Troy Engines Ltd manufactures a variety of engines for use i

Troy Engines, Ltd., manufactures a variety of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburetor to Troy Engines, Ltd., for a cost of $48 per unit. To evaluate this offer, Troy Engines, Ltd., has gathered the following information relating to its own cost of producing the carburetor internally: 14,500 Units Per UnitPer Year S 13 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead, traceable Fixed manufacturing overhead, allocated Total cost $ 188,500 217,500 58,000 130,500 246,500 G 5& $ 841,000 9* $58 \"40% supervisory salaries, 60% depreciation of special equipment (no resale value). Required 1a. Assuming that the company has no alternative use for the facilities that are now being used to produce the carburetors, compute the total cost of making and buying the parts. (Round your Fixed manufacturing overhead per unit rate to 2 decimals.) Make Buy Total relevant cost (14,500 units) 696,000 1b. Should the outside supplier\'s offer be accepted? Reject O Accept

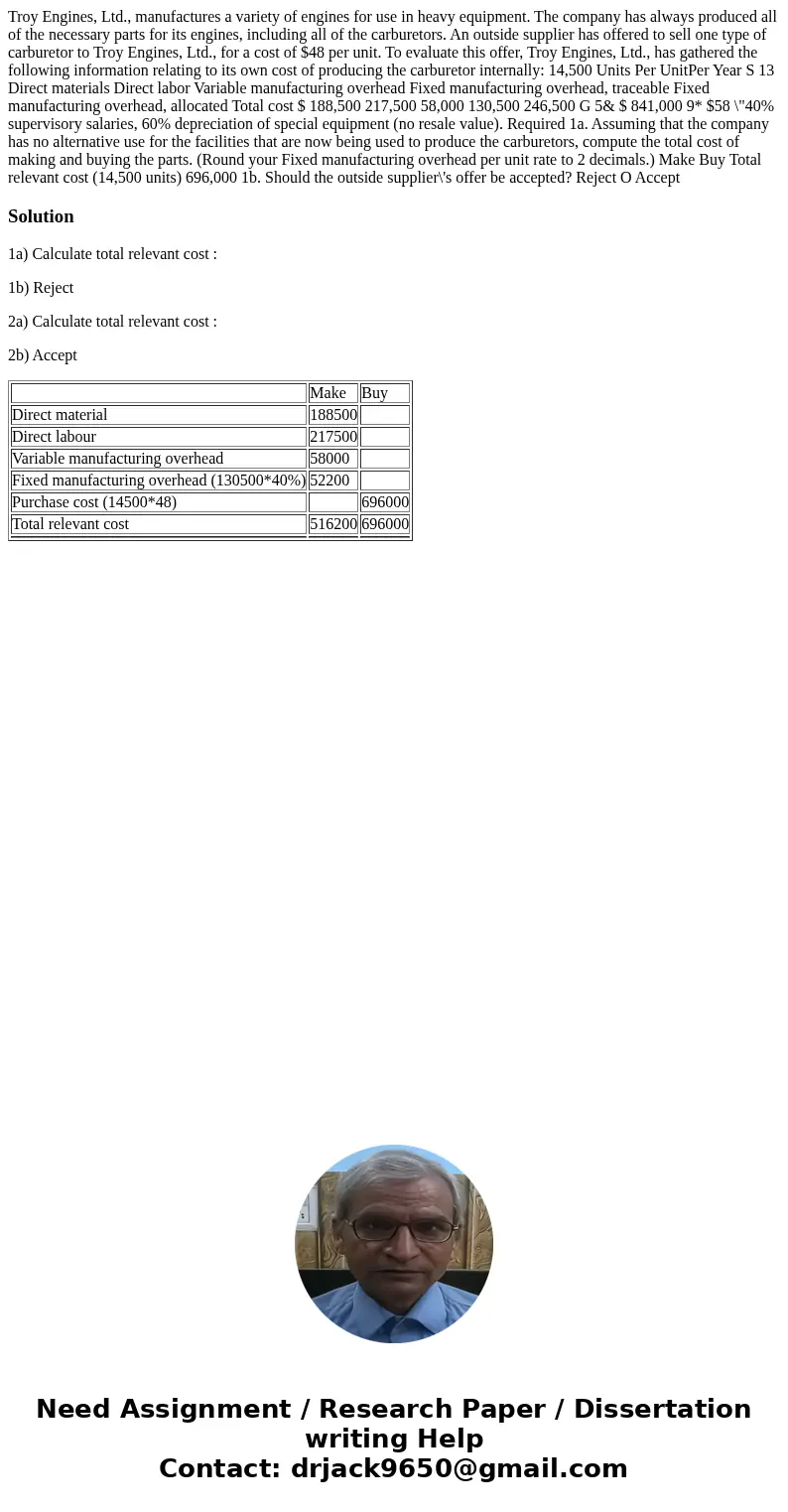

Solution

1a) Calculate total relevant cost :

1b) Reject

2a) Calculate total relevant cost :

2b) Accept

| Make | Buy | |

| Direct material | 188500 | |

| Direct labour | 217500 | |

| Variable manufacturing overhead | 58000 | |

| Fixed manufacturing overhead (130500*40%) | 52200 | |

| Purchase cost (14500*48) | 696000 | |

| Total relevant cost | 516200 | 696000 |

Homework Sourse

Homework Sourse