Remaining Time 2 24 QUESTION 3 a Ball Corporation redeemed 3

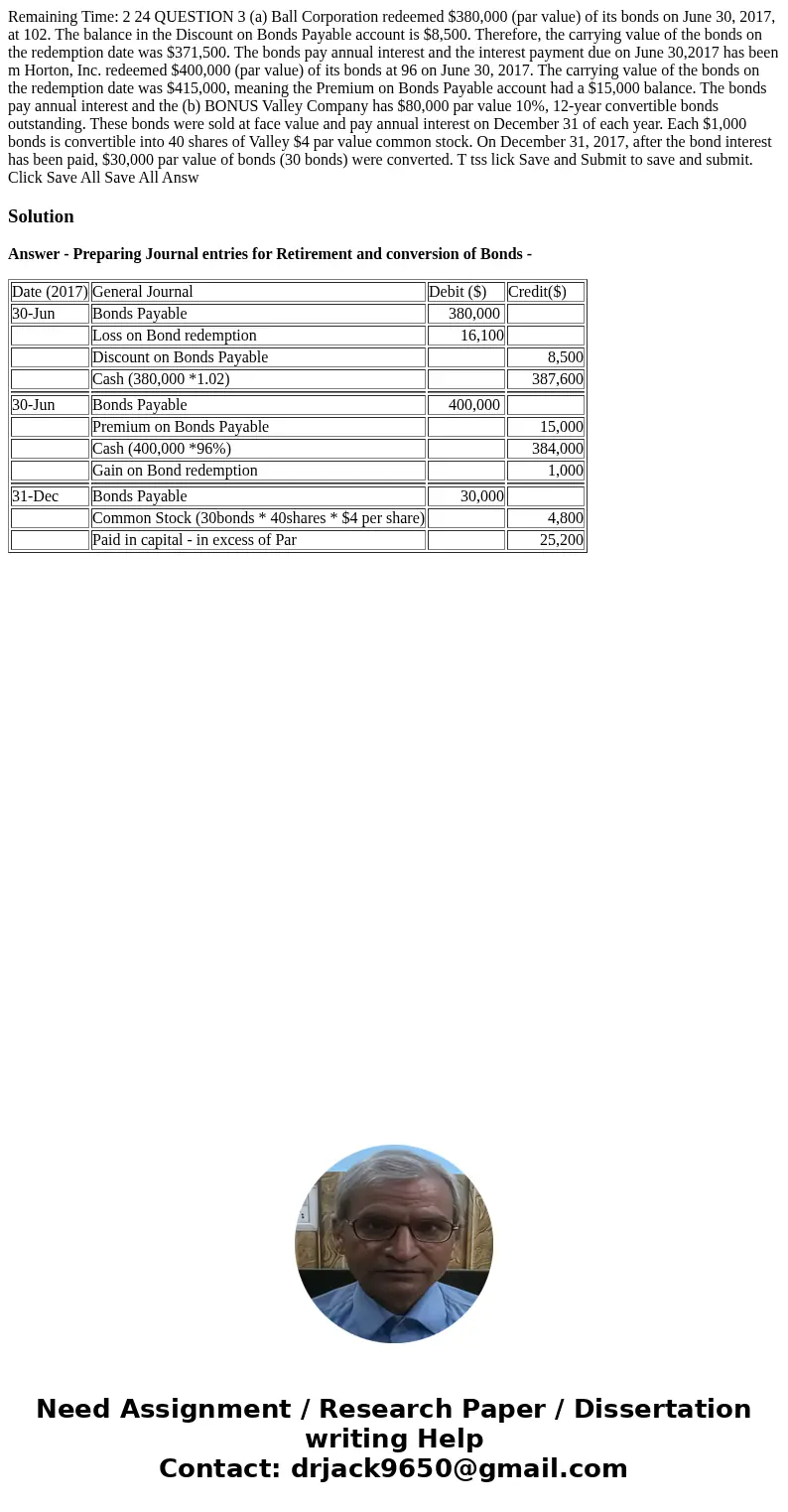

Remaining Time: 2 24 QUESTION 3 (a) Ball Corporation redeemed $380,000 (par value) of its bonds on June 30, 2017, at 102. The balance in the Discount on Bonds Payable account is $8,500. Therefore, the carrying value of the bonds on the redemption date was $371,500. The bonds pay annual interest and the interest payment due on June 30,2017 has been m Horton, Inc. redeemed $400,000 (par value) of its bonds at 96 on June 30, 2017. The carrying value of the bonds on the redemption date was $415,000, meaning the Premium on Bonds Payable account had a $15,000 balance. The bonds pay annual interest and the (b) BONUS Valley Company has $80,000 par value 10%, 12-year convertible bonds outstanding. These bonds were sold at face value and pay annual interest on December 31 of each year. Each $1,000 bonds is convertible into 40 shares of Valley $4 par value common stock. On December 31, 2017, after the bond interest has been paid, $30,000 par value of bonds (30 bonds) were converted. T tss lick Save and Submit to save and submit. Click Save All Save All Answ

Solution

Answer - Preparing Journal entries for Retirement and conversion of Bonds -

| Date (2017) | General Journal | Debit ($) | Credit($) |

| 30-Jun | Bonds Payable | 380,000 | |

| Loss on Bond redemption | 16,100 | ||

| Discount on Bonds Payable | 8,500 | ||

| Cash (380,000 *1.02) | 387,600 | ||

| 30-Jun | Bonds Payable | 400,000 | |

| Premium on Bonds Payable | 15,000 | ||

| Cash (400,000 *96%) | 384,000 | ||

| Gain on Bond redemption | 1,000 | ||

| 31-Dec | Bonds Payable | 30,000 | |

| Common Stock (30bonds * 40shares * $4 per share) | 4,800 | ||

| Paid in capital - in excess of Par | 25,200 |

Homework Sourse

Homework Sourse