Grand Prix Displays Inc manufactures and assembles automobil

Grand Prix Displays Inc. manufactures and assembles automobile instrument panels for both Yokohama Motors and Detroit Motors. The process consists of a lean product cell for each customer’s instrument assembly. The data that follow concern only the Yokohama lean cell.

For the year, Grand Prix Displays Inc. budgeted the following costs for the Yokohama production cell:

1

Conversion Cost Categories

Budget

2

Labor

$585,000.00

3

Supplies

45,000.00

4

Utilities

30,000.00

5

Total

$660,000.00

Grand Prix Displays Inc. plans 2,200 hours of production for the Yokohama cell for the year. The materials cost is $180 per instrument assembly. Each assembly requires 15 minutes of cell assembly time. There was no November 1 inventory for either Raw and In Process Inventory or Finished Goods Inventory.

The following summary events took place in the Yokohama cell during November:

Nov.

4

Electronic parts and wiring were purchased to produce 9,000 instrument assemblies in November.

6

Conversion costs were applied for the production of 8,800 units in November.

24

8,650 units were started, completed, and transferred to finished goods in November.

29

8,600 units were shipped to customers at a price of $400 per unit.

Required:

1.

Determine the budgeted cell conversion cost per hour.

2.

Determine the budgeted cell conversion cost per unit.

3.

Journalize the summary transactions for November. Refer to the Chart of Accounts for exact wording of account titles.

4.

Determine the ending balance in Raw and In Process Inventory and Finished Goods Inventory.

5.

How does the accounting in a lean environment differ from traditional accounting?

CHART OF ACCOUNTS

Grand Prix Displays Inc.

General Ledger

ASSETS

110

Cash

120

Accounts Receivable

125

Notes Receivable

140

Office Supplies

141

Store Supplies

142

Prepaid Insurance

150

Raw and In Process Inventory

151

Finished Goods Inventory

180

Land

190

Equipment

191

Accumulated Depreciation-Equipment

LIABILITIES

210

Accounts Payable

216

Salaries Payable

218

Sales Tax Payable

219

Customers Refunds Payable

221

Notes Payable

EQUITY

31

Common Stock

32

Retained Earnings

33

Dividends

34

Income Summary

REVENUE

410

Sales

EXPENSES

510

Cost of Goods Sold

511

Conversion Costs

521

Advertising Expense

523

Depreciation Expense-Equipment

526

Salaries Expense

531

Rent Expense

533

Insurance Expense

534

Store Supplies Expense

535

Office Supplies Expense

536

Credit Card Expense

539

Miscellaneous Expense

710

Interest Expense

1. Determine the budgeted cell conversion cost per hour.

per hour

2. Determine the budgeted cell conversion cost per unit.

per unit

3. Journalize the summary transactions for November. Refer to the Chart of Accounts for exact wording of account titles.

PAGE 10

JOURNAL

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

1

2

3

4

5

6

7

8

9

10

4. Determine the ending balance in Raw and In Process Inventory and Finished Goods Inventory.

5. How does the accounting in a lean environment differ from traditional accounting?

Lean accounting is different from traditional accounting because it is more and uses control.

Solution

Solution 1:

budgeted cell conversion cost per hour = Budgeted conversion cost / Budgeted labor hours = $660,000.00 / 2200 = $ 300

Solution 2:

budgeted cell conversion cost per unit = Conversion cost per hour * conversion time per unit = $ 300 x 15/60 = $ 75

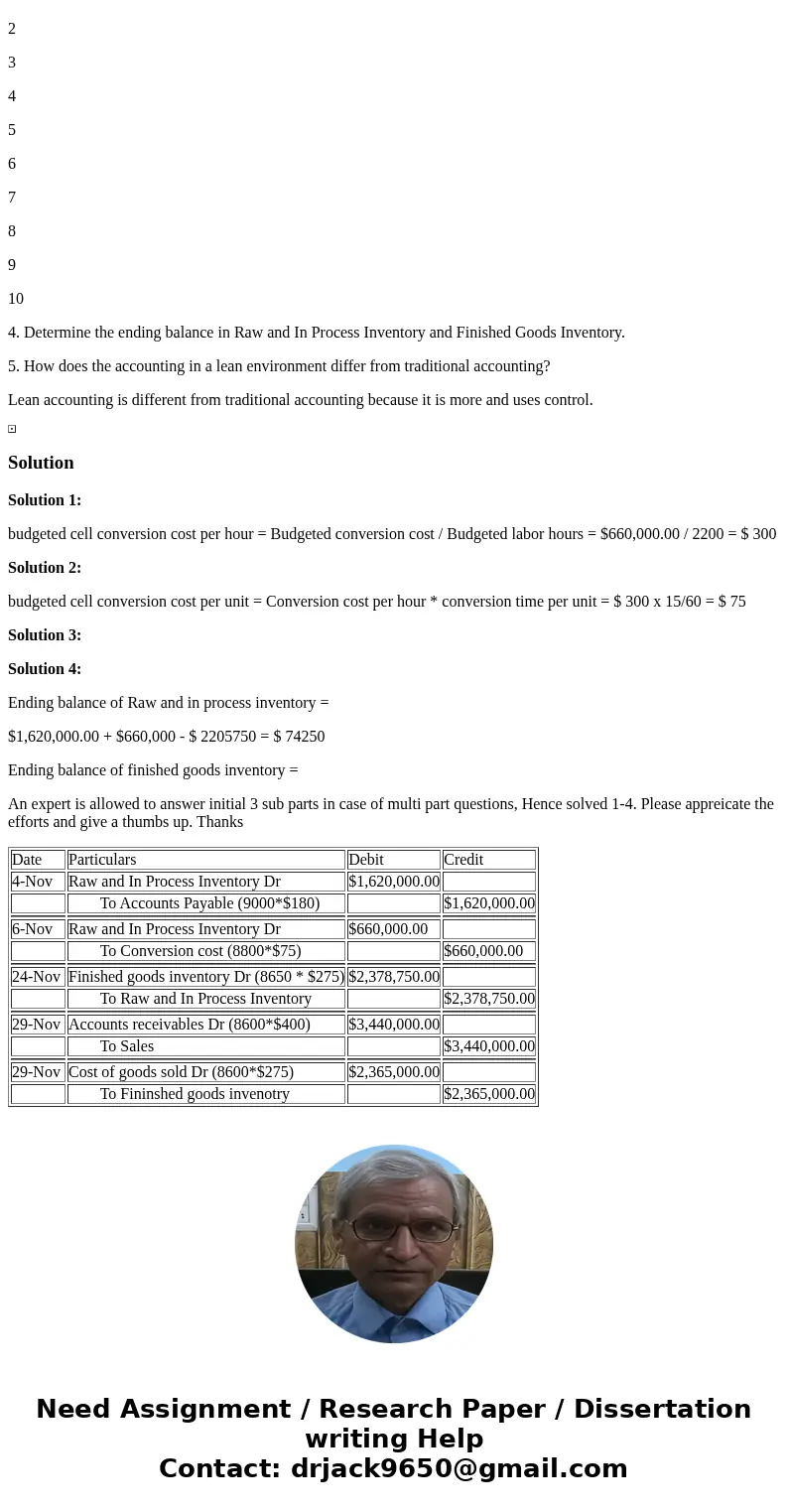

Solution 3:

Solution 4:

Ending balance of Raw and in process inventory =

$1,620,000.00 + $660,000 - $ 2205750 = $ 74250

Ending balance of finished goods inventory =

An expert is allowed to answer initial 3 sub parts in case of multi part questions, Hence solved 1-4. Please appreicate the efforts and give a thumbs up. Thanks

| Date | Particulars | Debit | Credit |

| 4-Nov | Raw and In Process Inventory Dr | $1,620,000.00 | |

| To Accounts Payable (9000*$180) | $1,620,000.00 | ||

| 6-Nov | Raw and In Process Inventory Dr | $660,000.00 | |

| To Conversion cost (8800*$75) | $660,000.00 | ||

| 24-Nov | Finished goods inventory Dr (8650 * $275) | $2,378,750.00 | |

| To Raw and In Process Inventory | $2,378,750.00 | ||

| 29-Nov | Accounts receivables Dr (8600*$400) | $3,440,000.00 | |

| To Sales | $3,440,000.00 | ||

| 29-Nov | Cost of goods sold Dr (8600*$275) | $2,365,000.00 | |

| To Fininshed goods invenotry | $2,365,000.00 |

Homework Sourse

Homework Sourse