Exercise 123 On January 2 2018 Tylor Company issued a 4year

Exercise 123

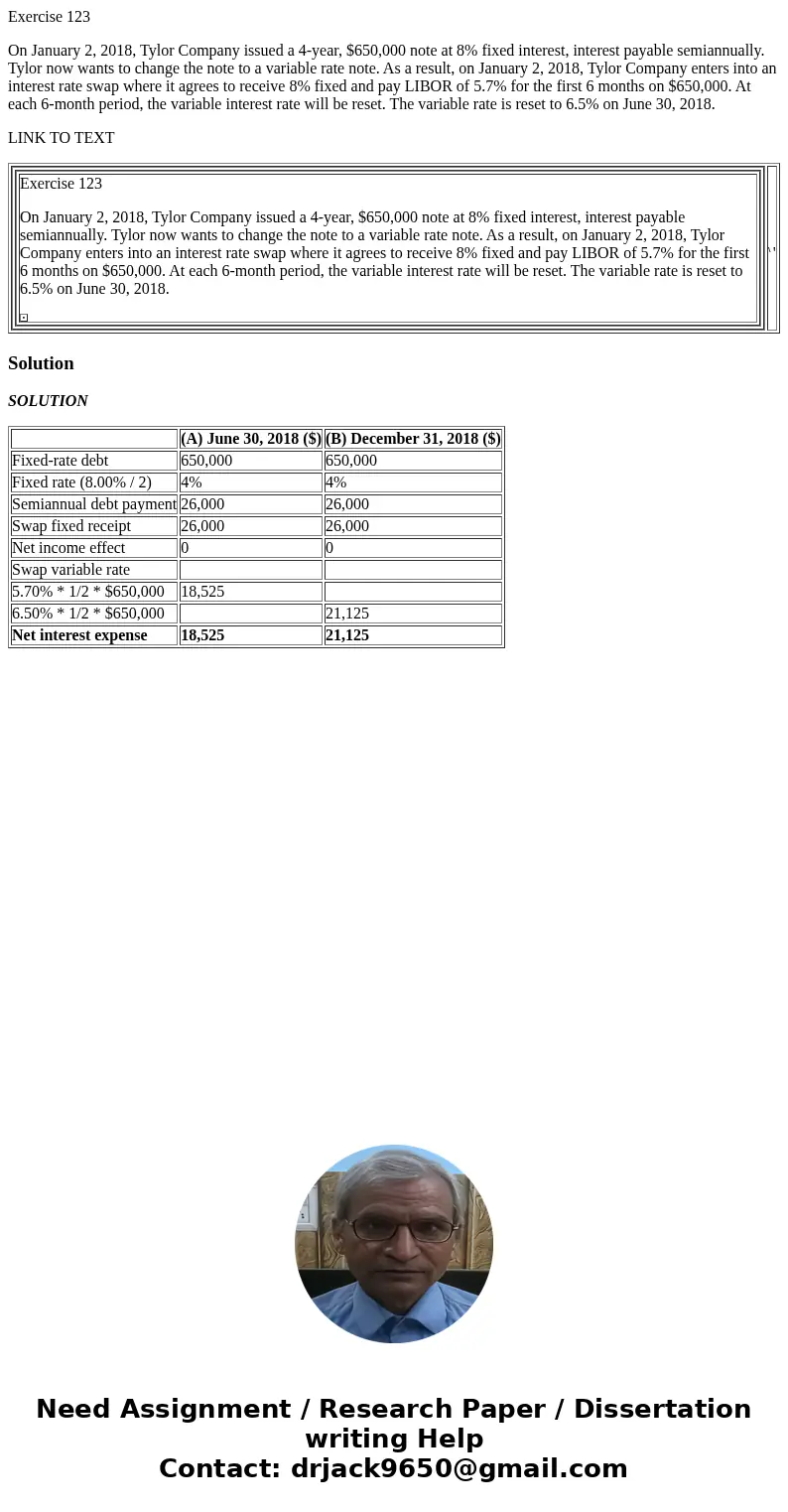

On January 2, 2018, Tylor Company issued a 4-year, $650,000 note at 8% fixed interest, interest payable semiannually. Tylor now wants to change the note to a variable rate note. As a result, on January 2, 2018, Tylor Company enters into an interest rate swap where it agrees to receive 8% fixed and pay LIBOR of 5.7% for the first 6 months on $650,000. At each 6-month period, the variable interest rate will be reset. The variable rate is reset to 6.5% on June 30, 2018.

LINK TO TEXT

|

Solution

SOLUTION

| (A) June 30, 2018 ($) | (B) December 31, 2018 ($) | |

| Fixed-rate debt | 650,000 | 650,000 |

| Fixed rate (8.00% / 2) | 4% | 4% |

| Semiannual debt payment | 26,000 | 26,000 |

| Swap fixed receipt | 26,000 | 26,000 |

| Net income effect | 0 | 0 |

| Swap variable rate | ||

| 5.70% * 1/2 * $650,000 | 18,525 | |

| 6.50% * 1/2 * $650,000 | 21,125 | |

| Net interest expense | 18,525 | 21,125 |

Homework Sourse

Homework Sourse