vailue is 10 million and the value is not paid in cash The f

Solution

Part 1)

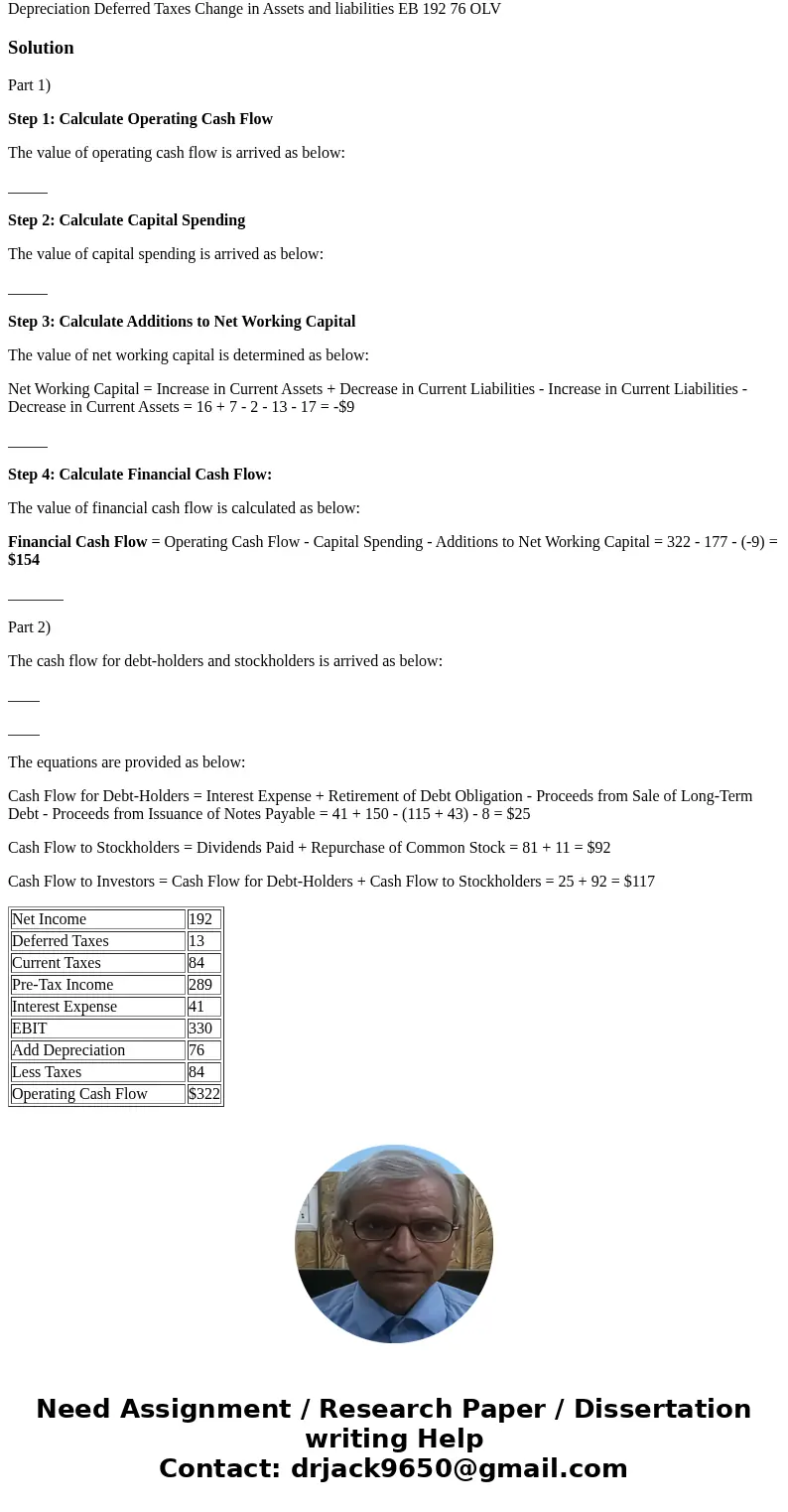

Step 1: Calculate Operating Cash Flow

The value of operating cash flow is arrived as below:

_____

Step 2: Calculate Capital Spending

The value of capital spending is arrived as below:

_____

Step 3: Calculate Additions to Net Working Capital

The value of net working capital is determined as below:

Net Working Capital = Increase in Current Assets + Decrease in Current Liabilities - Increase in Current Liabilities - Decrease in Current Assets = 16 + 7 - 2 - 13 - 17 = -$9

_____

Step 4: Calculate Financial Cash Flow:

The value of financial cash flow is calculated as below:

Financial Cash Flow = Operating Cash Flow - Capital Spending - Additions to Net Working Capital = 322 - 177 - (-9) = $154

_______

Part 2)

The cash flow for debt-holders and stockholders is arrived as below:

____

____

The equations are provided as below:

Cash Flow for Debt-Holders = Interest Expense + Retirement of Debt Obligation - Proceeds from Sale of Long-Term Debt - Proceeds from Issuance of Notes Payable = 41 + 150 - (115 + 43) - 8 = $25

Cash Flow to Stockholders = Dividends Paid + Repurchase of Common Stock = 81 + 11 = $92

Cash Flow to Investors = Cash Flow for Debt-Holders + Cash Flow to Stockholders = 25 + 92 = $117

| Net Income | 192 |

| Deferred Taxes | 13 |

| Current Taxes | 84 |

| Pre-Tax Income | 289 |

| Interest Expense | 41 |

| EBIT | 330 |

| Add Depreciation | 76 |

| Less Taxes | 84 |

| Operating Cash Flow | $322 |

Homework Sourse

Homework Sourse