File Edit View History Bookmarks Window Help canvashighlinee

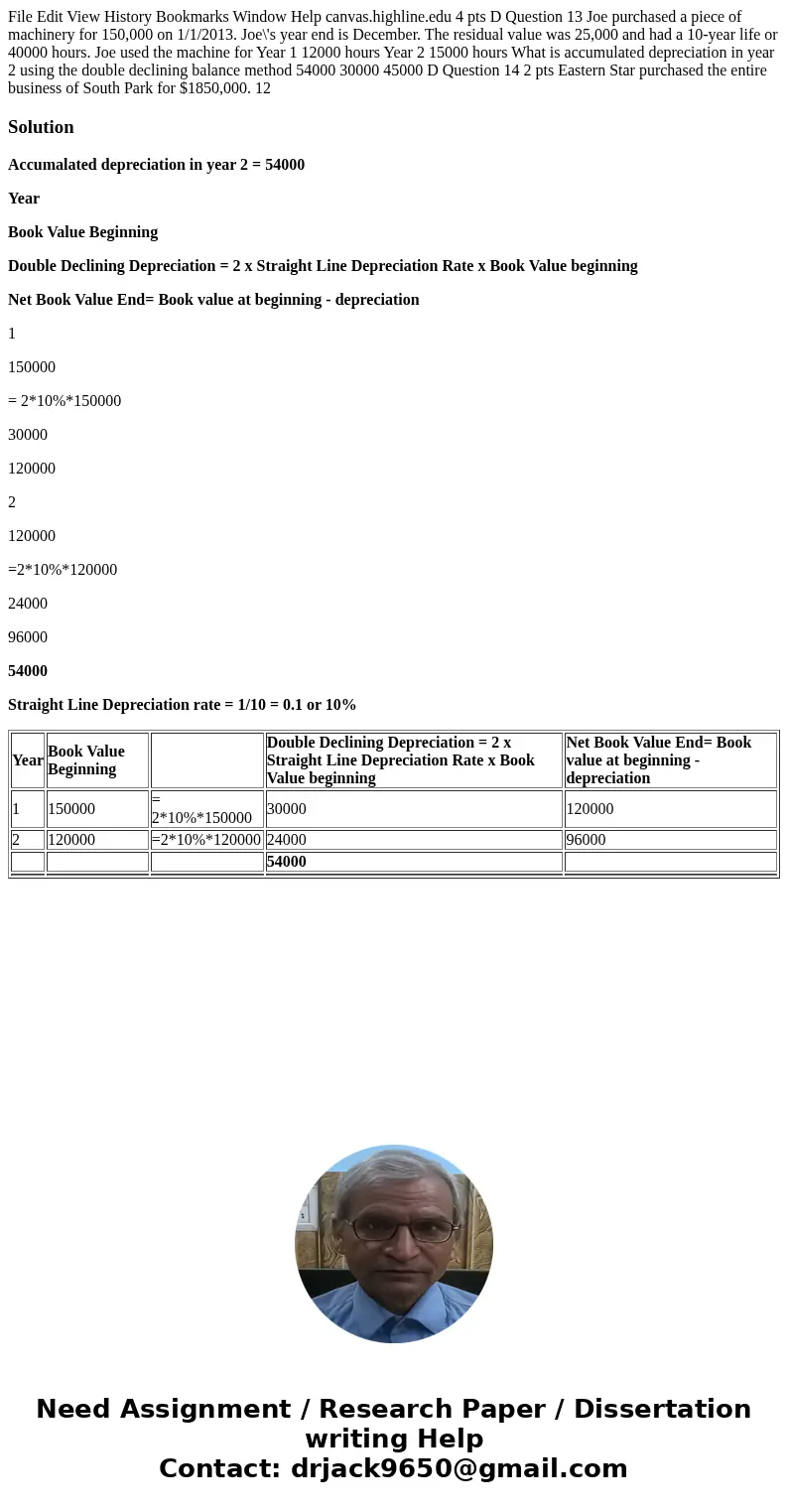

File Edit View History Bookmarks Window Help canvas.highline.edu 4 pts D Question 13 Joe purchased a piece of machinery for 150,000 on 1/1/2013. Joe\'s year end is December. The residual value was 25,000 and had a 10-year life or 40000 hours. Joe used the machine for Year 1 12000 hours Year 2 15000 hours What is accumulated depreciation in year 2 using the double declining balance method 54000 30000 45000 D Question 14 2 pts Eastern Star purchased the entire business of South Park for $1850,000. 12

Solution

Accumalated depreciation in year 2 = 54000

Year

Book Value Beginning

Double Declining Depreciation = 2 x Straight Line Depreciation Rate x Book Value beginning

Net Book Value End= Book value at beginning - depreciation

1

150000

= 2*10%*150000

30000

120000

2

120000

=2*10%*120000

24000

96000

54000

Straight Line Depreciation rate = 1/10 = 0.1 or 10%

| Year | Book Value Beginning | Double Declining Depreciation = 2 x Straight Line Depreciation Rate x Book Value beginning | Net Book Value End= Book value at beginning - depreciation | |

| 1 | 150000 | = 2*10%*150000 | 30000 | 120000 |

| 2 | 120000 | =2*10%*120000 | 24000 | 96000 |

| 54000 | ||||

Homework Sourse

Homework Sourse