Carolyn Inc is considering two alternatives to finance its c

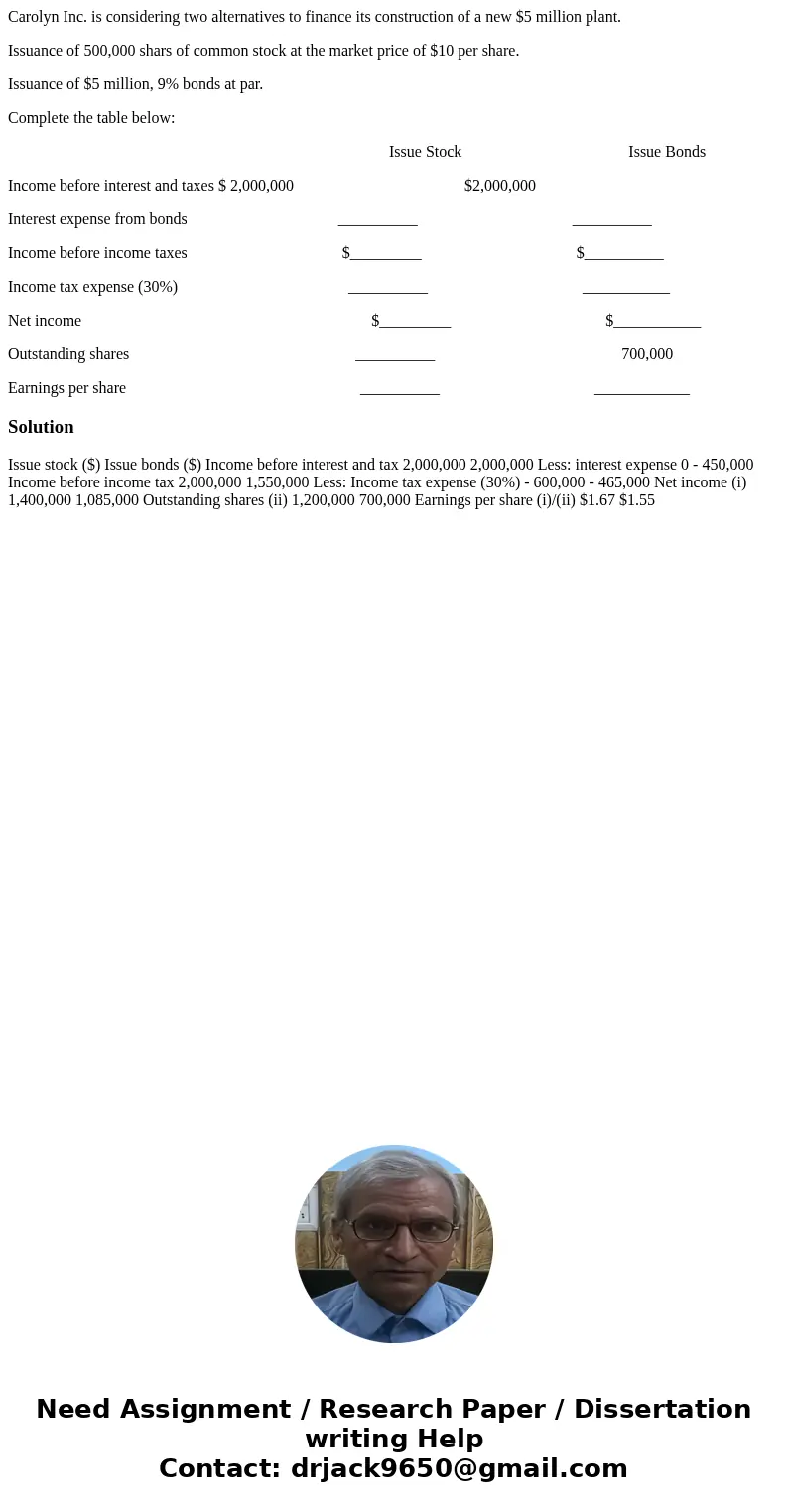

Carolyn Inc. is considering two alternatives to finance its construction of a new $5 million plant.

Issuance of 500,000 shars of common stock at the market price of $10 per share.

Issuance of $5 million, 9% bonds at par.

Complete the table below:

Issue Stock Issue Bonds

Income before interest and taxes $ 2,000,000 $2,000,000

Interest expense from bonds __________ __________

Income before income taxes $_________ $__________

Income tax expense (30%) __________ ___________

Net income $_________ $___________

Outstanding shares __________ 700,000

Earnings per share __________ ____________

Solution

Issue stock ($) Issue bonds ($) Income before interest and tax 2,000,000 2,000,000 Less: interest expense 0 - 450,000 Income before income tax 2,000,000 1,550,000 Less: Income tax expense (30%) - 600,000 - 465,000 Net income (i) 1,400,000 1,085,000 Outstanding shares (ii) 1,200,000 700,000 Earnings per share (i)/(ii) $1.67 $1.55

Homework Sourse

Homework Sourse