Rotorua Products, Ltd., of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company’s current assets, current liabilities, and sales have been reported as follows over the last five years (Year 5 is the most recent year):

| Rotorua Products, Ltd., of New Zealand markets agricultural products for the burgeoning Asian consumer market. The company’s current assets, current liabilities, and sales have been reported as follows over the last five years (Year 5 is the most recent year): |

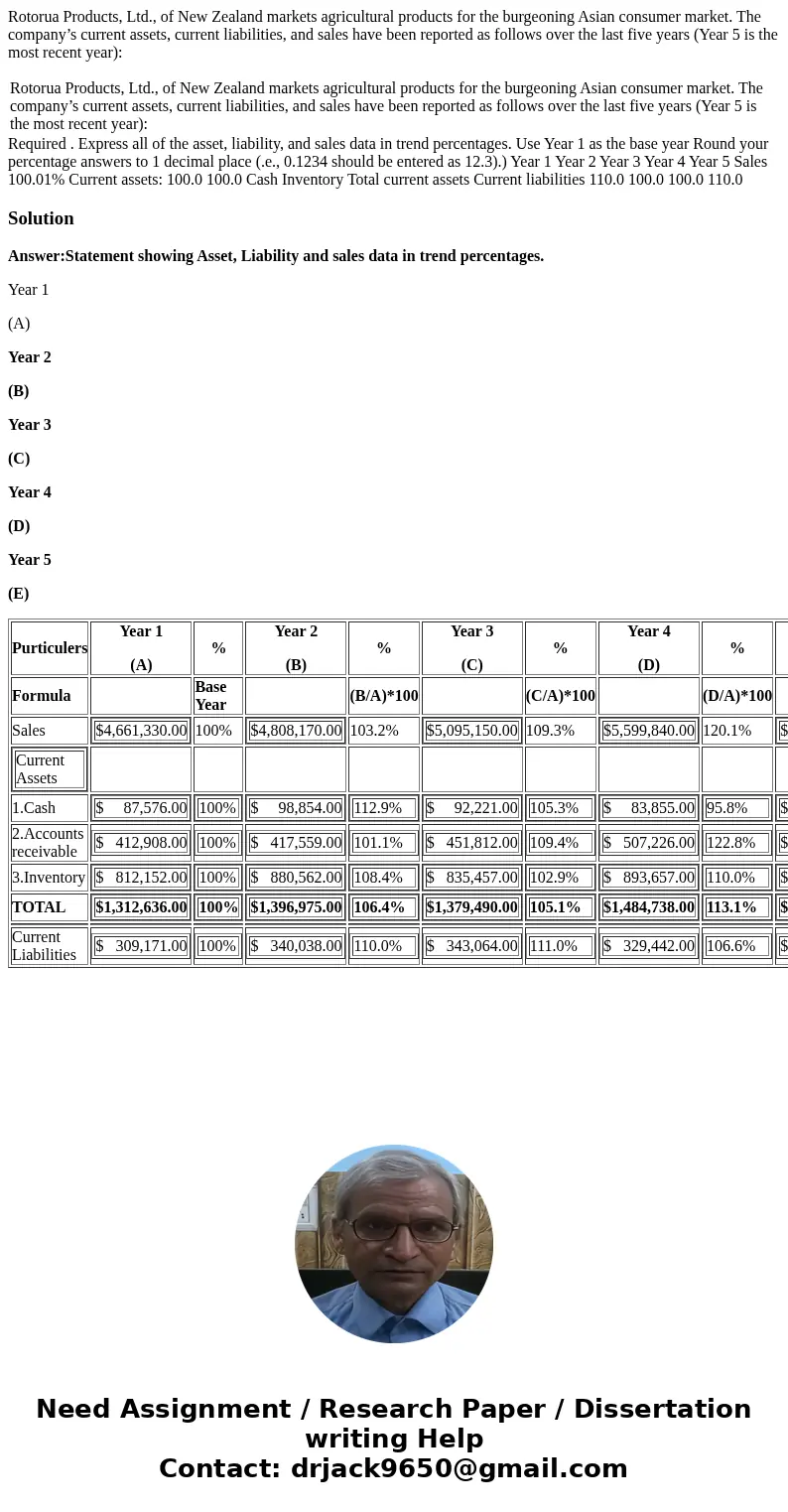

Required . Express all of the asset, liability, and sales data in trend percentages. Use Year 1 as the base year Round your percentage answers to 1 decimal place (.e., 0.1234 should be entered as 12.3).) Year 1 Year 2 Year 3 Year 4 Year 5 Sales 100.01% Current assets: 100.0 100.0 Cash Inventory Total current assets Current liabilities 110.0 100.0 100.0 110.0

Answer:Statement showing Asset, Liability and sales data in trend percentages.

Year 1

(A)

Year 2

(B)

Year 3

(C)

Year 4

(D)

Year 5

(E)

| Purticulers | Year 1 (A) | % | Year 2 (B) | % | Year 3 (C) | % | Year 4 (D) | % | Year 5 (E) | % |

| Formula | | Base Year | | (B/A)*100 | | (C/A)*100 | | (D/A)*100 | | (E/A)*100 |

| Sales | | 100% | | 103.2% | | 109.3% | | 120.1% | | 123.6% |

| | | | | | | | | | | |

| 1.Cash | | | | | | | | | | |

| 2.Accounts receivable | | | | | | | | | | |

| 3.Inventory | | | | | | | | | | |

| TOTAL | | | | | | | | | | |

| | | | | | | | | | |

| Current Liabilities | | | | | | | | | | |

Homework Sourse

Homework Sourse