19 On 1 January 2011 Scott Pty Ltd started the year with a 2

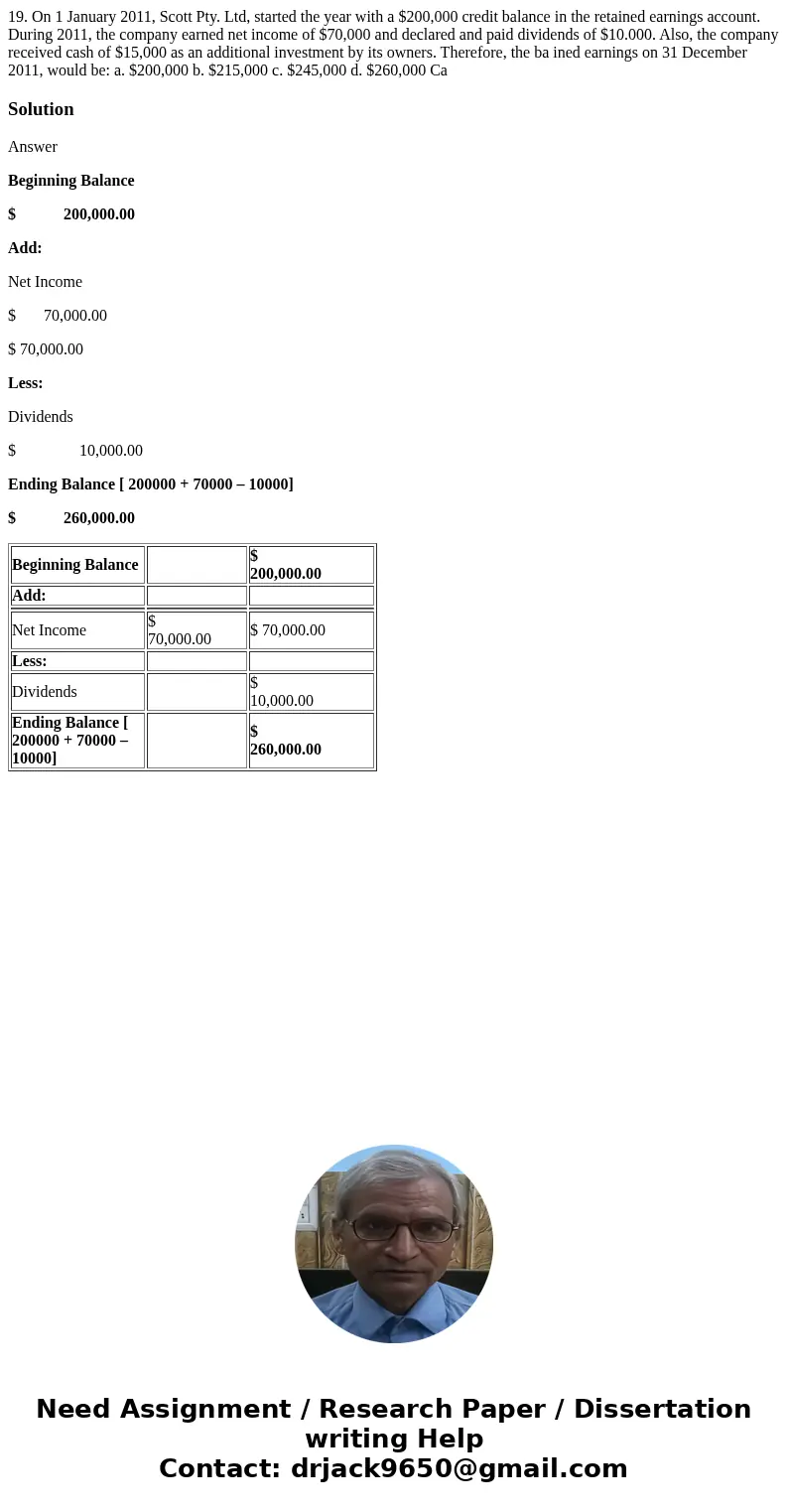

19. On 1 January 2011, Scott Pty. Ltd, started the year with a $200,000 credit balance in the retained earnings account. During 2011, the company earned net income of $70,000 and declared and paid dividends of $10.000. Also, the company received cash of $15,000 as an additional investment by its owners. Therefore, the ba ined earnings on 31 December 2011, would be: a. $200,000 b. $215,000 c. $245,000 d. $260,000 Ca

Solution

Answer

Beginning Balance

$ 200,000.00

Add:

Net Income

$ 70,000.00

$ 70,000.00

Less:

Dividends

$ 10,000.00

Ending Balance [ 200000 + 70000 – 10000]

$ 260,000.00

| Beginning Balance | $ 200,000.00 | |

| Add: | ||

| Net Income | $ 70,000.00 | $ 70,000.00 |

| Less: | ||

| Dividends | $ 10,000.00 | |

| Ending Balance [ 200000 + 70000 – 10000] | $ 260,000.00 |

Homework Sourse

Homework Sourse