Score out of 10 Question 2 Lillys Sign Company Operating inc

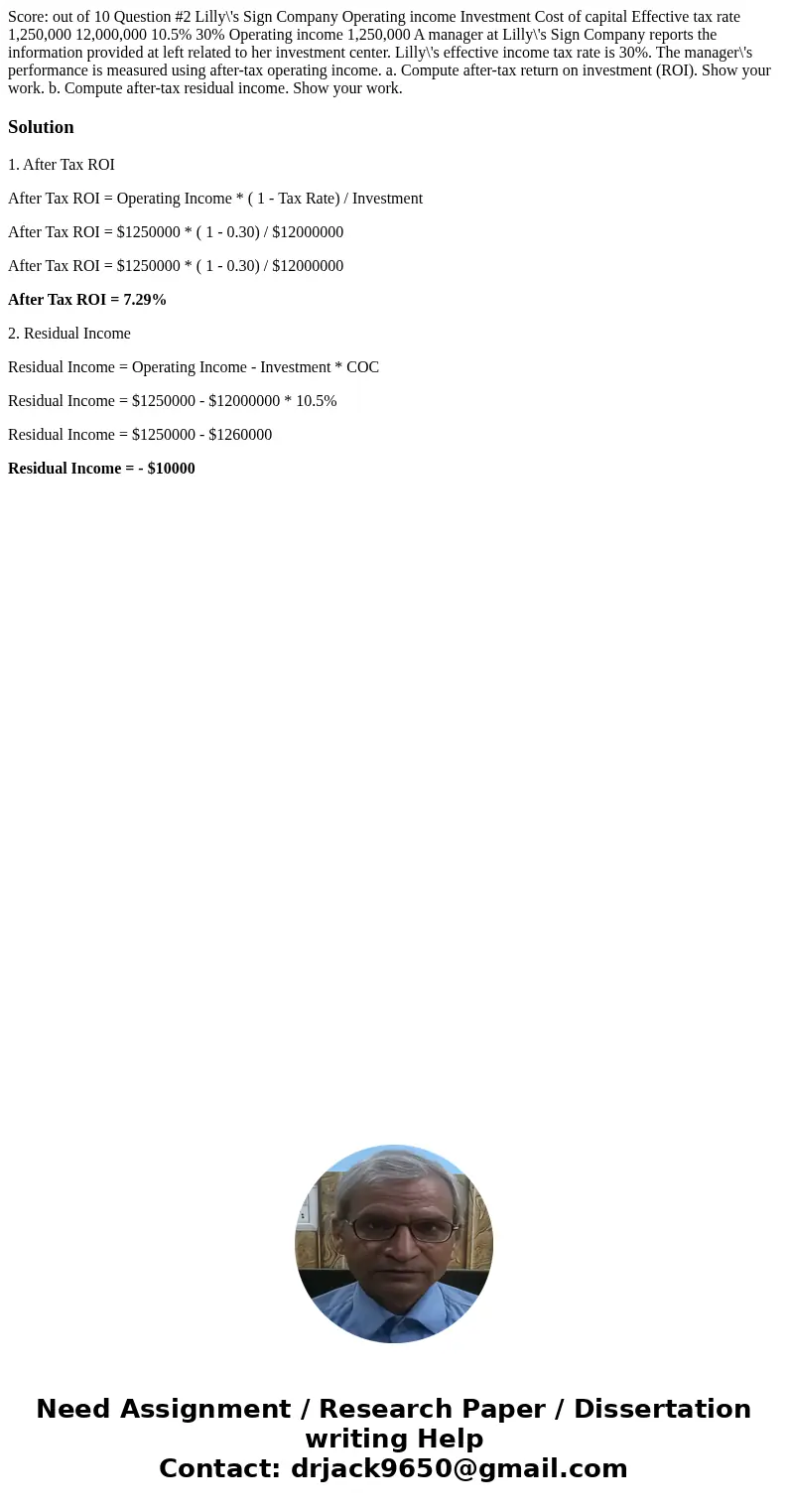

Score: out of 10 Question #2 Lilly\'s Sign Company Operating income Investment Cost of capital Effective tax rate 1,250,000 12,000,000 10.5% 30% Operating income 1,250,000 A manager at Lilly\'s Sign Company reports the information provided at left related to her investment center. Lilly\'s effective income tax rate is 30%. The manager\'s performance is measured using after-tax operating income. a. Compute after-tax return on investment (ROI). Show your work. b. Compute after-tax residual income. Show your work.

Solution

1. After Tax ROI

After Tax ROI = Operating Income * ( 1 - Tax Rate) / Investment

After Tax ROI = $1250000 * ( 1 - 0.30) / $12000000

After Tax ROI = $1250000 * ( 1 - 0.30) / $12000000

After Tax ROI = 7.29%

2. Residual Income

Residual Income = Operating Income - Investment * COC

Residual Income = $1250000 - $12000000 * 10.5%

Residual Income = $1250000 - $1260000

Residual Income = - $10000

Homework Sourse

Homework Sourse