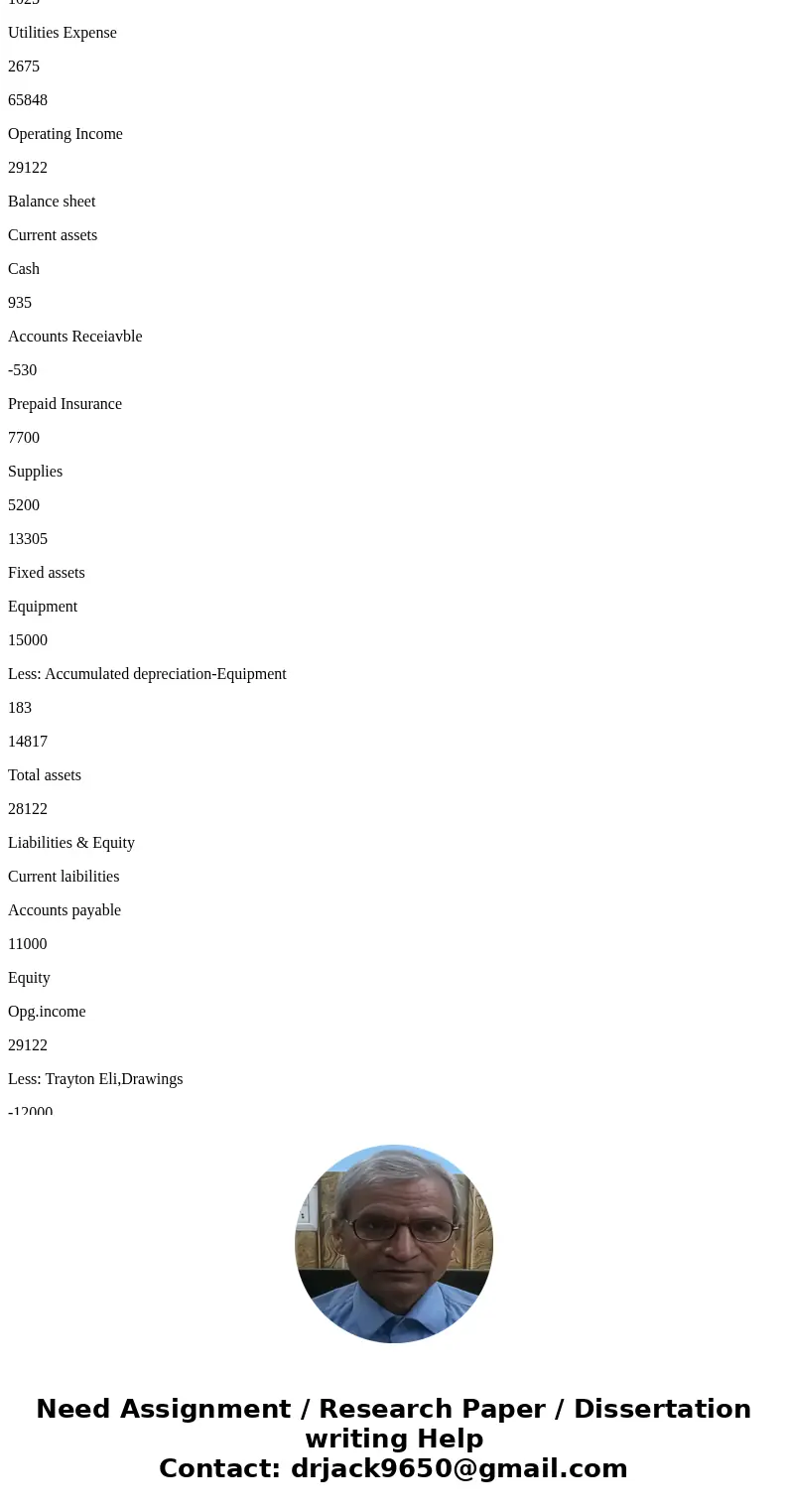

Balance sheet

Current assets

Cash

935

Accounts Receiavble

-530

Prepaid Insurance

7700

Supplies

5200

13305

Fixed assets

Equipment

15000

Less: Accumulated depreciation-Equipment

183

14817

Total assets

28122

Liabilities & Equity

Current laibilities

Accounts payable

11000

Equity

Opg.income

29122

Less: Trayton Eli,Drawings

-12000

17122

Total Liabilities & Equity

28122

Statement of Owner\'s Equity

Current year Operating income

29122

Less: Trayton Eli,Drawings

-12000

Net Equity balance

17122

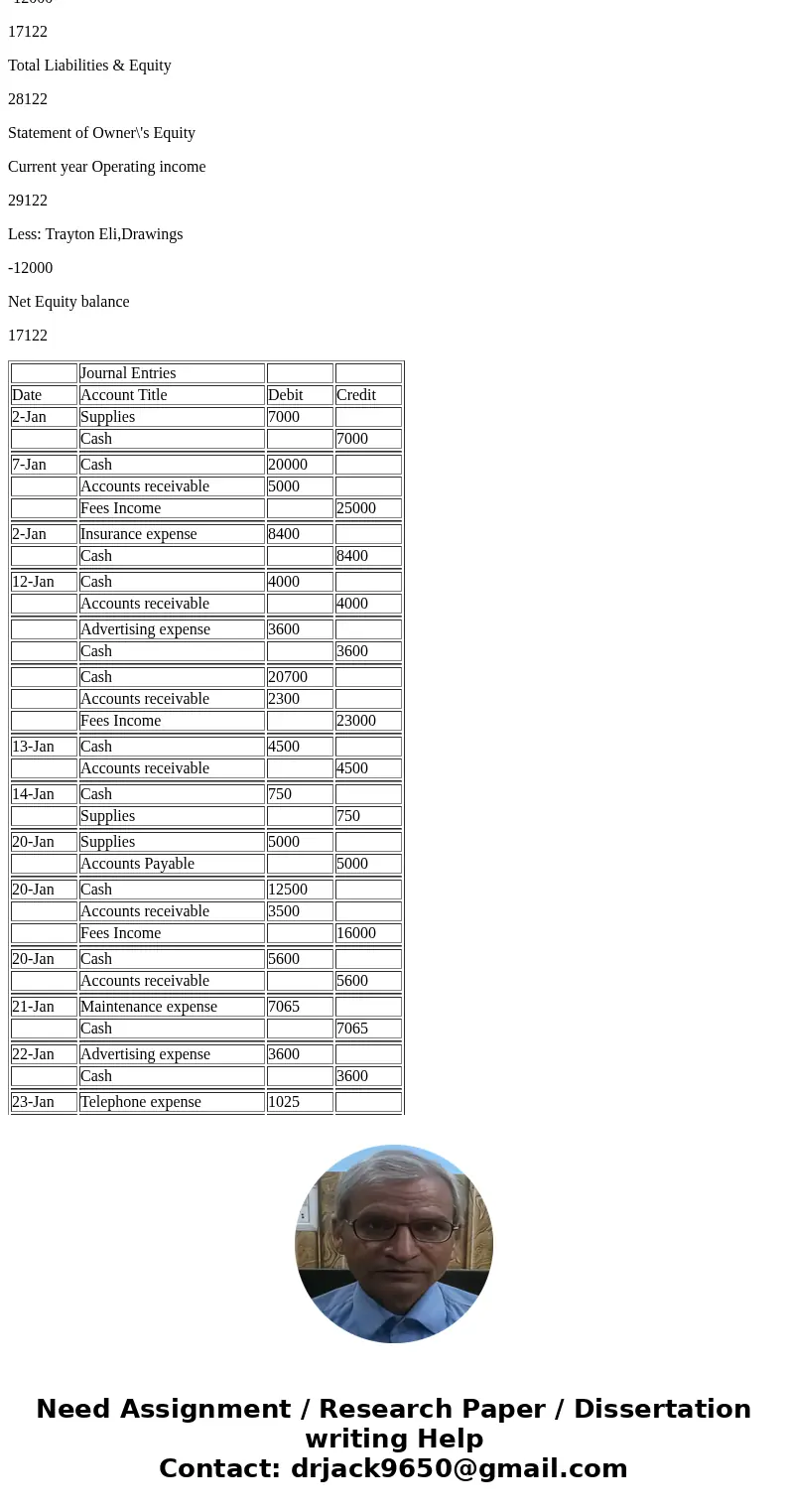

| Journal Entries | |||

| Date | Account Title | Debit | Credit |

| 2-Jan | Supplies | 7000 | |

| Cash | 7000 | ||

| 7-Jan | Cash | 20000 | |

| Accounts receivable | 5000 | ||

| Fees Income | 25000 | ||

| 2-Jan | Insurance expense | 8400 | |

| Cash | 8400 | ||

| 12-Jan | Cash | 4000 | |

| Accounts receivable | 4000 | ||

| Advertising expense | 3600 | ||

| Cash | 3600 | ||

| Cash | 20700 | ||

| Accounts receivable | 2300 | ||

| Fees Income | 23000 | ||

| 13-Jan | Cash | 4500 | |

| Accounts receivable | 4500 | ||

| 14-Jan | Cash | 750 | |

| Supplies | 750 | ||

| 20-Jan | Supplies | 5000 | |

| Accounts Payable | 5000 | ||

| 20-Jan | Cash | 12500 | |

| Accounts receivable | 3500 | ||

| Fees Income | 16000 | ||

| 20-Jan | Cash | 5600 | |

| Accounts receivable | 5600 | ||

| 21-Jan | Maintenance expense | 7065 | |

| Cash | 7065 | ||

| 22-Jan | Advertising expense | 3600 | |

| Cash | 3600 | ||

| 23-Jan | Telephone expense | 1025 | |

| Cash | 1025 | ||

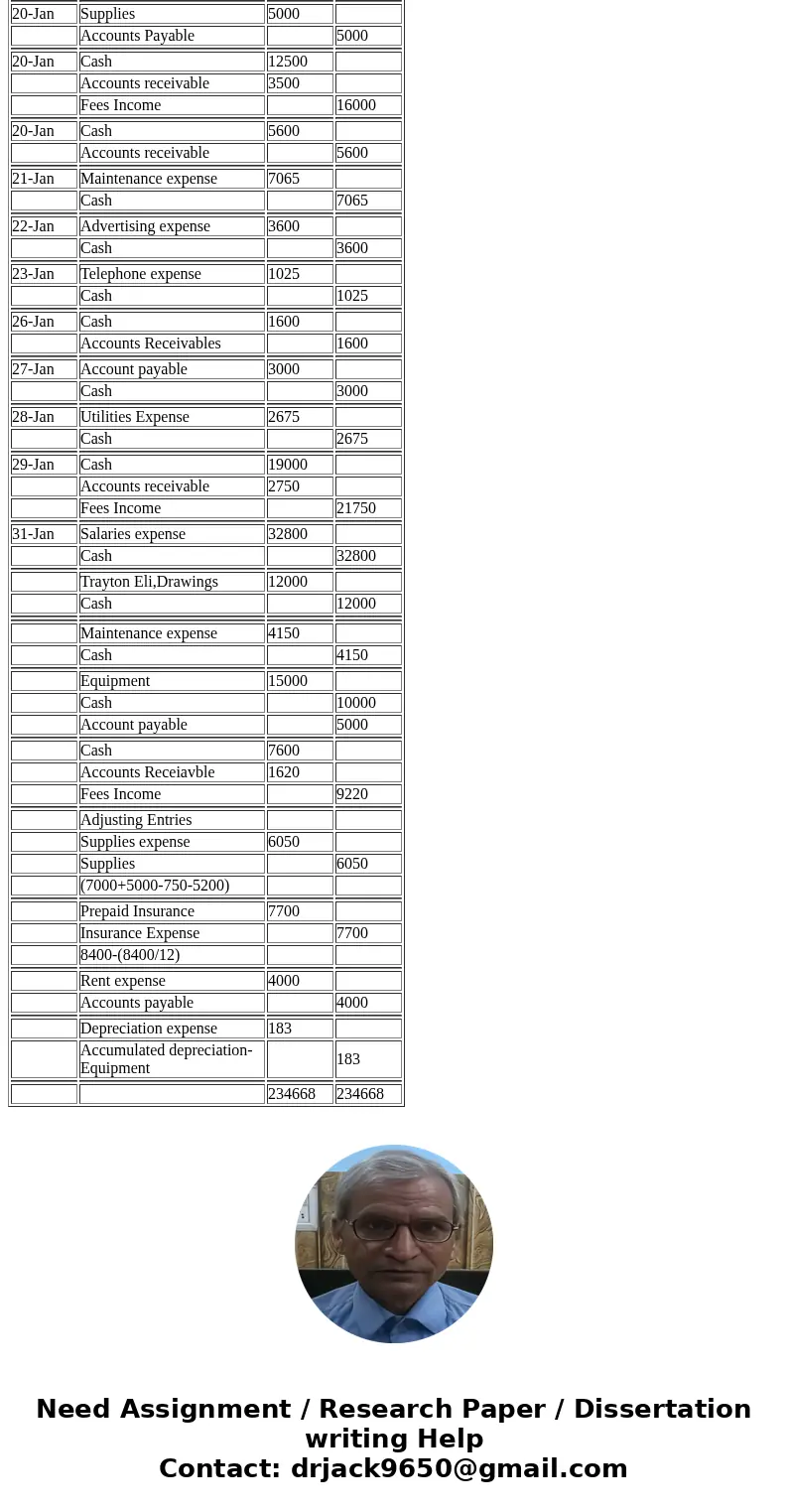

| 26-Jan | Cash | 1600 | |

| Accounts Receivables | 1600 | ||

| 27-Jan | Account payable | 3000 | |

| Cash | 3000 | ||

| 28-Jan | Utilities Expense | 2675 | |

| Cash | 2675 | ||

| 29-Jan | Cash | 19000 | |

| Accounts receivable | 2750 | ||

| Fees Income | 21750 | ||

| 31-Jan | Salaries expense | 32800 | |

| Cash | 32800 | ||

| Trayton Eli,Drawings | 12000 | ||

| Cash | 12000 | ||

| Maintenance expense | 4150 | ||

| Cash | 4150 | ||

| Equipment | 15000 | ||

| Cash | 10000 | ||

| Account payable | 5000 | ||

| Cash | 7600 | ||

| Accounts Receiavble | 1620 | ||

| Fees Income | 9220 | ||

| Adjusting Entries | |||

| Supplies expense | 6050 | ||

| Supplies | 6050 | ||

| (7000+5000-750-5200) | |||

| Prepaid Insurance | 7700 | ||

| Insurance Expense | 7700 | ||

| 8400-(8400/12) | |||

| Rent expense | 4000 | ||

| Accounts payable | 4000 | ||

| Depreciation expense | 183 | ||

| Accumulated depreciation-Equipment | 183 | ||

| 234668 | 234668 |

Homework Sourse

Homework Sourse