Problem 1 Textbook Reference P14A Financial Accounting Revi

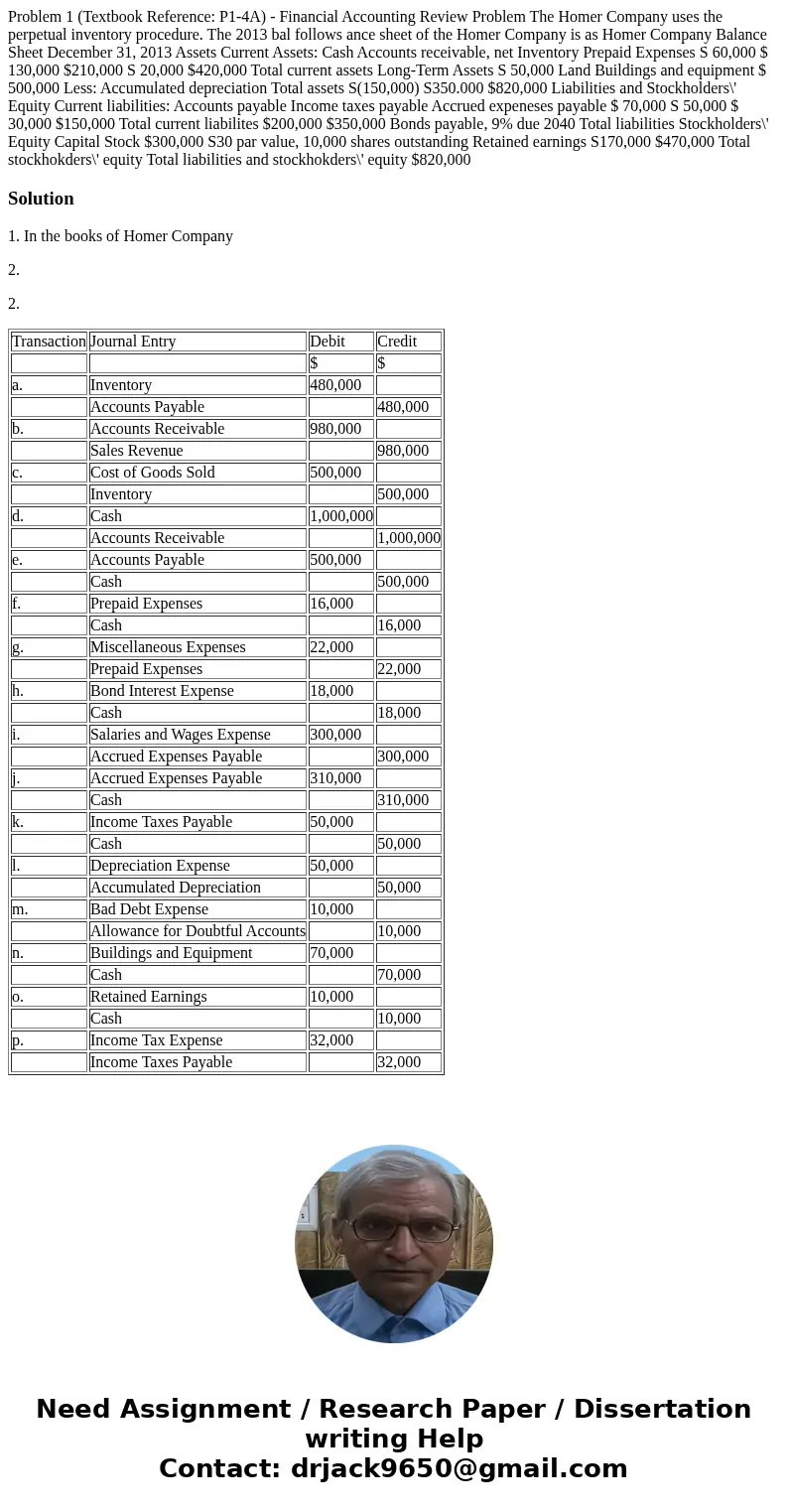

Problem 1 (Textbook Reference: P1-4A) - Financial Accounting Review Problem The Homer Company uses the perpetual inventory procedure. The 2013 bal follows ance sheet of the Homer Company is as Homer Company Balance Sheet December 31, 2013 Assets Current Assets: Cash Accounts receivable, net Inventory Prepaid Expenses S 60,000 $ 130,000 $210,000 S 20,000 $420,000 Total current assets Long-Term Assets S 50,000 Land Buildings and equipment $ 500,000 Less: Accumulated depreciation Total assets S(150,000) S350.000 $820,000 Liabilities and Stockholders\' Equity Current liabilities: Accounts payable Income taxes payable Accrued expeneses payable $ 70,000 S 50,000 $ 30,000 $150,000 Total current liabilites $200,000 $350,000 Bonds payable, 9% due 2040 Total liabilities Stockholders\' Equity Capital Stock $300,000 S30 par value, 10,000 shares outstanding Retained earnings S170,000 $470,000 Total stockhokders\' equity Total liabilities and stockhokders\' equity $820,000

Solution

1. In the books of Homer Company

2.

2.

| Transaction | Journal Entry | Debit | Credit |

| $ | $ | ||

| a. | Inventory | 480,000 | |

| Accounts Payable | 480,000 | ||

| b. | Accounts Receivable | 980,000 | |

| Sales Revenue | 980,000 | ||

| c. | Cost of Goods Sold | 500,000 | |

| Inventory | 500,000 | ||

| d. | Cash | 1,000,000 | |

| Accounts Receivable | 1,000,000 | ||

| e. | Accounts Payable | 500,000 | |

| Cash | 500,000 | ||

| f. | Prepaid Expenses | 16,000 | |

| Cash | 16,000 | ||

| g. | Miscellaneous Expenses | 22,000 | |

| Prepaid Expenses | 22,000 | ||

| h. | Bond Interest Expense | 18,000 | |

| Cash | 18,000 | ||

| i. | Salaries and Wages Expense | 300,000 | |

| Accrued Expenses Payable | 300,000 | ||

| j. | Accrued Expenses Payable | 310,000 | |

| Cash | 310,000 | ||

| k. | Income Taxes Payable | 50,000 | |

| Cash | 50,000 | ||

| l. | Depreciation Expense | 50,000 | |

| Accumulated Depreciation | 50,000 | ||

| m. | Bad Debt Expense | 10,000 | |

| Allowance for Doubtful Accounts | 10,000 | ||

| n. | Buildings and Equipment | 70,000 | |

| Cash | 70,000 | ||

| o. | Retained Earnings | 10,000 | |

| Cash | 10,000 | ||

| p. | Income Tax Expense | 32,000 | |

| Income Taxes Payable | 32,000 |

Homework Sourse

Homework Sourse