Main Street Restaurant incurred salaries expense of 60000 fo

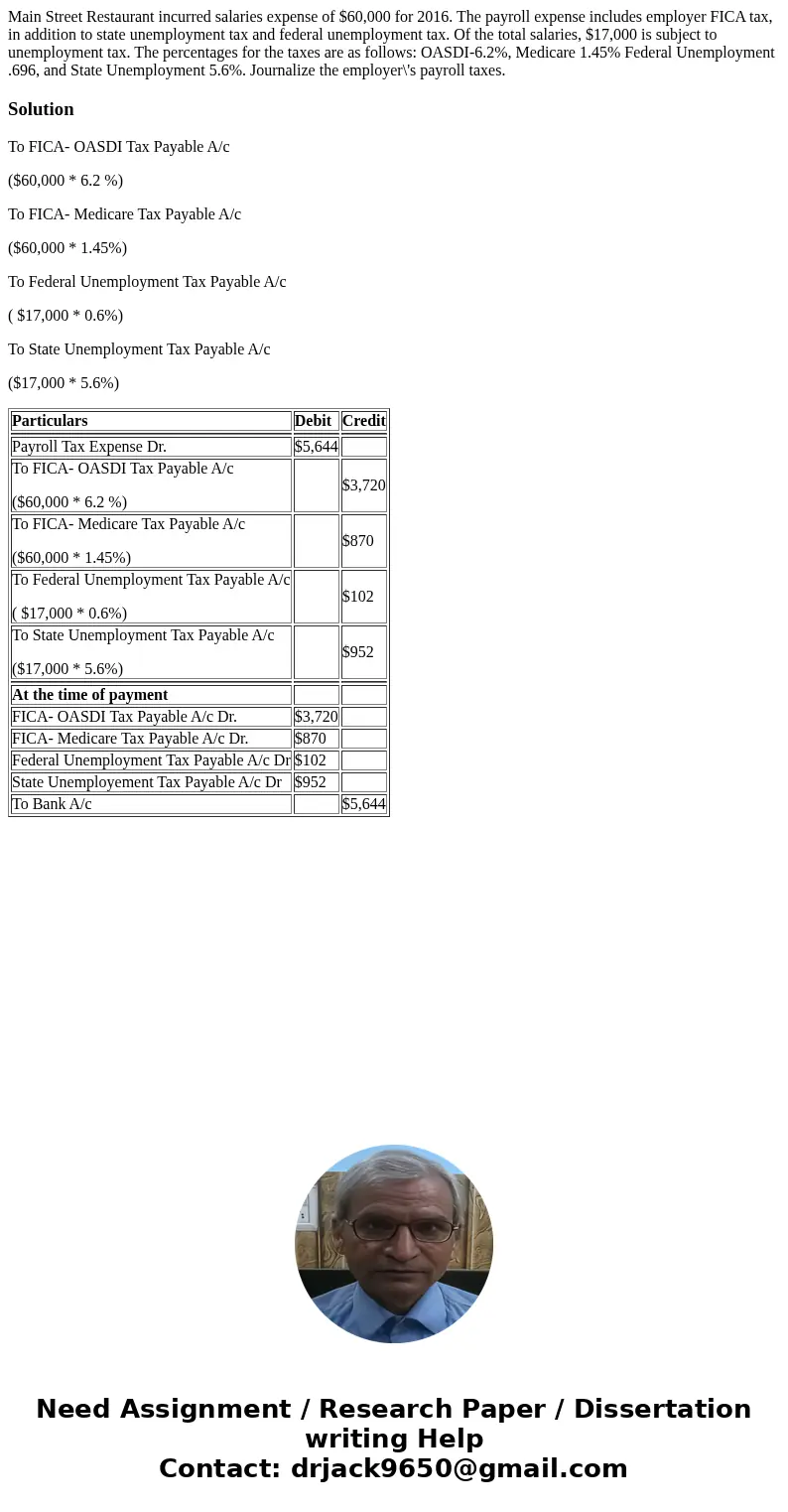

Main Street Restaurant incurred salaries expense of $60,000 for 2016. The payroll expense includes employer FICA tax, in addition to state unemployment tax and federal unemployment tax. Of the total salaries, $17,000 is subject to unemployment tax. The percentages for the taxes are as follows: OASDI-6.2%, Medicare 1.45% Federal Unemployment .696, and State Unemployment 5.6%. Journalize the employer\'s payroll taxes.

Solution

To FICA- OASDI Tax Payable A/c

($60,000 * 6.2 %)

To FICA- Medicare Tax Payable A/c

($60,000 * 1.45%)

To Federal Unemployment Tax Payable A/c

( $17,000 * 0.6%)

To State Unemployment Tax Payable A/c

($17,000 * 5.6%)

| Particulars | Debit | Credit |

| Payroll Tax Expense Dr. | $5,644 | |

| To FICA- OASDI Tax Payable A/c ($60,000 * 6.2 %) | $3,720 | |

| To FICA- Medicare Tax Payable A/c ($60,000 * 1.45%) | $870 | |

| To Federal Unemployment Tax Payable A/c ( $17,000 * 0.6%) | $102 | |

| To State Unemployment Tax Payable A/c ($17,000 * 5.6%) | $952 | |

| At the time of payment | ||

| FICA- OASDI Tax Payable A/c Dr. | $3,720 | |

| FICA- Medicare Tax Payable A/c Dr. | $870 | |

| Federal Unemployment Tax Payable A/c Dr | $102 | |

| State Unemployement Tax Payable A/c Dr | $952 | |

| To Bank A/c | $5,644 |

Homework Sourse

Homework Sourse