disposal the accounts reflected the following Original Resid

disposal, the accounts reflected the following: Original Residual Estimated Cost Machine A $68,000 $11,900 2,300 Life 6 years$28,050 (3 years) 4 years Machine B 15,000 6,350 (2 years) The machines were disposed of in the following ways: Machine A: Sold on January 2, for $42,600 cash. immediately by a salvage company at no cost. a. from an accident and was Required 182. Give the journal entries related to the disposal of Machine A and Machine B on January 2 of the entry is required for a transaction/event, select \"No Journal Entry Required\" in the first account field.) General Debit No 1January 02 No ya MacBook A

Solution

Answer:

Date

General Journal

Debit $

Credit $

Jan,-2

No entry

Jan,-2

Cash

42600

Accumulated depreciation- Machine A

28050

Gain on Disposal

2650

Equipment

68000

Jan,-2

No entry

Jan,-2

Accumulated depreciation-Machine B

6350

Loss on Disposal of machine

8650

Equipment

15000

Notes:

here on january-2 no entry for the depreciation because it is starting of the year

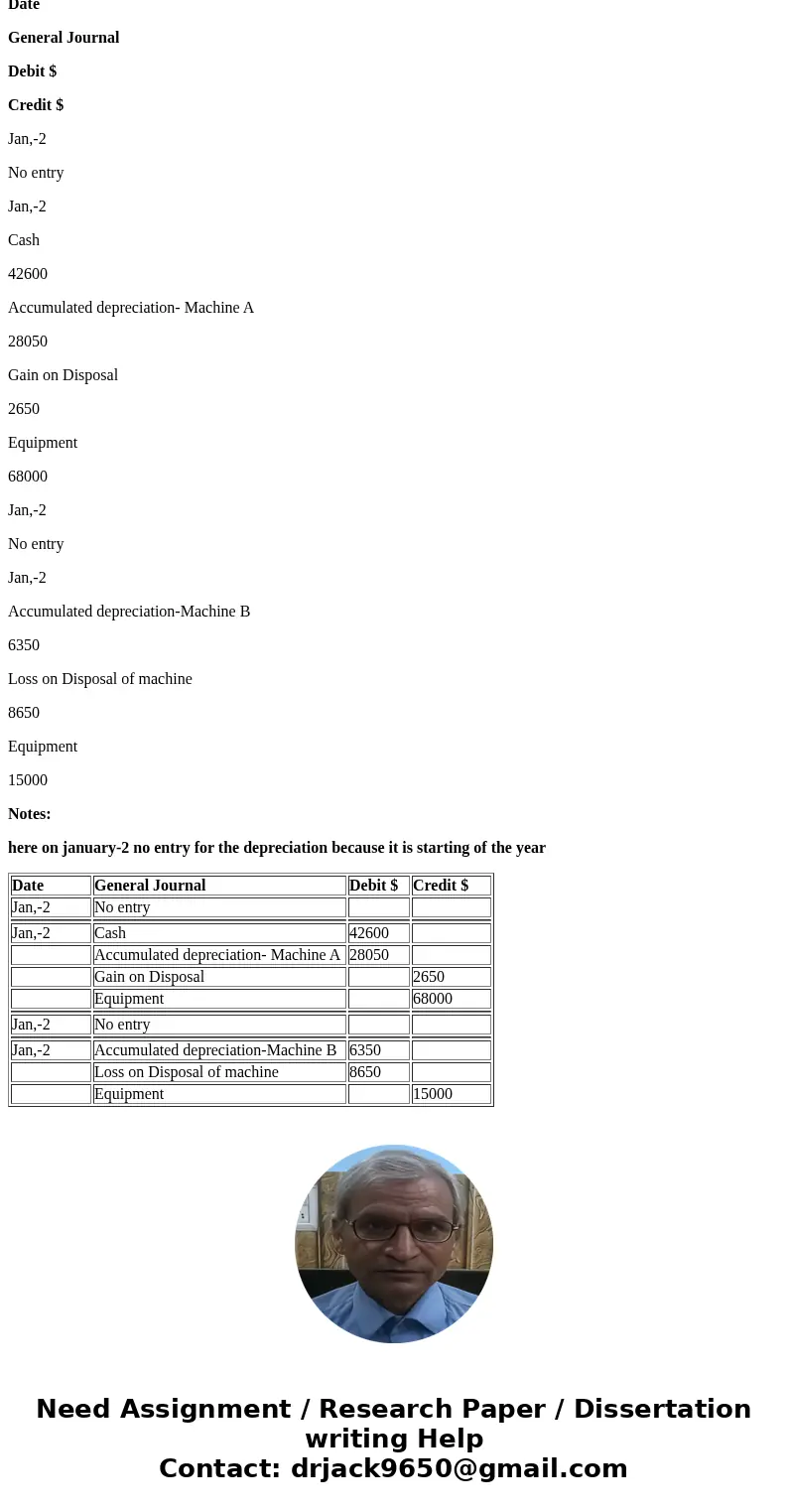

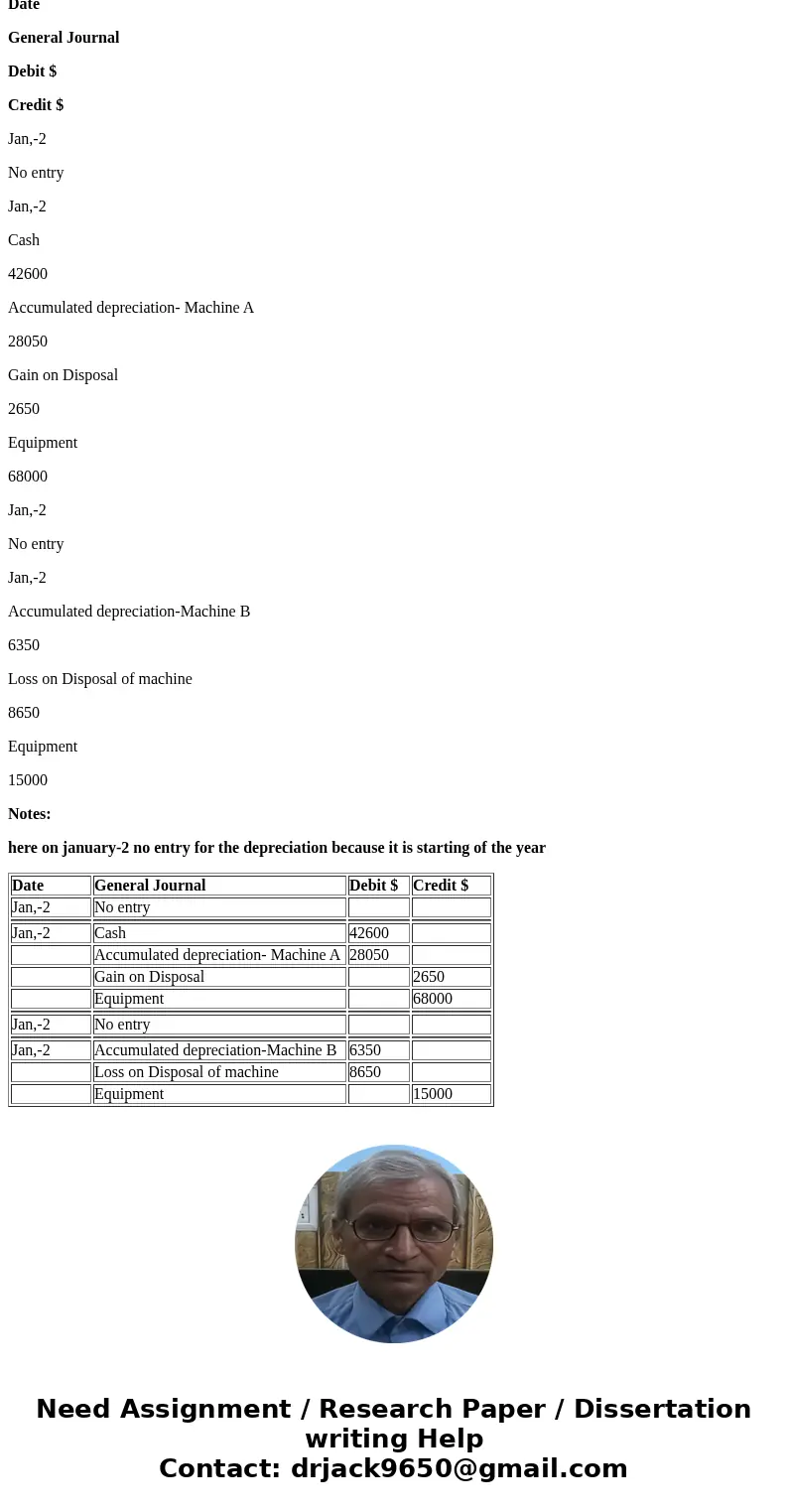

| Date | General Journal | Debit $ | Credit $ |

| Jan,-2 | No entry | ||

| Jan,-2 | Cash | 42600 | |

| Accumulated depreciation- Machine A | 28050 | ||

| Gain on Disposal | 2650 | ||

| Equipment | 68000 | ||

| Jan,-2 | No entry | ||

| Jan,-2 | Accumulated depreciation-Machine B | 6350 | |

| Loss on Disposal of machine | 8650 | ||

| Equipment | 15000 |

Homework Sourse

Homework Sourse