KeeporDrop Decision Petoskey Company produces three products

Keep-or-Drop Decision Petoskey Company produces three products: Alanson, Boyne, and Conway. A segmented income statement, with amounts given in thousands, follows: Alanson Boyne Conway Total $1,280 $185 S435 $1,900 326 1,486 $165 $140 $109 $414 Sales revenue Less: Variable expenses 1,115 45 Contribution margin Less direct fixed expenses: 76 292 $46 Depreciation 50 15 95 85 $20 $40 $(14) 112 Salaries Segment margin Direct fixed expenses consist of depreciation and plant supervisory salaries. All depreciation on the equipment is dedicated to the product lines. None of the equipment can be sold. Assume that each of the three products has a different supervisor whose position would be eliminated if the associated product were Required: Conceptual Connection: Estimate the impact on profit that would result from dropping Conway. Enter amount in full, rather than in

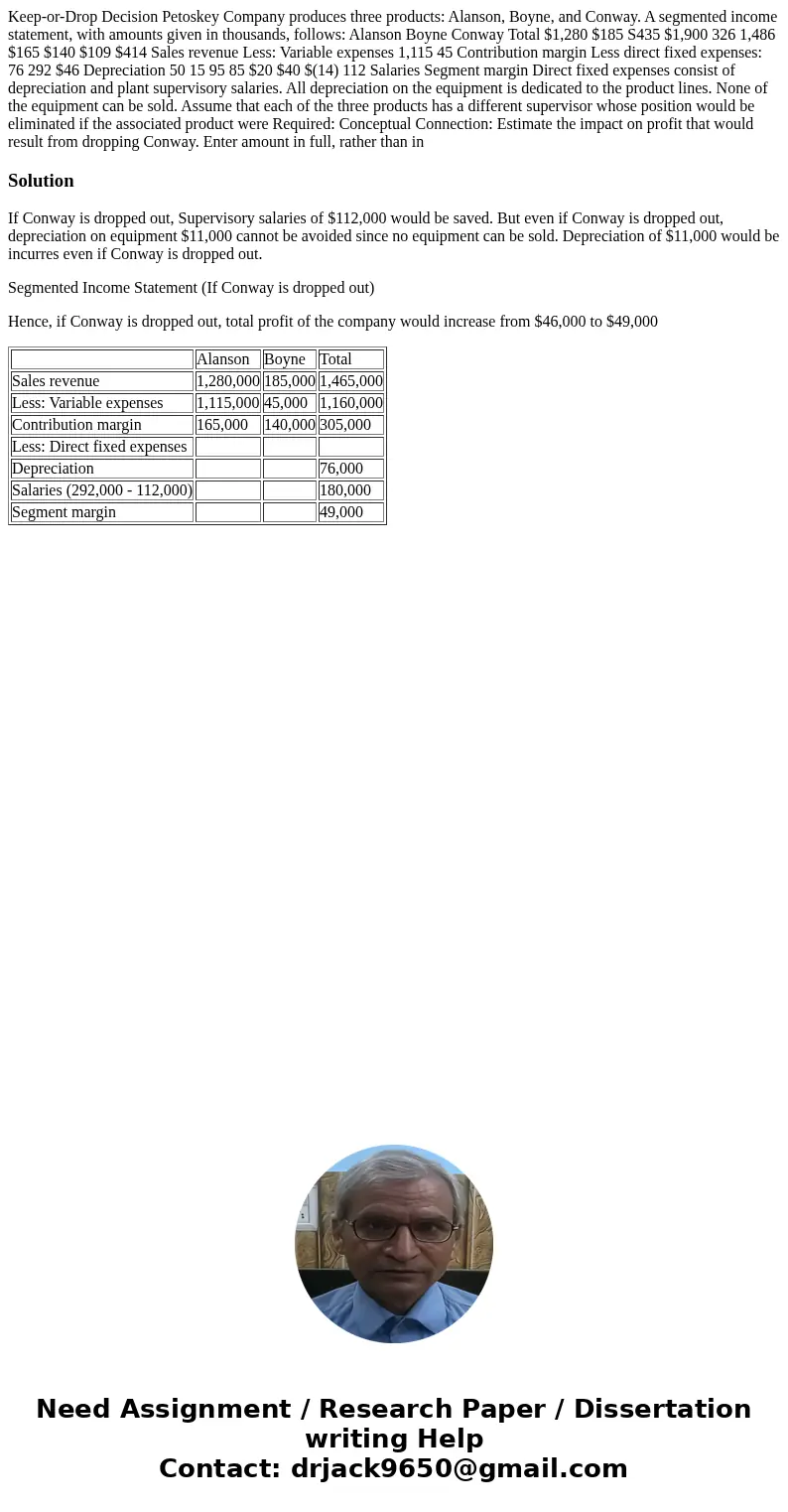

Solution

If Conway is dropped out, Supervisory salaries of $112,000 would be saved. But even if Conway is dropped out, depreciation on equipment $11,000 cannot be avoided since no equipment can be sold. Depreciation of $11,000 would be incurres even if Conway is dropped out.

Segmented Income Statement (If Conway is dropped out)

Hence, if Conway is dropped out, total profit of the company would increase from $46,000 to $49,000

| Alanson | Boyne | Total | |

| Sales revenue | 1,280,000 | 185,000 | 1,465,000 |

| Less: Variable expenses | 1,115,000 | 45,000 | 1,160,000 |

| Contribution margin | 165,000 | 140,000 | 305,000 |

| Less: Direct fixed expenses | |||

| Depreciation | 76,000 | ||

| Salaries (292,000 - 112,000) | 180,000 | ||

| Segment margin | 49,000 |

Homework Sourse

Homework Sourse