statement ot Cash lows Angelas Cleaning Consortium Comparati

Solution

Cash Flow Statement (Indirect Method):-

Cash flow from Operating Actvities:-

Net Income

62700

Adjustment to reconcile net income to net cash:-

Gain on sale of plant

-12000

Dividend Revenue

-9700

Interest Revenue

-15000

Depreciation Exp

25000

Decrease A/c receivable

18000

Increase Inventory

-7000

Decrease A/c payable

-31000

Decrease Accrued Liab

-30000

Cash flow from Operating Actvities (A)

1000

1000

Cash flow from Investing Actvities:-

Dividend Revenue

9700

Interest Revenue

15000

Plant sold (75000 – 7500 + 12000)

79500

Purchased plant asset (507000 – 304000 + 75000)

-278000

Sold investment in walking co.

50000

Cash flow from Investing Actvities (B)

-123800

-123800

Cash flow from Financing Actvities:-

Issue common stock

120000

Purchase Treasury stock

-50000

Issue Notes Payable

70000

Dividend Paid (90000 + 62700 – 140000)

-12700

Cash flow from Financing Actvities (C)

127300

127300

Total cash flow (A +B +C)

4500

(+) Beginning cash flow

62000

Ending cash flow

66500

Plant Asset A/c

To bal b/d

304000

By cash (sold)

79500

To cash (purchase)

278000

By acc Dep (asset sold)

7500

To gain on sale

12000

By bal c/d

507000

594000

594000

To bal b/d

507000

Accumulated Dep:-

To Plant Asset(sold)

7500

By bal b/d

42000

To bal c/d

59500

By Dep exp

25000

67000

67000

By bal b/d

59500

Retained Earnings:-

To Dividend Paid

12700

By bal b/d

90000

To bal c/d

140000

By Net Income

62700

152700

152700

By Bal b/d

140000

Journal Entry for sale of Plant:-

Cash A/c Dr 79500

Accumulated Dep A/c Dr 7500

To Plant Asset Cr 75000

To gain on plant sold Cr 12000

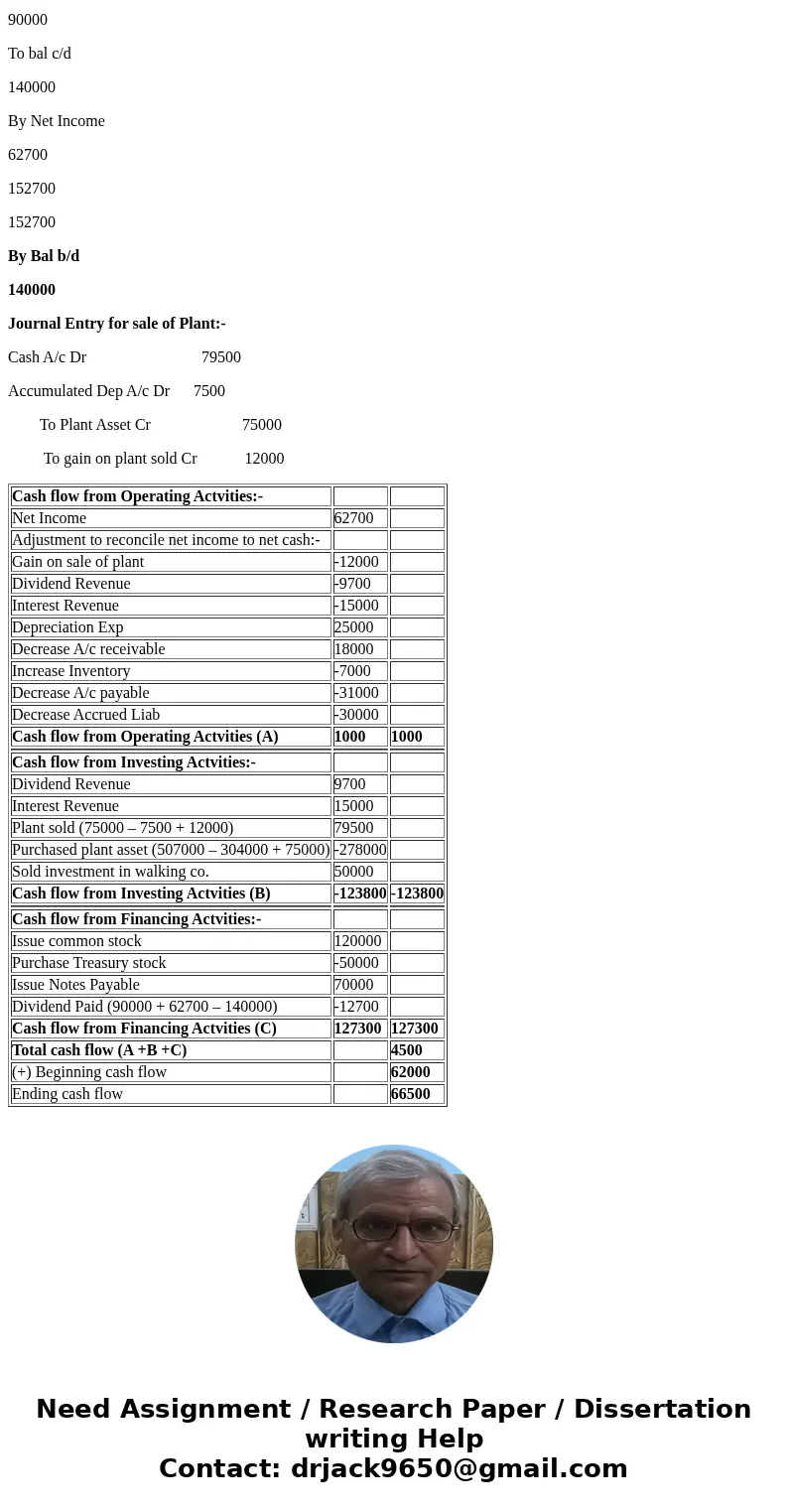

| Cash flow from Operating Actvities:- | ||

| Net Income | 62700 | |

| Adjustment to reconcile net income to net cash:- | ||

| Gain on sale of plant | -12000 | |

| Dividend Revenue | -9700 | |

| Interest Revenue | -15000 | |

| Depreciation Exp | 25000 | |

| Decrease A/c receivable | 18000 | |

| Increase Inventory | -7000 | |

| Decrease A/c payable | -31000 | |

| Decrease Accrued Liab | -30000 | |

| Cash flow from Operating Actvities (A) | 1000 | 1000 |

| Cash flow from Investing Actvities:- | ||

| Dividend Revenue | 9700 | |

| Interest Revenue | 15000 | |

| Plant sold (75000 – 7500 + 12000) | 79500 | |

| Purchased plant asset (507000 – 304000 + 75000) | -278000 | |

| Sold investment in walking co. | 50000 | |

| Cash flow from Investing Actvities (B) | -123800 | -123800 |

| Cash flow from Financing Actvities:- | ||

| Issue common stock | 120000 | |

| Purchase Treasury stock | -50000 | |

| Issue Notes Payable | 70000 | |

| Dividend Paid (90000 + 62700 – 140000) | -12700 | |

| Cash flow from Financing Actvities (C) | 127300 | 127300 |

| Total cash flow (A +B +C) | 4500 | |

| (+) Beginning cash flow | 62000 | |

| Ending cash flow | 66500 |

Homework Sourse

Homework Sourse