Homework Week 3 Chapter 03 problems HW Score 218 score 009

Solution

1)

Sl no.

Accounts Title and Explanation

Debit

Credit

Dec 31

a)

Utilities Expense

375

Utilities Payable

375

(Being utilities expense payable)

b)

Insurance Expense

400

Prepaid Insurance

400

(Being insurance expense recorded, (1800/9)*2

c)

Account Receivable

1500

Service Revenue

1500

(Being Service revenue recorded)

d)

Depreciation Expense

14000

Accumulated Depreciation

14000

(Being Depreciation as per straight line method = (Cost of asset – Residual value)/useful life of asset. (73000-3000)/5=14000

e)

Unearned Revenue

3000

Service Revenue

3000

(Being charter completed and revenue recorded)

2)

Sl no.

Accounts Title

Category of accounts Affected

Overstated/Understated

a)

Utilities Expense

Profit and loss account

Overstated

Utilities Payable

Current Liability

Understated

b)

Insurance Expense

Profit and loss account

Overstated

Prepaid Insurance

Current Asset

Overstated

c)

Account Receivable

Current Asset

Understated

Service Revenue

Profit and loss account

Understated

d)

Depreciation Expense

Profit and loss account

Overstated

Accumulated Depreciation

Contra asset account

Understated

e)

Unearned Revenue

Current Liability

Overstated

Service Revenue

Profit and loss account

Understated

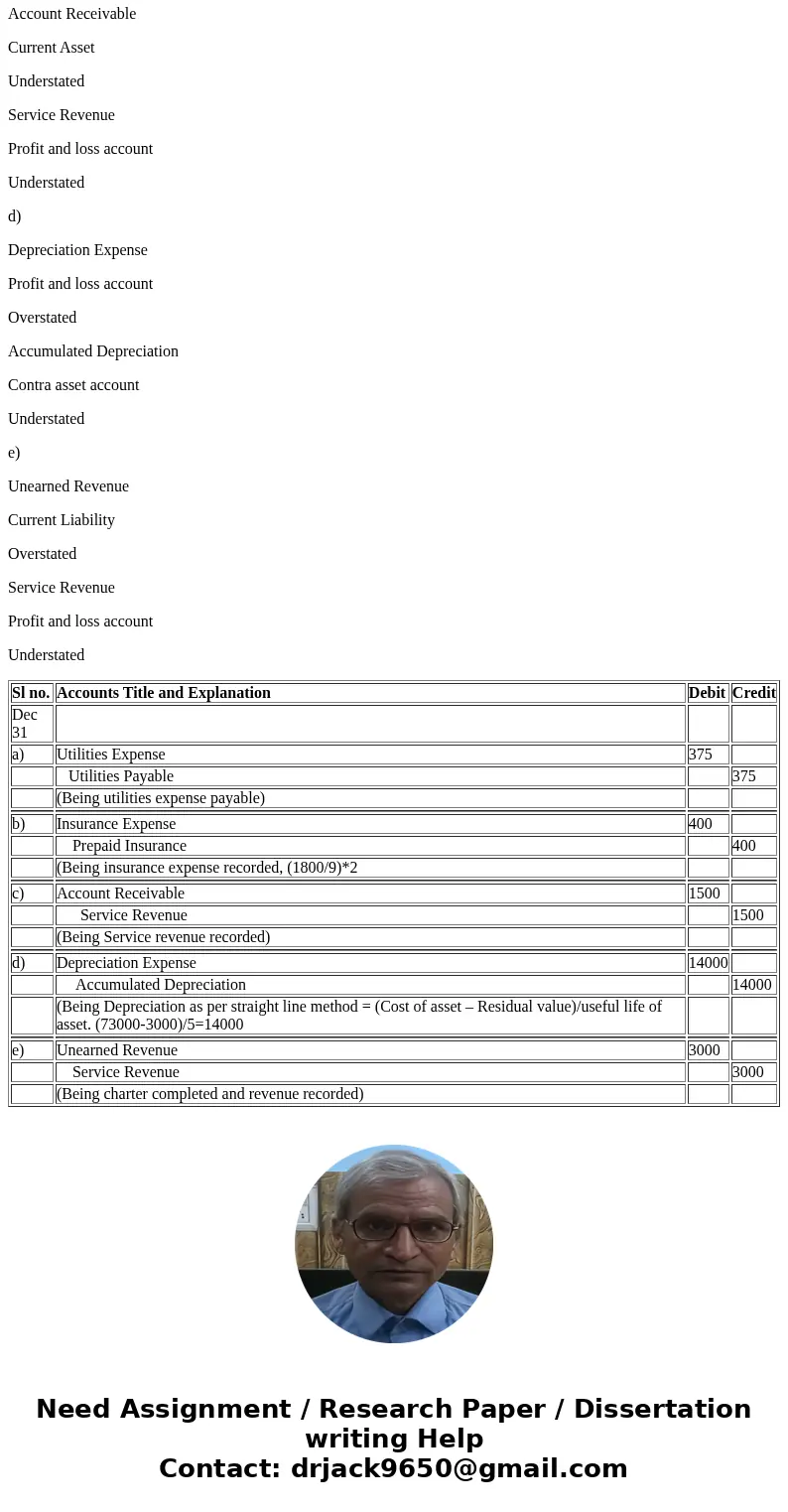

| Sl no. | Accounts Title and Explanation | Debit | Credit |

| Dec 31 | |||

| a) | Utilities Expense | 375 | |

| Utilities Payable | 375 | ||

| (Being utilities expense payable) | |||

| b) | Insurance Expense | 400 | |

| Prepaid Insurance | 400 | ||

| (Being insurance expense recorded, (1800/9)*2 | |||

| c) | Account Receivable | 1500 | |

| Service Revenue | 1500 | ||

| (Being Service revenue recorded) | |||

| d) | Depreciation Expense | 14000 | |

| Accumulated Depreciation | 14000 | ||

| (Being Depreciation as per straight line method = (Cost of asset – Residual value)/useful life of asset. (73000-3000)/5=14000 | |||

| e) | Unearned Revenue | 3000 | |

| Service Revenue | 3000 | ||

| (Being charter completed and revenue recorded) |

Homework Sourse

Homework Sourse