Harris Company manufactures and sells a single product A par

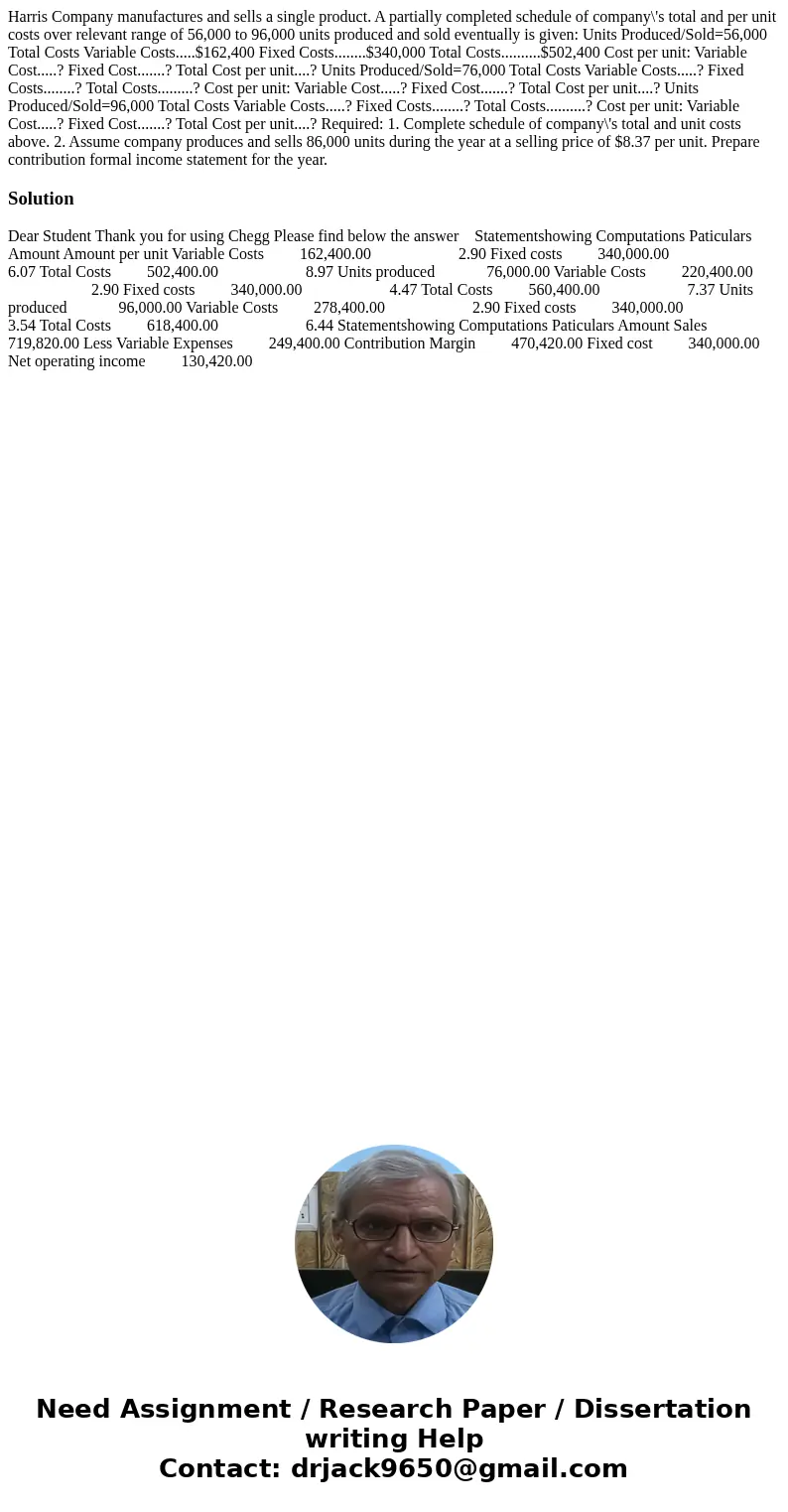

Harris Company manufactures and sells a single product. A partially completed schedule of company\'s total and per unit costs over relevant range of 56,000 to 96,000 units produced and sold eventually is given: Units Produced/Sold=56,000 Total Costs Variable Costs.....$162,400 Fixed Costs........$340,000 Total Costs..........$502,400 Cost per unit: Variable Cost.....? Fixed Cost.......? Total Cost per unit....? Units Produced/Sold=76,000 Total Costs Variable Costs.....? Fixed Costs........? Total Costs.........? Cost per unit: Variable Cost.....? Fixed Cost.......? Total Cost per unit....? Units Produced/Sold=96,000 Total Costs Variable Costs.....? Fixed Costs........? Total Costs..........? Cost per unit: Variable Cost.....? Fixed Cost.......? Total Cost per unit....? Required: 1. Complete schedule of company\'s total and unit costs above. 2. Assume company produces and sells 86,000 units during the year at a selling price of $8.37 per unit. Prepare contribution formal income statement for the year.

Solution

Dear Student Thank you for using Chegg Please find below the answer Statementshowing Computations Paticulars Amount Amount per unit Variable Costs 162,400.00 2.90 Fixed costs 340,000.00 6.07 Total Costs 502,400.00 8.97 Units produced 76,000.00 Variable Costs 220,400.00 2.90 Fixed costs 340,000.00 4.47 Total Costs 560,400.00 7.37 Units produced 96,000.00 Variable Costs 278,400.00 2.90 Fixed costs 340,000.00 3.54 Total Costs 618,400.00 6.44 Statementshowing Computations Paticulars Amount Sales 719,820.00 Less Variable Expenses 249,400.00 Contribution Margin 470,420.00 Fixed cost 340,000.00 Net operating income 130,420.00

Homework Sourse

Homework Sourse