Problem 3 10 points Prepare the journal entries to record th

Solution

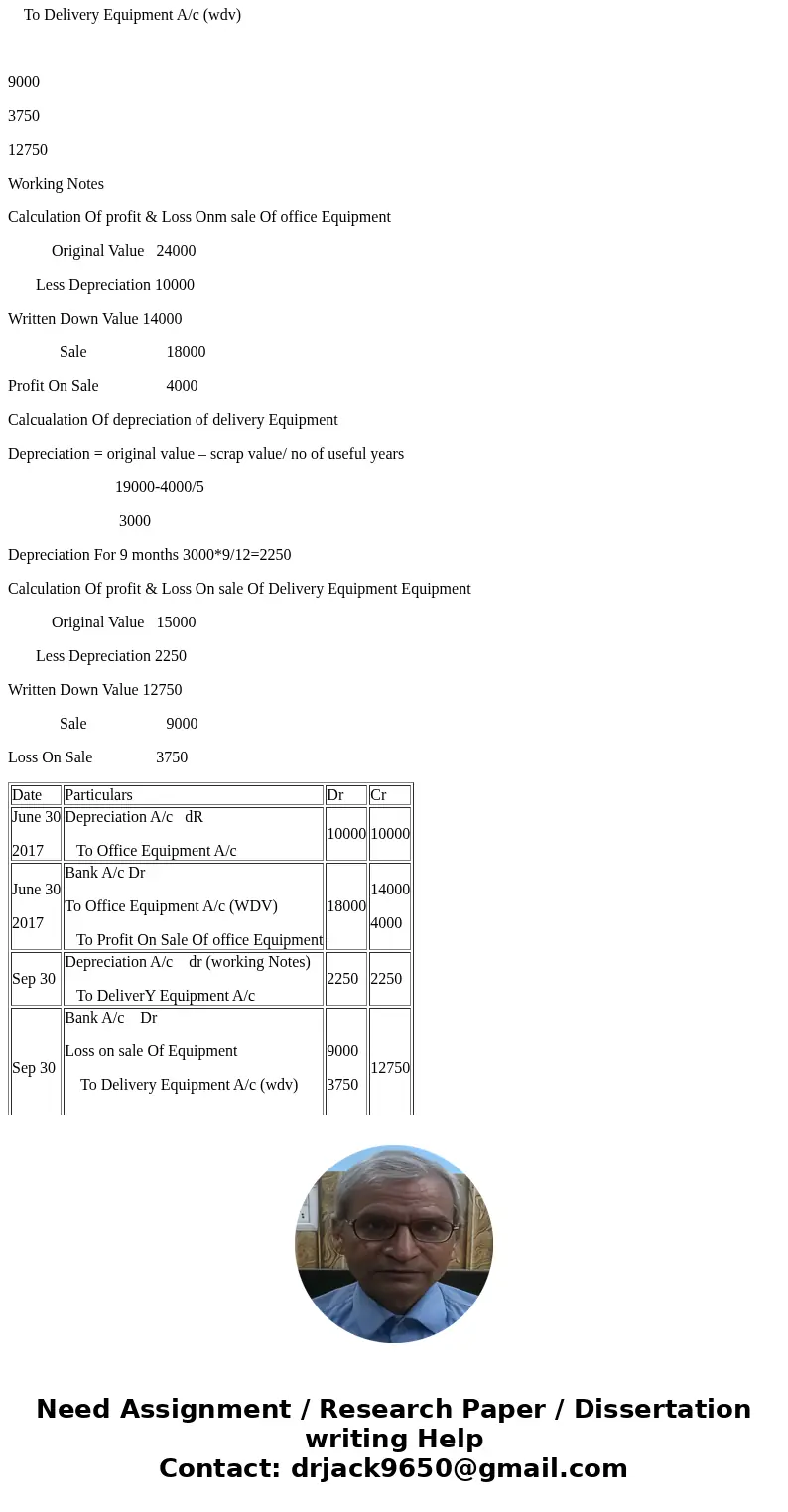

Journal Entries

Date

Particulars

Dr

Cr

June 30

2017

Depreciation A/c dR

To Office Equipment A/c

10000

10000

June 30

2017

Bank A/c Dr

To Office Equipment A/c (WDV)

To Profit On Sale Of office Equipment

18000

14000

4000

Sep 30

Depreciation A/c dr (working Notes)

To DeliverY Equipment A/c

2250

2250

Sep 30

Bank A/c Dr

Loss on sale Of Equipment

To Delivery Equipment A/c (wdv)

9000

3750

12750

Working Notes

Calculation Of profit & Loss Onm sale Of office Equipment

Original Value 24000

Less Depreciation 10000

Written Down Value 14000

Sale 18000

Profit On Sale 4000

Calcualation Of depreciation of delivery Equipment

Depreciation = original value – scrap value/ no of useful years

19000-4000/5

3000

Depreciation For 9 months 3000*9/12=2250

Calculation Of profit & Loss On sale Of Delivery Equipment Equipment

Original Value 15000

Less Depreciation 2250

Written Down Value 12750

Sale 9000

Loss On Sale 3750

| Date | Particulars | Dr | Cr |

| June 30 2017 | Depreciation A/c dR To Office Equipment A/c | 10000 | 10000 |

| June 30 2017 | Bank A/c Dr To Office Equipment A/c (WDV) To Profit On Sale Of office Equipment | 18000 | 14000 4000 |

| Sep 30 | Depreciation A/c dr (working Notes) To DeliverY Equipment A/c | 2250 | 2250 |

| Sep 30 | Bank A/c Dr Loss on sale Of Equipment To Delivery Equipment A/c (wdv)

| 9000 3750 | 12750 |

Homework Sourse

Homework Sourse