Comprehensive Problem 5 Part Level Submission Debit Credit a

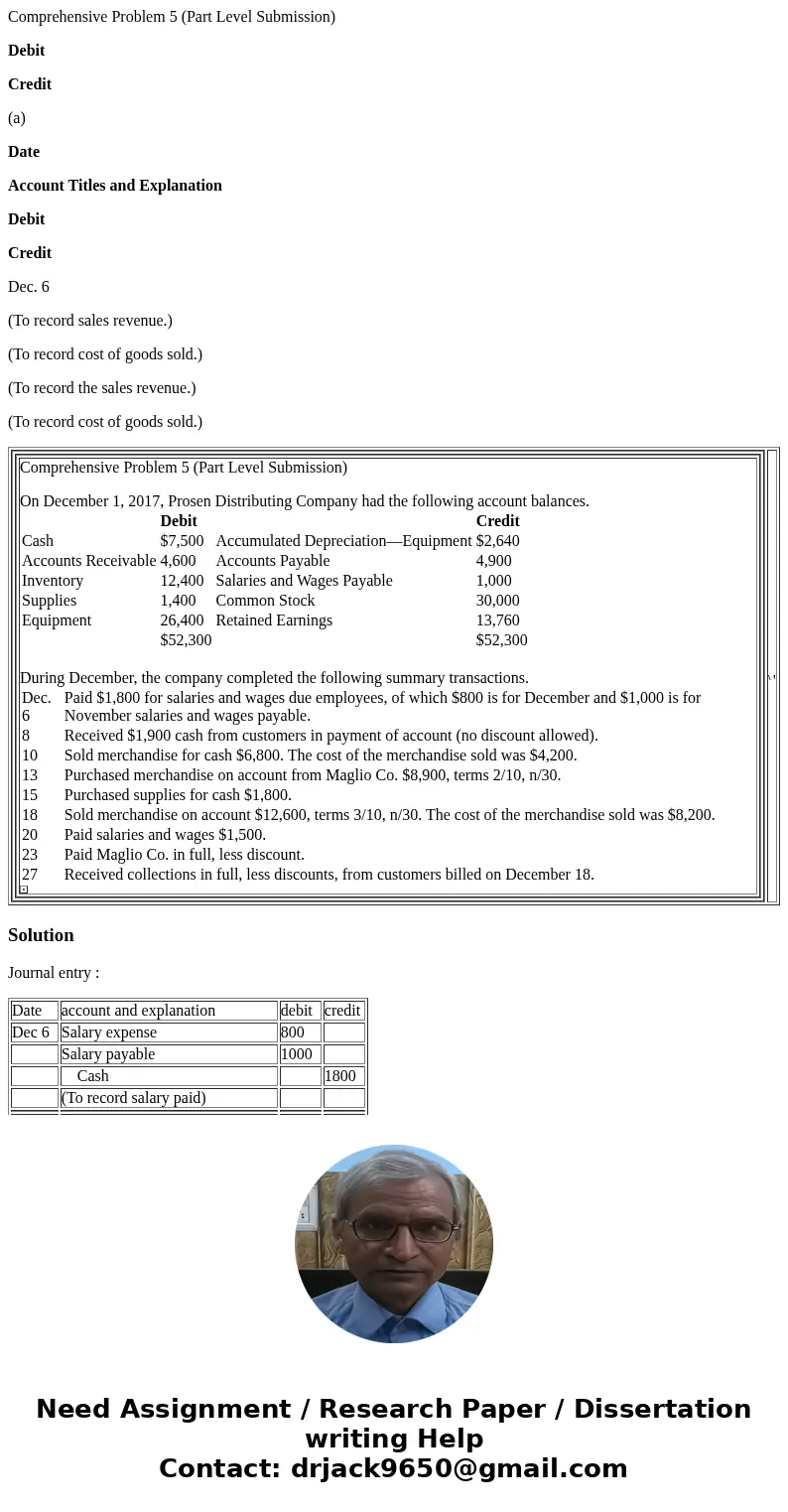

Comprehensive Problem 5 (Part Level Submission)

Debit

Credit

(a)

Date

Account Titles and Explanation

Debit

Credit

Dec. 6

(To record sales revenue.)

(To record cost of goods sold.)

(To record the sales revenue.)

(To record cost of goods sold.)

|

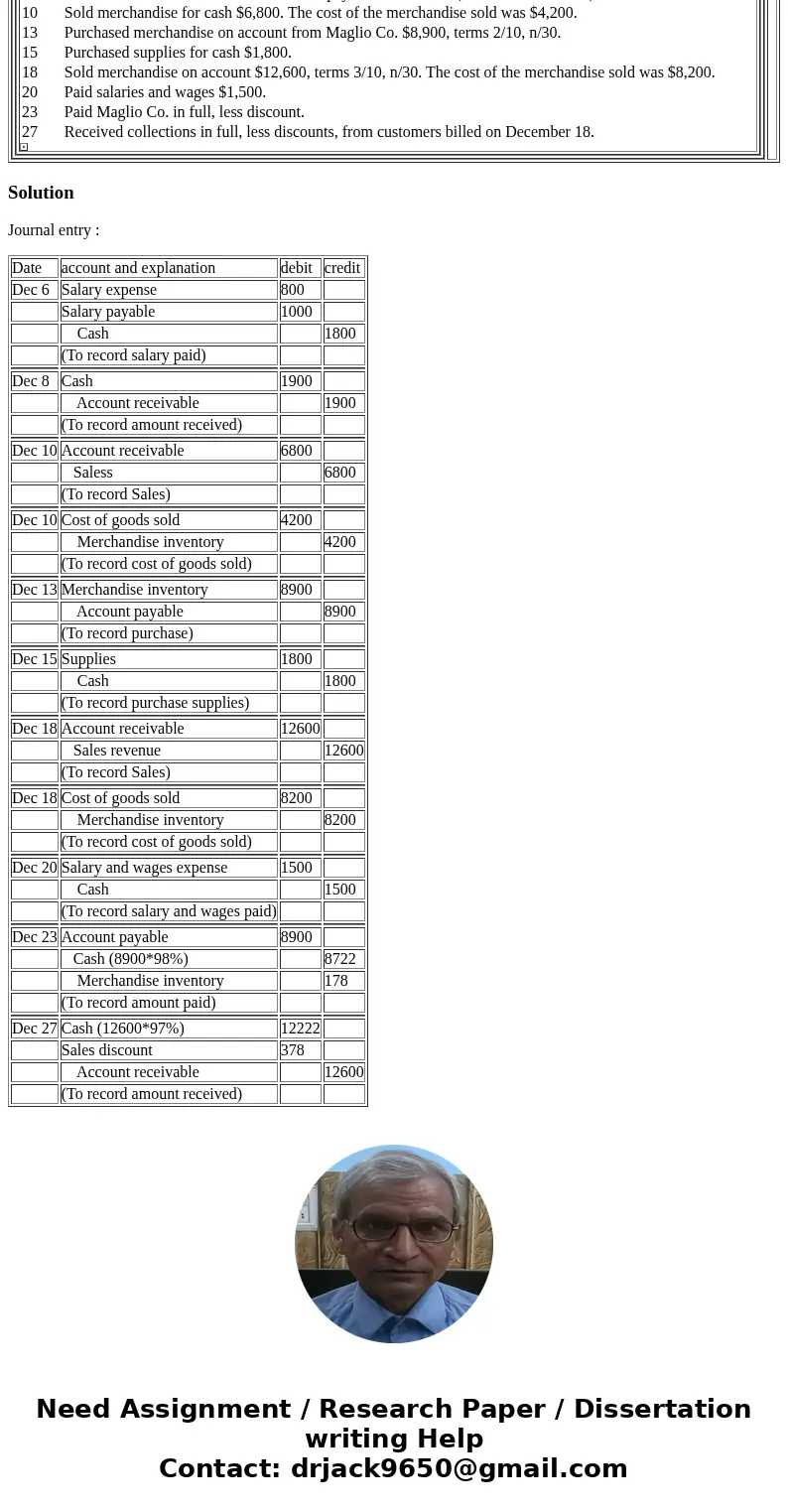

Solution

Journal entry :

| Date | account and explanation | debit | credit |

| Dec 6 | Salary expense | 800 | |

| Salary payable | 1000 | ||

| Cash | 1800 | ||

| (To record salary paid) | |||

| Dec 8 | Cash | 1900 | |

| Account receivable | 1900 | ||

| (To record amount received) | |||

| Dec 10 | Account receivable | 6800 | |

| Saless | 6800 | ||

| (To record Sales) | |||

| Dec 10 | Cost of goods sold | 4200 | |

| Merchandise inventory | 4200 | ||

| (To record cost of goods sold) | |||

| Dec 13 | Merchandise inventory | 8900 | |

| Account payable | 8900 | ||

| (To record purchase) | |||

| Dec 15 | Supplies | 1800 | |

| Cash | 1800 | ||

| (To record purchase supplies) | |||

| Dec 18 | Account receivable | 12600 | |

| Sales revenue | 12600 | ||

| (To record Sales) | |||

| Dec 18 | Cost of goods sold | 8200 | |

| Merchandise inventory | 8200 | ||

| (To record cost of goods sold) | |||

| Dec 20 | Salary and wages expense | 1500 | |

| Cash | 1500 | ||

| (To record salary and wages paid) | |||

| Dec 23 | Account payable | 8900 | |

| Cash (8900*98%) | 8722 | ||

| Merchandise inventory | 178 | ||

| (To record amount paid) | |||

| Dec 27 | Cash (12600*97%) | 12222 | |

| Sales discount | 378 | ||

| Account receivable | 12600 | ||

| (To record amount received) |

Homework Sourse

Homework Sourse