On March 31 2018 Modern Landscapes discarded equipment that

On March 31?, 2018?, Modern Landscapes discarded equipment that had a cost of $ 26 comma 600. Accumulated Depreciation as of December ?31, 2017?, was $ 26,000. Assume annual depreciation on the equipment is $ 600. Journalize the? partial-year depreciation expense and disposal of the equipment. ?(Record debits? first, then credits. Select the explanation on the last line of the journal entry? table.)

Journalize the? partial-year depreciation expense.

Date Accounts and Explanation Debit Credit Mar. 31

Calculate any gain or loss on the disposal of the equipment. ?(Enter a? \"0\" for items with a zero value. Enter a loss with a minus sign or? parentheses.) Market value of assets received Less: Book value of asset disposed of Cost Less: Accumulated Depreciation Gain or (Loss) Journalize the disposal of the equipment. Date Accounts and Explanation Debit Credit Mar. 31

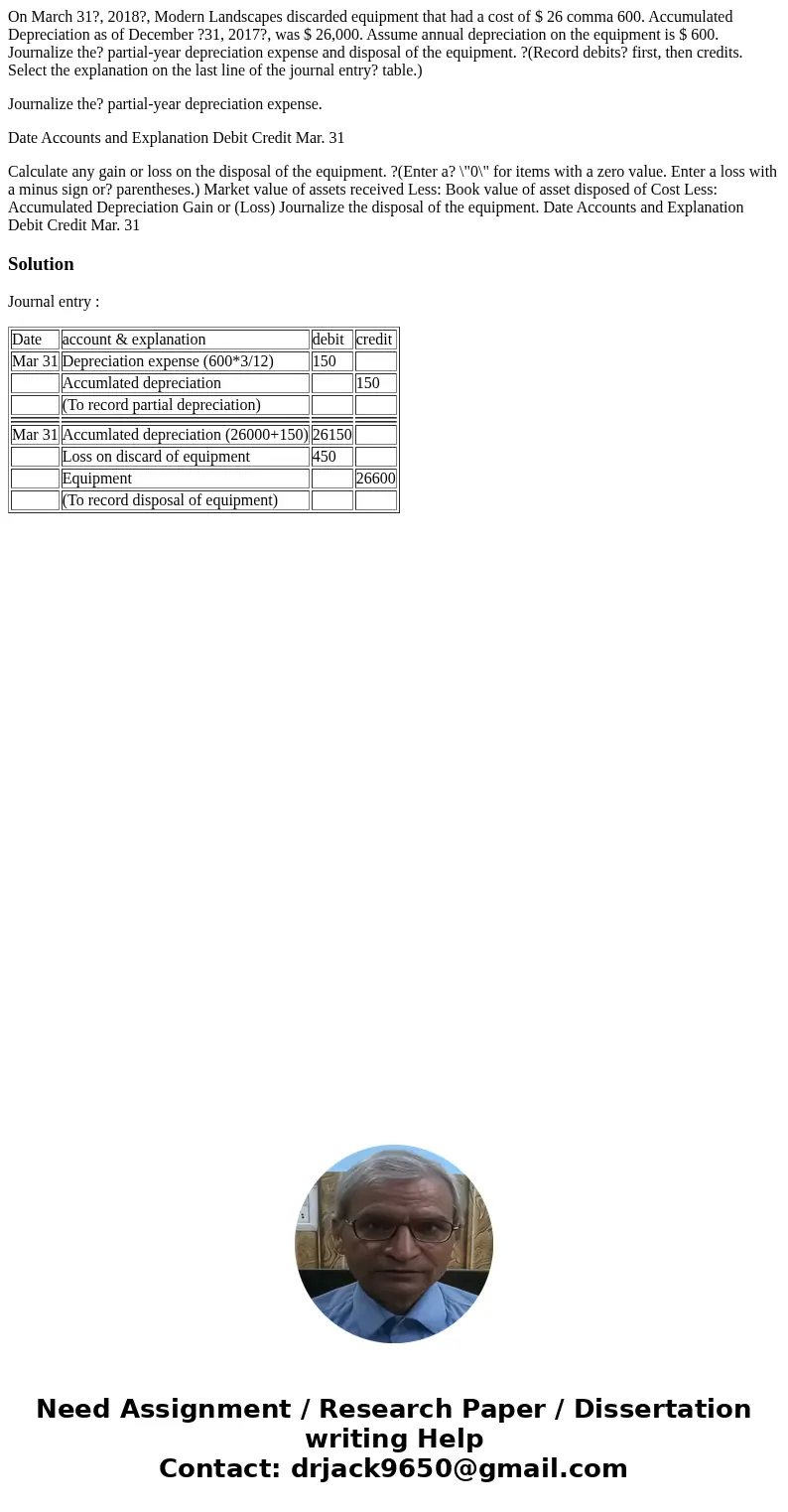

Solution

Journal entry :

| Date | account & explanation | debit | credit |

| Mar 31 | Depreciation expense (600*3/12) | 150 | |

| Accumlated depreciation | 150 | ||

| (To record partial depreciation) | |||

| Mar 31 | Accumlated depreciation (26000+150) | 26150 | |

| Loss on discard of equipment | 450 | ||

| Equipment | 26600 | ||

| (To record disposal of equipment) |

Homework Sourse

Homework Sourse