Deadline Due by the end of Week 7 at 1159 pm ET Directions Q

Deadline Due by the end of Week 7 at 11.59 pm, ET. Directions Question 1: Employer\'s FICA An employee earned S50.000 during the year. F?CA tas for Social Security is 62% and FICA tax for Medicare is 1.45%. The employer\'s share of FICA taxes is A. Zero, since the employee\'s pay exceeds the FICA limit. B, Zero, since FICA is not an employer tax. C. S3,100 D. $725 E. S3,825 Question 2: Employer\'s FUTA Assume the FUTA tax rate is 06% and the SUTA tax rate is 54%. Both taues are applied to the first $7,000 of an employee\'s pay. What is the total unemployment tax an employer must pay on an employee\'s annual wages of $40,000? A. $2,400 B. $420 C.$42 D. S378 E Zero; the employee\'s wages exceed the $7,000 maximum

Solution

Question 1

Answer is option E $3,825

50000*(6.2%+1.45%) = 50000*7.65% = 3825

Question 2

Answer is option B $420

7000*(0.6%+5.4%) = 7000*6% = 420

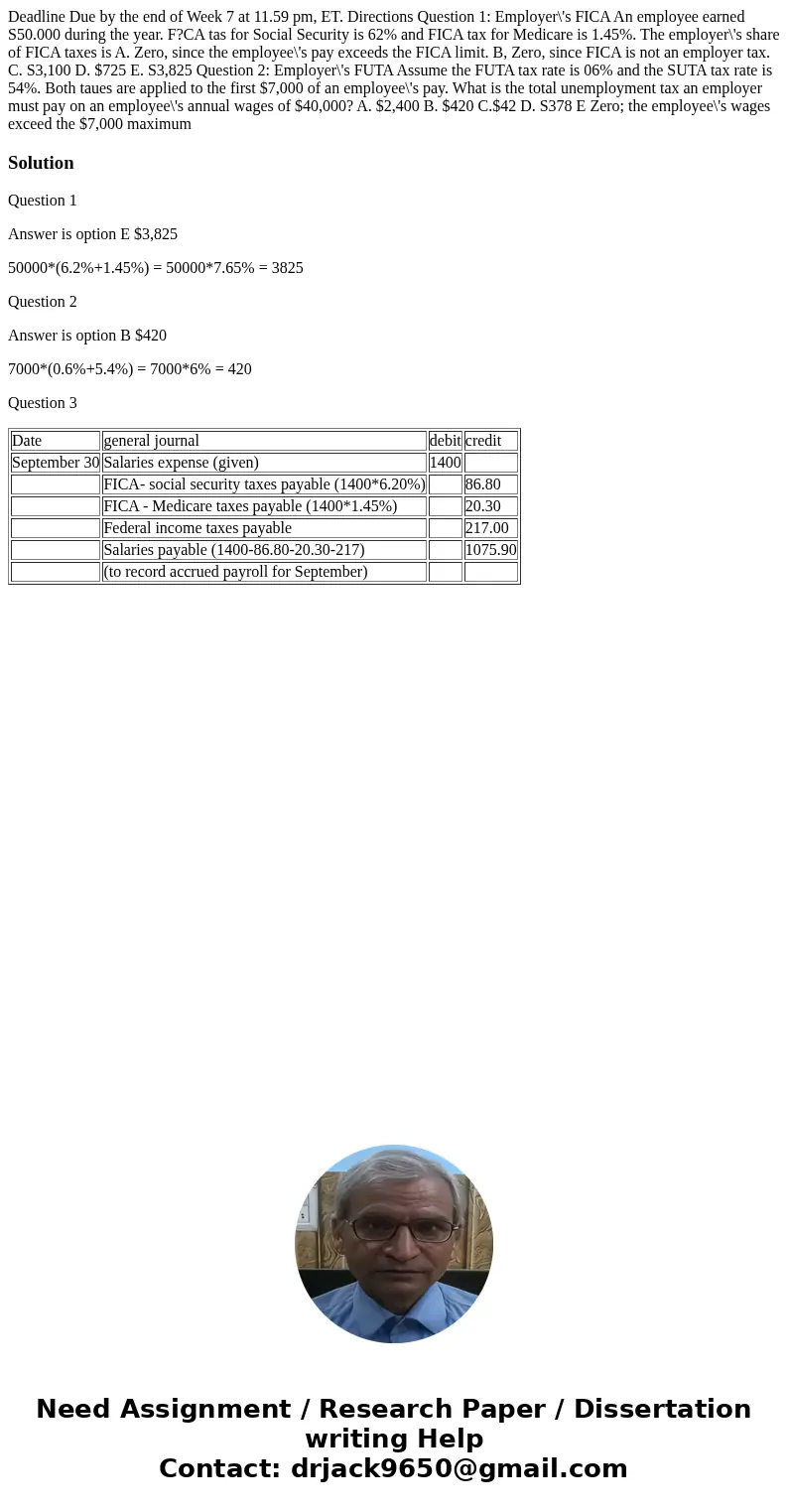

Question 3

| Date | general journal | debit | credit |

| September 30 | Salaries expense (given) | 1400 | |

| FICA- social security taxes payable (1400*6.20%) | 86.80 | ||

| FICA - Medicare taxes payable (1400*1.45%) | 20.30 | ||

| Federal income taxes payable | 217.00 | ||

| Salaries payable (1400-86.80-20.30-217) | 1075.90 | ||

| (to record accrued payroll for September) |

Homework Sourse

Homework Sourse