QUESTION 2 The following trial balance relates to KAF as at

QUESTION 2 The following trial balance relates to KAF as at 30 September 2012: GHS\'000 Stated capital (250m shares (note i) 8% loan note (note ii) Income surplus- 30/09/2011 Other equity surplus Capital surplus Land and building at valuation- 30/09/2011 Land (GHS 7m) and building (GHS36m) (note GHS\'000 61,000 30,600 12,100 3,000 7,000 43,000 67,400 Plant and equipment at cost Accumulated depreciation-30/09/2011 13,400

Solution

Investment fair value

Decrease

Statement of financial position

Land & building

(43+1.2+67.4-13.4)

Capital surplus(7000+1200)

Increase in land value

statement of changes in equity

Land and building

Revaluation

statement of other comprehensive income

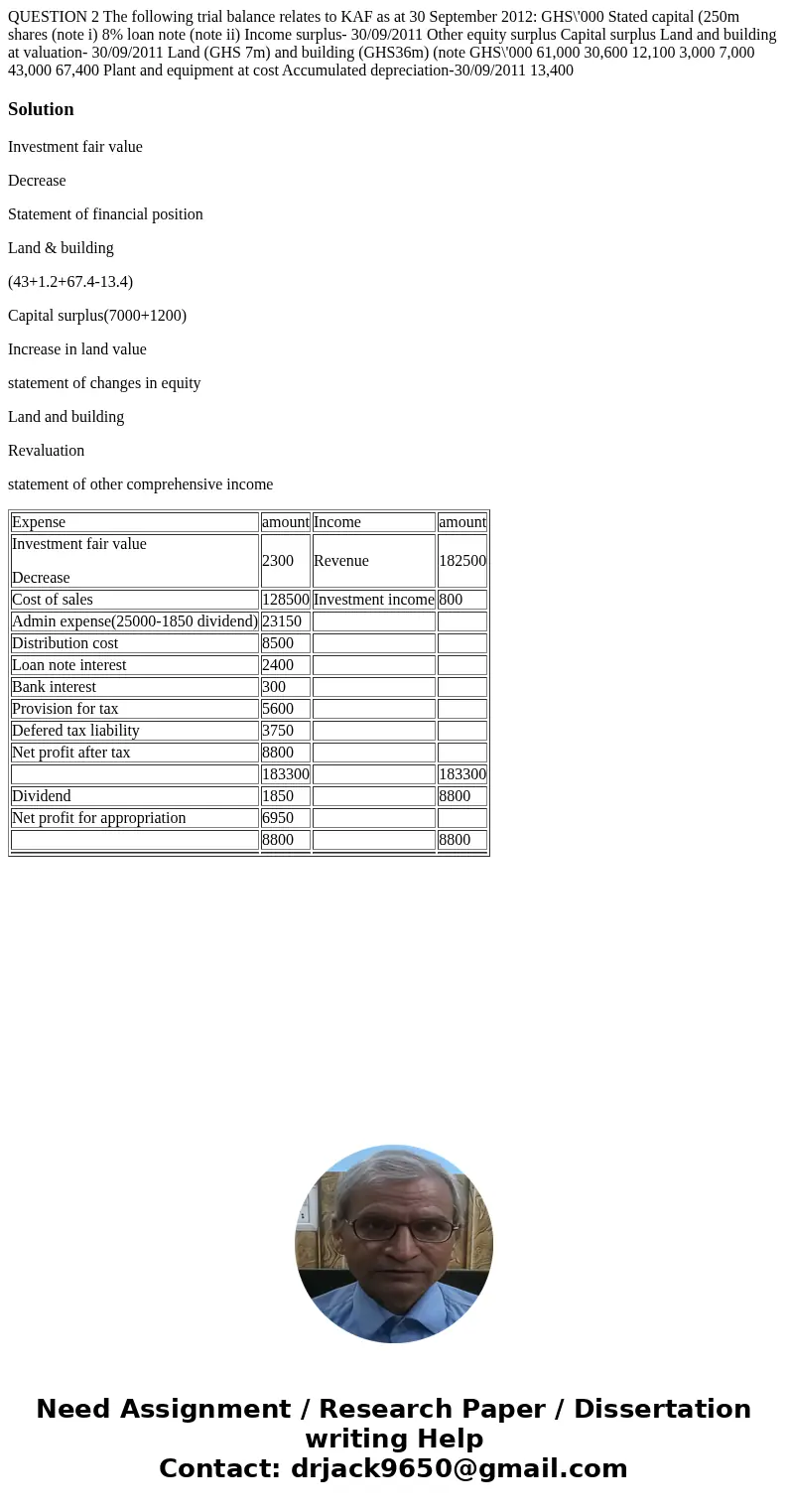

| Expense | amount | Income | amount |

| Investment fair value Decrease | 2300 | Revenue | 182500 |

| Cost of sales | 128500 | Investment income | 800 |

| Admin expense(25000-1850 dividend) | 23150 | ||

| Distribution cost | 8500 | ||

| Loan note interest | 2400 | ||

| Bank interest | 300 | ||

| Provision for tax | 5600 | ||

| Defered tax liability | 3750 | ||

| Net profit after tax | 8800 | ||

| 183300 | 183300 | ||

| Dividend | 1850 | 8800 | |

| Net profit for appropriation | 6950 | ||

| 8800 | 8800 | ||

Homework Sourse

Homework Sourse