With showing all the steps with the details please Thanks Ye

With showing all the steps with the details please.

Thanks

Year 2 Year 3 $258,808 $358,880 169,89e 39,890 Amounts billed to customers forservices rendered Cash collected from credit customers Cash disbursements: Payment of rent Salaries paid to employe Travel and entertainment Advertising 78,898 es for services rendered during the year 139,899 156,89 28,8e 3,89e 18, 25,89e In addition, you leam that the company incurred advertising costs of $15,000 in year 2, owed the advertising agency $4,000 at the end of year 1, and there were no liabilities at the end of year 3. Also, there were no anticipated bad debts on receivables, and the rent payment was for a two-year period, year 2 and year 3. Required: 1. Calculate accrual net income for both years. 2. Determine the amount due the advertising agency that would be shown as a liability on RPG\'s balance sheet at the end of year 2 Complete this question by entering your answers in the tabs below Required 1Required 2 Calculate accrual net income for both years. Expenses: Rent Salaries Travel and entertainment Net incomeSolution

Answers

---Amount billed to customer = actual revenue earned and shown in Income statement. Cash received from clients billed need not to be considered.

---Rent paid in Year 2 is of $70,000 for 2 years. Hence, for Year 2 and Year 3, Rent expense will be $ 35,000 each [70000/2 years]

---Advertising:

$10,000 is paid for advertising in year 2, but Advertising cost incurred for Year 2 = $ 15,000 which will become advertisement expense in income statement.

Year 2

Year 3

Revenues

$ 2,50,000.00

$ 3,50,000.00

Expenses:

Rent

$ 35,000.00

$ 35,000.00

Salaries

$ 1,30,000.00

$ 1,50,000.00

Travel & Entertainment

$ 20,000.00

$ 30,000.00

Advertising

$ 15,000.00

$ 16,000.00

Net Income

$ 50,000.00

$ 1,19,000.00

Working

Advertisement Agency balance working:

A

Beginning Balance Year 2

$ 4,000.00

B

Advertising cost incurred Year 2

$ 15,000.00

C

Cash paid

$ 10,000.00

D=A+B-C

Year 2 End Balance

$ 9,000.00

E

Cash paid in Year 3

$ 25,000.00

F = D

Cash for liabilities

$ 9,000.00

G = E -F

Year 3 Advertising expense

$ 16,000.00

Answer for balance to be shown in the balance sheet

Year 2

Year 3

A

Beginning balance

$ 4,000.00

$ 9,000.00

B

Expense incurred

$ 15,000.00

$ 16,000.00

C

Cash paid

$ 10,000.00

$ 25,000.00

D=A+B-C

Ending balance

$ 9,000.00

$ -

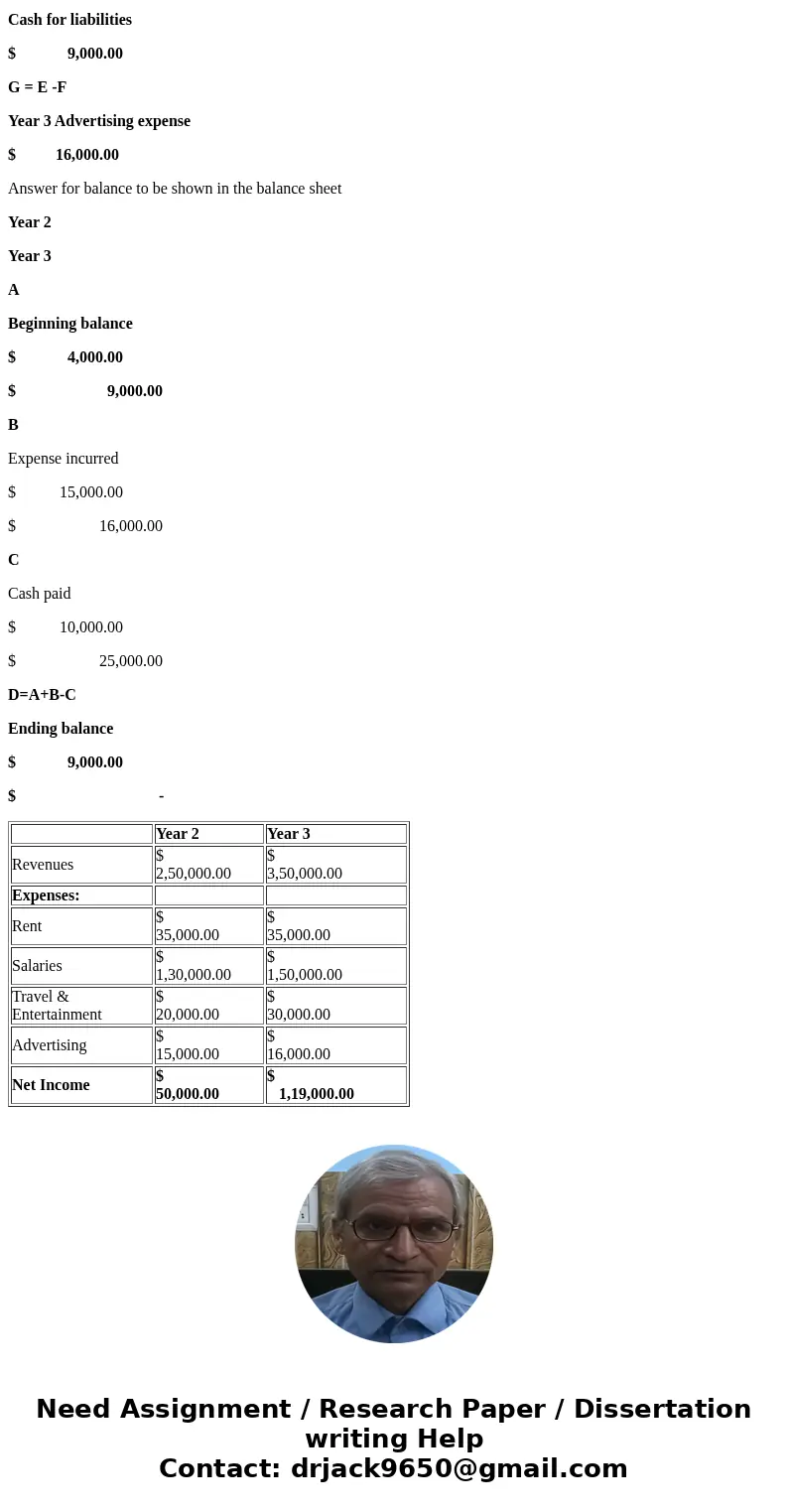

| Year 2 | Year 3 | |

| Revenues | $ 2,50,000.00 | $ 3,50,000.00 |

| Expenses: | ||

| Rent | $ 35,000.00 | $ 35,000.00 |

| Salaries | $ 1,30,000.00 | $ 1,50,000.00 |

| Travel & Entertainment | $ 20,000.00 | $ 30,000.00 |

| Advertising | $ 15,000.00 | $ 16,000.00 |

| Net Income | $ 50,000.00 | $ 1,19,000.00 |

Homework Sourse

Homework Sourse