LUS fr uni nt for 1255000 and collected 920000 At December 3

LUS fr uni nt for $1,255,000, and collected $920,000. At December 31, 2017, the estimated additional costs to complete the project total $3,338,370. Do not indent manually. For costs incurred use account Materials, Cash, Payables. If no entry is required, select \"No entry\" for the account titles

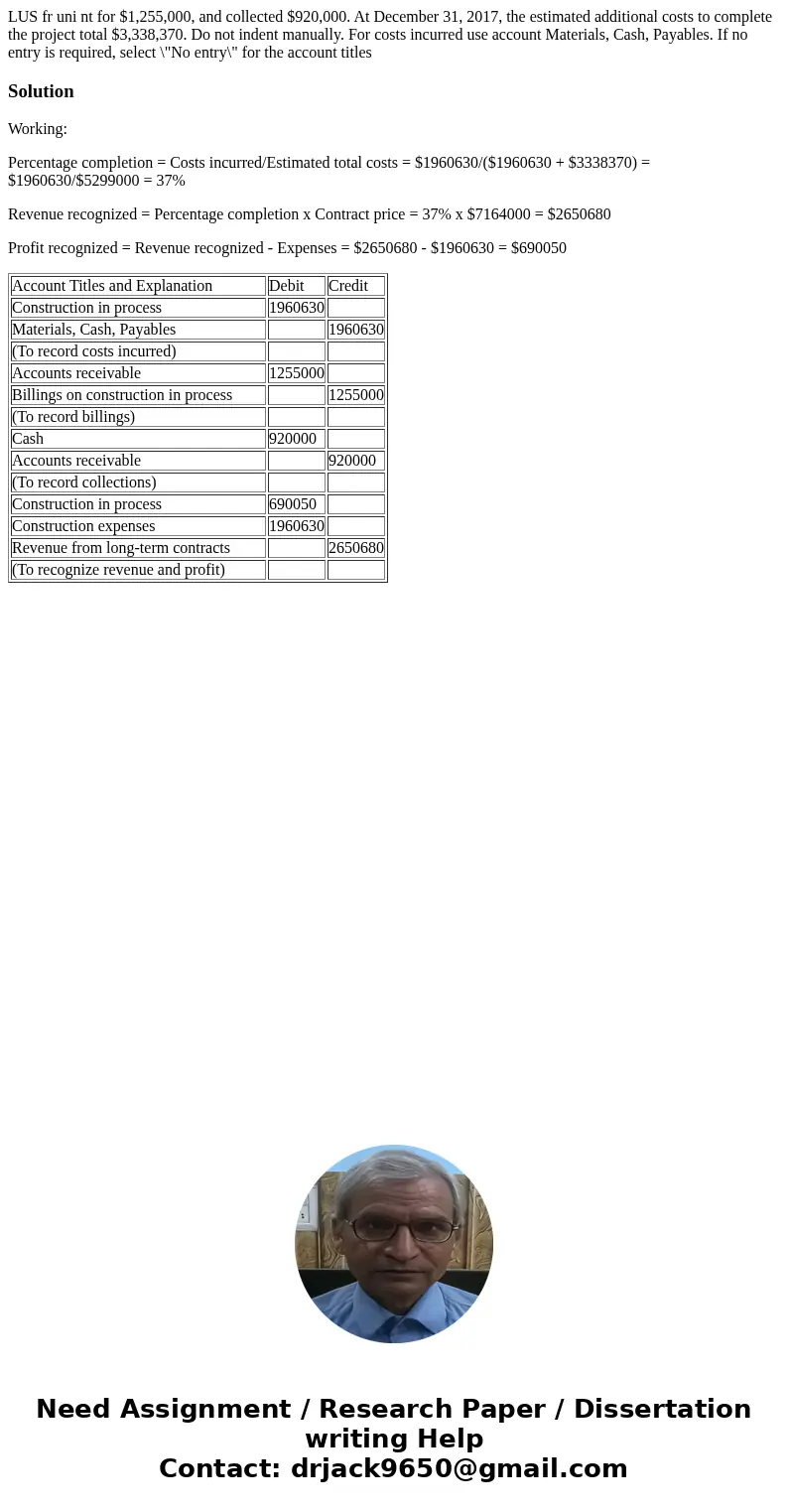

Solution

Working:

Percentage completion = Costs incurred/Estimated total costs = $1960630/($1960630 + $3338370) = $1960630/$5299000 = 37%

Revenue recognized = Percentage completion x Contract price = 37% x $7164000 = $2650680

Profit recognized = Revenue recognized - Expenses = $2650680 - $1960630 = $690050

| Account Titles and Explanation | Debit | Credit |

| Construction in process | 1960630 | |

| Materials, Cash, Payables | 1960630 | |

| (To record costs incurred) | ||

| Accounts receivable | 1255000 | |

| Billings on construction in process | 1255000 | |

| (To record billings) | ||

| Cash | 920000 | |

| Accounts receivable | 920000 | |

| (To record collections) | ||

| Construction in process | 690050 | |

| Construction expenses | 1960630 | |

| Revenue from long-term contracts | 2650680 | |

| (To recognize revenue and profit) |

Homework Sourse

Homework Sourse