View History Bookmarks Window Help roblems Todrick Company i

Solution

1) Cost of goods sold (assumed variable) = Beg. Inventory+Purchases-End. Inventory

= $29,000+$290,000-$14,500 = $304,500

Total Variable Costs = Sales - Contribution Margin

= $435,000 - $87,000 = $348,000

Total Variable costs = Cost of goods sold+Variable selling exp.+Variable administrative exp.

Variable Administrative Exp. = Total Variable costs - Cost of goods sold - Variable selling exp.

= $348,000 - $304,500 - $21,750 = $21,750

Total Fixed Costs = Contribution Margin - Net Operating Income

= $87,000 - $26,100 = $60,900

Fixed Selling Exp. = Total Fixed costs - Fixed administrative exp.

= $60,900 - $17,400 = $43,500

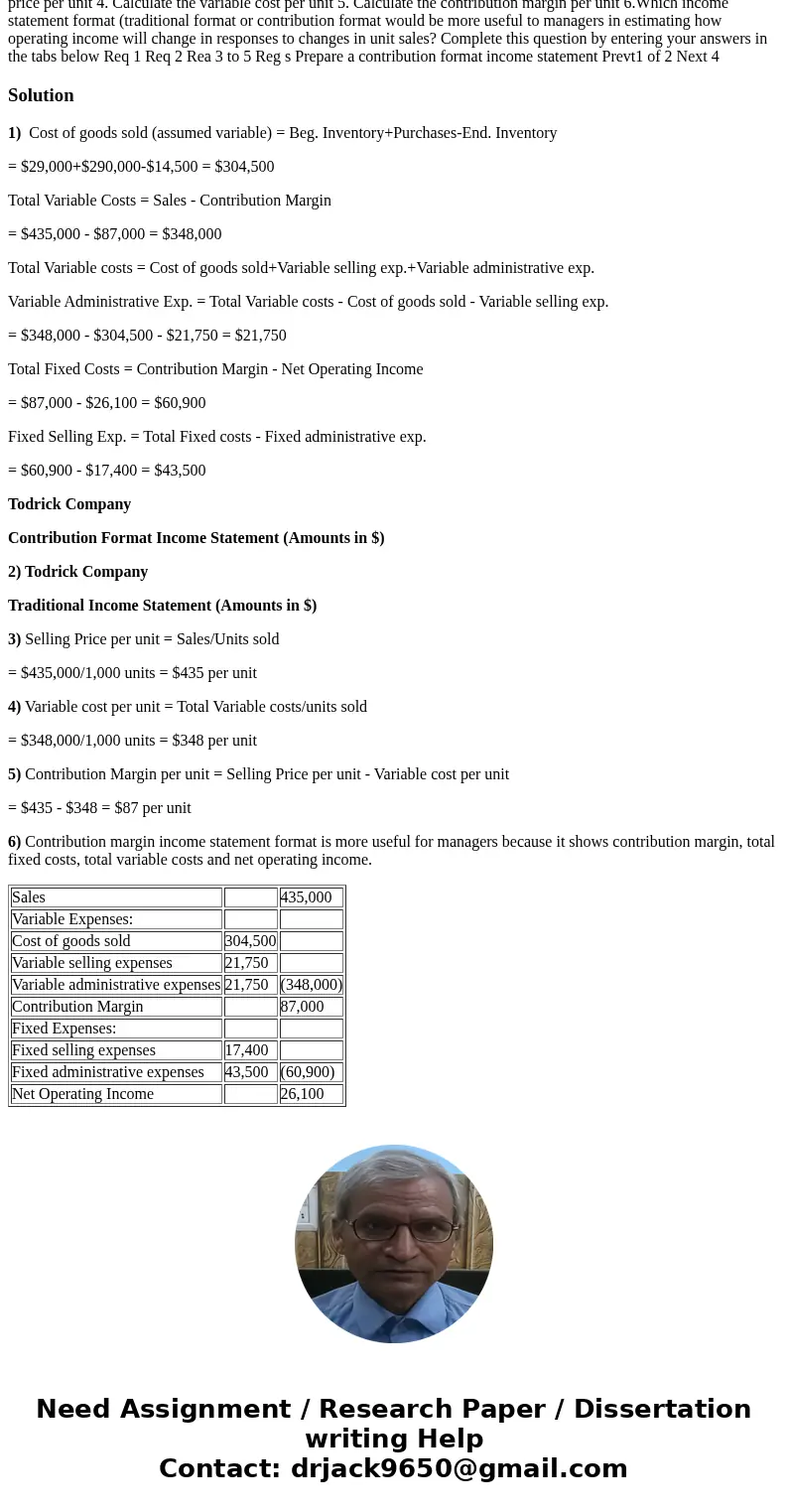

Todrick Company

Contribution Format Income Statement (Amounts in $)

2) Todrick Company

Traditional Income Statement (Amounts in $)

3) Selling Price per unit = Sales/Units sold

= $435,000/1,000 units = $435 per unit

4) Variable cost per unit = Total Variable costs/units sold

= $348,000/1,000 units = $348 per unit

5) Contribution Margin per unit = Selling Price per unit - Variable cost per unit

= $435 - $348 = $87 per unit

6) Contribution margin income statement format is more useful for managers because it shows contribution margin, total fixed costs, total variable costs and net operating income.

| Sales | 435,000 | |

| Variable Expenses: | ||

| Cost of goods sold | 304,500 | |

| Variable selling expenses | 21,750 | |

| Variable administrative expenses | 21,750 | (348,000) |

| Contribution Margin | 87,000 | |

| Fixed Expenses: | ||

| Fixed selling expenses | 17,400 | |

| Fixed administrative expenses | 43,500 | (60,900) |

| Net Operating Income | 26,100 |

Homework Sourse

Homework Sourse