Ollivier Corporation has an activitybased costing system wit

Ollivier Corporation has an activity-based costing system with three activity cost pools-Processing. Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow. Overhead costs Equipment expense Indirect labor Distribution of Resource Consumption Across Activity Cost Pools Activity Cost Pools Processing SupervisingOther Equipment expense Indirect labor 03060 0.10 0.30 0.60 0.30 0.40 Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company\'s two products follow Activity Prodluct C4 Prodluct L7 Tota 18,100 1,150 890 980 What is the overhead cost assigned to Product L7 under activity-based costing? (Round your intermedlate calculations to 2 decimal places and your final answer to nearest whole dollar) $989 $17,610 $16,621 $27,588

Solution

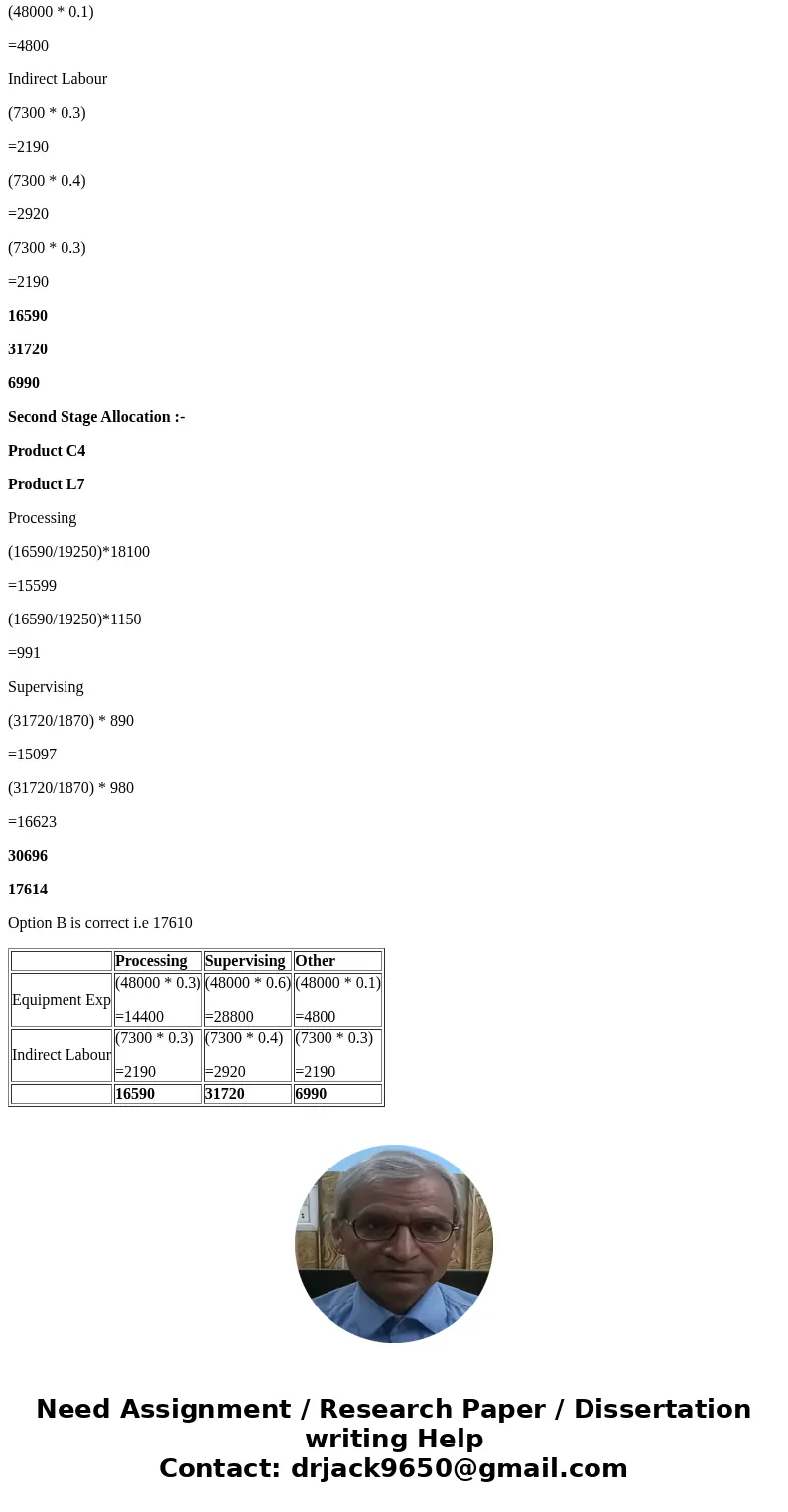

First Stage Allocation:-

Processing

Supervising

Other

Equipment Exp

(48000 * 0.3)

=14400

(48000 * 0.6)

=28800

(48000 * 0.1)

=4800

Indirect Labour

(7300 * 0.3)

=2190

(7300 * 0.4)

=2920

(7300 * 0.3)

=2190

16590

31720

6990

Second Stage Allocation :-

Product C4

Product L7

Processing

(16590/19250)*18100

=15599

(16590/19250)*1150

=991

Supervising

(31720/1870) * 890

=15097

(31720/1870) * 980

=16623

30696

17614

Option B is correct i.e 17610

| Processing | Supervising | Other | |

| Equipment Exp | (48000 * 0.3) =14400 | (48000 * 0.6) =28800 | (48000 * 0.1) =4800 |

| Indirect Labour | (7300 * 0.3) =2190 | (7300 * 0.4) =2920 | (7300 * 0.3) =2190 |

| 16590 | 31720 | 6990 |

Homework Sourse

Homework Sourse