Your parents are considering investing in David Jones Ltd DJ

Solution

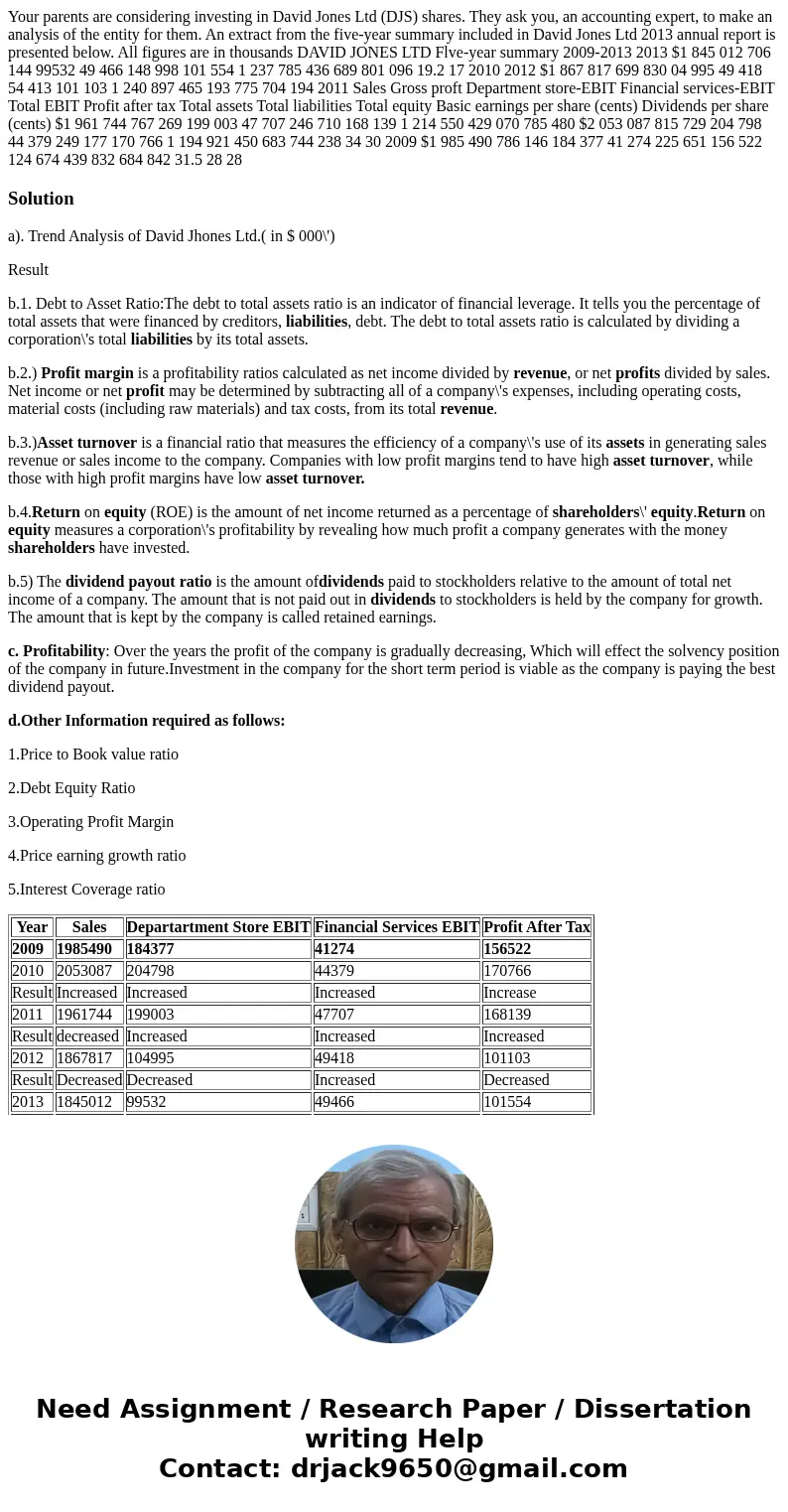

a). Trend Analysis of David Jhones Ltd.( in $ 000\')

Result

b.1. Debt to Asset Ratio:The debt to total assets ratio is an indicator of financial leverage. It tells you the percentage of total assets that were financed by creditors, liabilities, debt. The debt to total assets ratio is calculated by dividing a corporation\'s total liabilities by its total assets.

b.2.) Profit margin is a profitability ratios calculated as net income divided by revenue, or net profits divided by sales. Net income or net profit may be determined by subtracting all of a company\'s expenses, including operating costs, material costs (including raw materials) and tax costs, from its total revenue.

b.3.)Asset turnover is a financial ratio that measures the efficiency of a company\'s use of its assets in generating sales revenue or sales income to the company. Companies with low profit margins tend to have high asset turnover, while those with high profit margins have low asset turnover.

b.4.Return on equity (ROE) is the amount of net income returned as a percentage of shareholders\' equity.Return on equity measures a corporation\'s profitability by revealing how much profit a company generates with the money shareholders have invested.

b.5) The dividend payout ratio is the amount ofdividends paid to stockholders relative to the amount of total net income of a company. The amount that is not paid out in dividends to stockholders is held by the company for growth. The amount that is kept by the company is called retained earnings.

c. Profitability: Over the years the profit of the company is gradually decreasing, Which will effect the solvency position of the company in future.Investment in the company for the short term period is viable as the company is paying the best dividend payout.

d.Other Information required as follows:

1.Price to Book value ratio

2.Debt Equity Ratio

3.Operating Profit Margin

4.Price earning growth ratio

5.Interest Coverage ratio

| Year | Sales | Departartment Store EBIT | Financial Services EBIT | Profit After Tax |

|---|---|---|---|---|

| 2009 | 1985490 | 184377 | 41274 | 156522 |

| 2010 | 2053087 | 204798 | 44379 | 170766 |

| Result | Increased | Increased | Increased | Increase |

| 2011 | 1961744 | 199003 | 47707 | 168139 |

| Result | decreased | Increased | Increased | Increased |

| 2012 | 1867817 | 104995 | 49418 | 101103 |

| Result | Decreased | Decreased | Increased | Decreased |

| 2013 | 1845012 | 99532 | 49466 | 101554 |

| Result | Decreased | Decreased | Increased | Decreased |

Homework Sourse

Homework Sourse