An asset is purchased for 250000 The asset is depreciated us

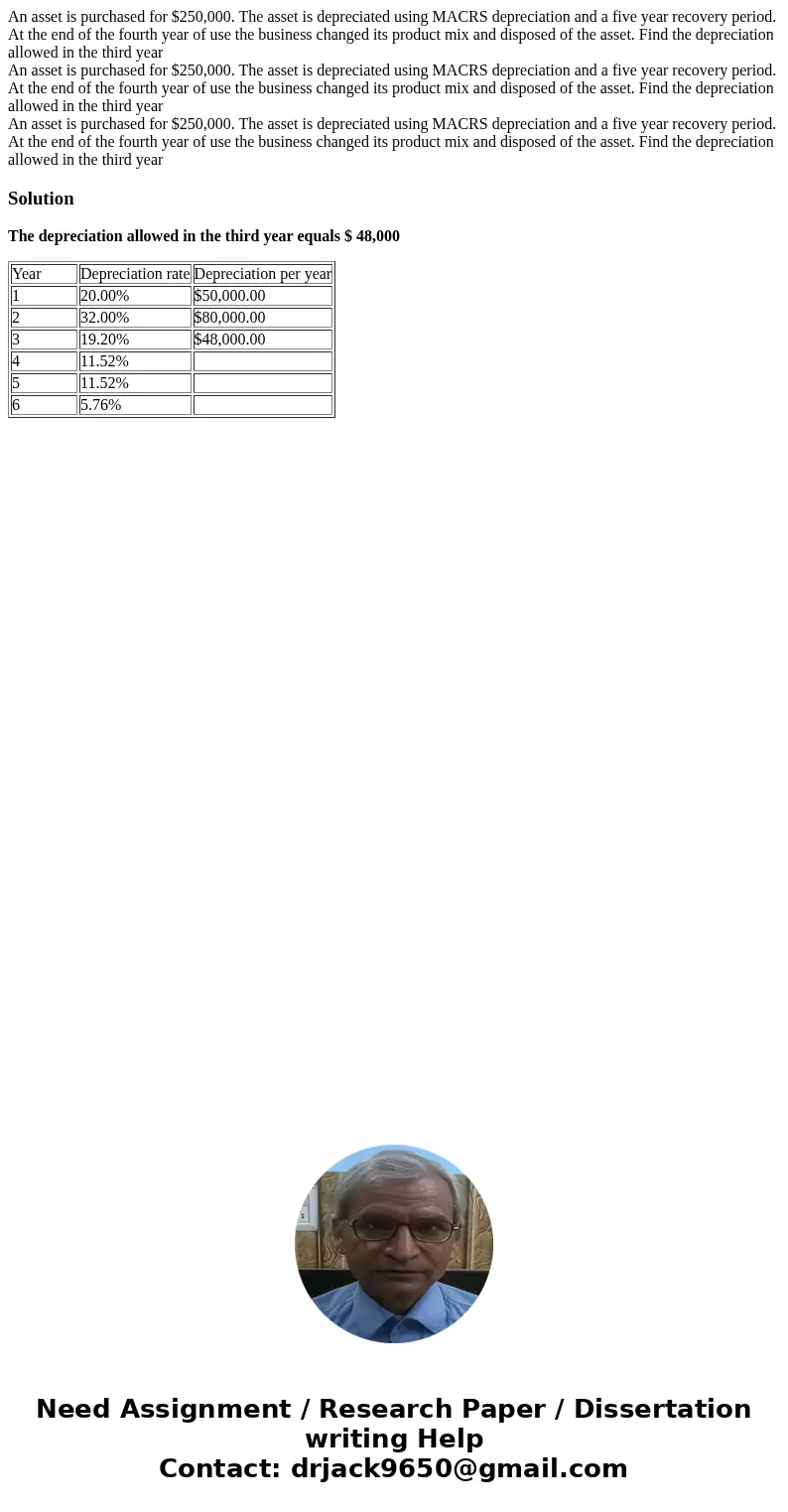

An asset is purchased for $250,000. The asset is depreciated using MACRS depreciation and a five year recovery period. At the end of the fourth year of use the business changed its product mix and disposed of the asset. Find the depreciation allowed in the third year

An asset is purchased for $250,000. The asset is depreciated using MACRS depreciation and a five year recovery period. At the end of the fourth year of use the business changed its product mix and disposed of the asset. Find the depreciation allowed in the third year

An asset is purchased for $250,000. The asset is depreciated using MACRS depreciation and a five year recovery period. At the end of the fourth year of use the business changed its product mix and disposed of the asset. Find the depreciation allowed in the third year

Solution

The depreciation allowed in the third year equals $ 48,000

| Year | Depreciation rate | Depreciation per year |

| 1 | 20.00% | $50,000.00 |

| 2 | 32.00% | $80,000.00 |

| 3 | 19.20% | $48,000.00 |

| 4 | 11.52% | |

| 5 | 11.52% | |

| 6 | 5.76% |

Homework Sourse

Homework Sourse