Fair Value Journal Entries AvailableforSale Investments The

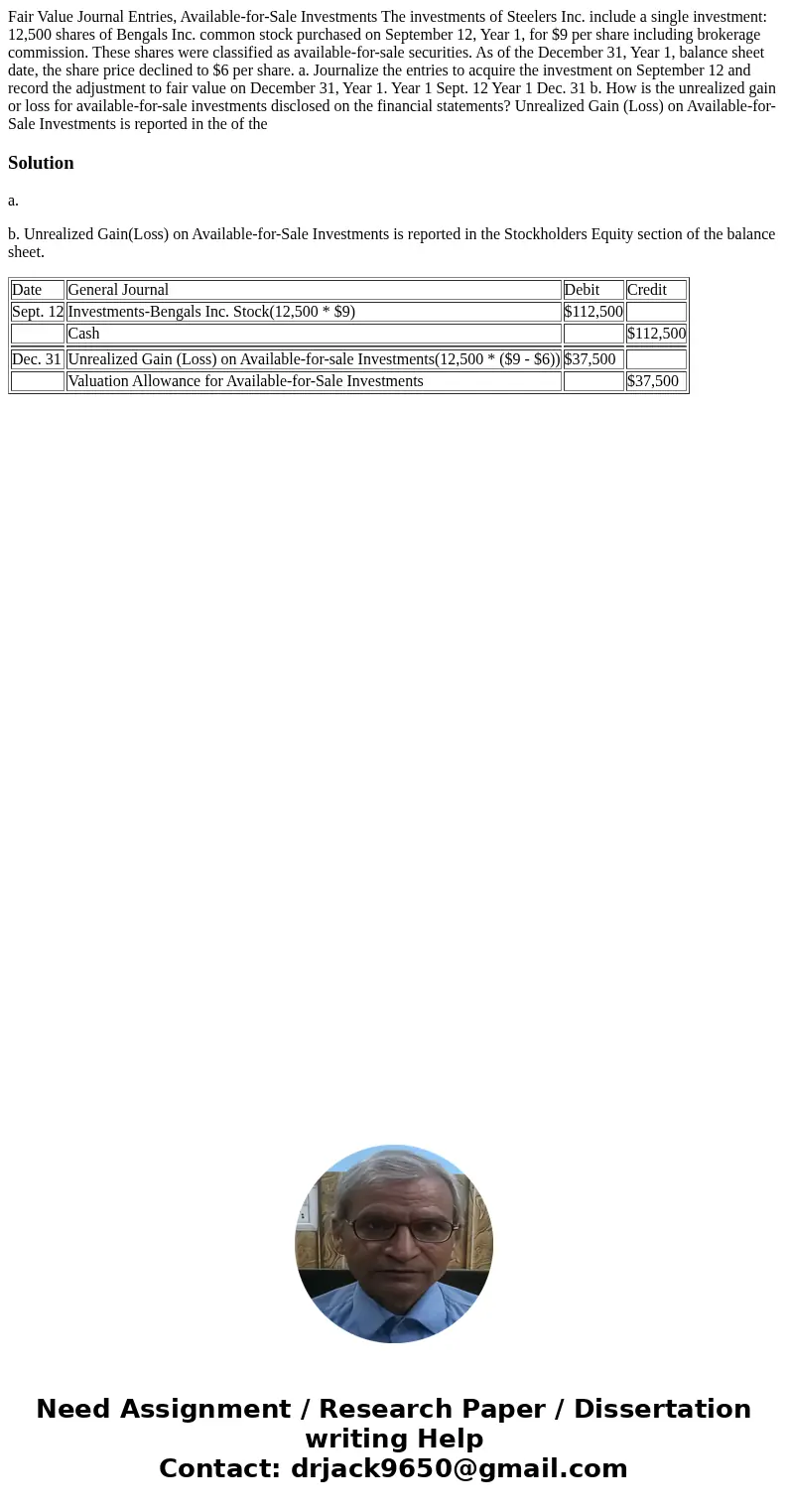

Fair Value Journal Entries, Available-for-Sale Investments The investments of Steelers Inc. include a single investment: 12,500 shares of Bengals Inc. common stock purchased on September 12, Year 1, for $9 per share including brokerage commission. These shares were classified as available-for-sale securities. As of the December 31, Year 1, balance sheet date, the share price declined to $6 per share. a. Journalize the entries to acquire the investment on September 12 and record the adjustment to fair value on December 31, Year 1. Year 1 Sept. 12 Year 1 Dec. 31 b. How is the unrealized gain or loss for available-for-sale investments disclosed on the financial statements? Unrealized Gain (Loss) on Available-for-Sale Investments is reported in the of the

Solution

a.

b. Unrealized Gain(Loss) on Available-for-Sale Investments is reported in the Stockholders Equity section of the balance sheet.

| Date | General Journal | Debit | Credit |

| Sept. 12 | Investments-Bengals Inc. Stock(12,500 * $9) | $112,500 | |

| Cash | $112,500 | ||

| Dec. 31 | Unrealized Gain (Loss) on Available-for-sale Investments(12,500 * ($9 - $6)) | $37,500 | |

| Valuation Allowance for Available-for-Sale Investments | $37,500 |

Homework Sourse

Homework Sourse