Given below is the preclosing trial balance for the General

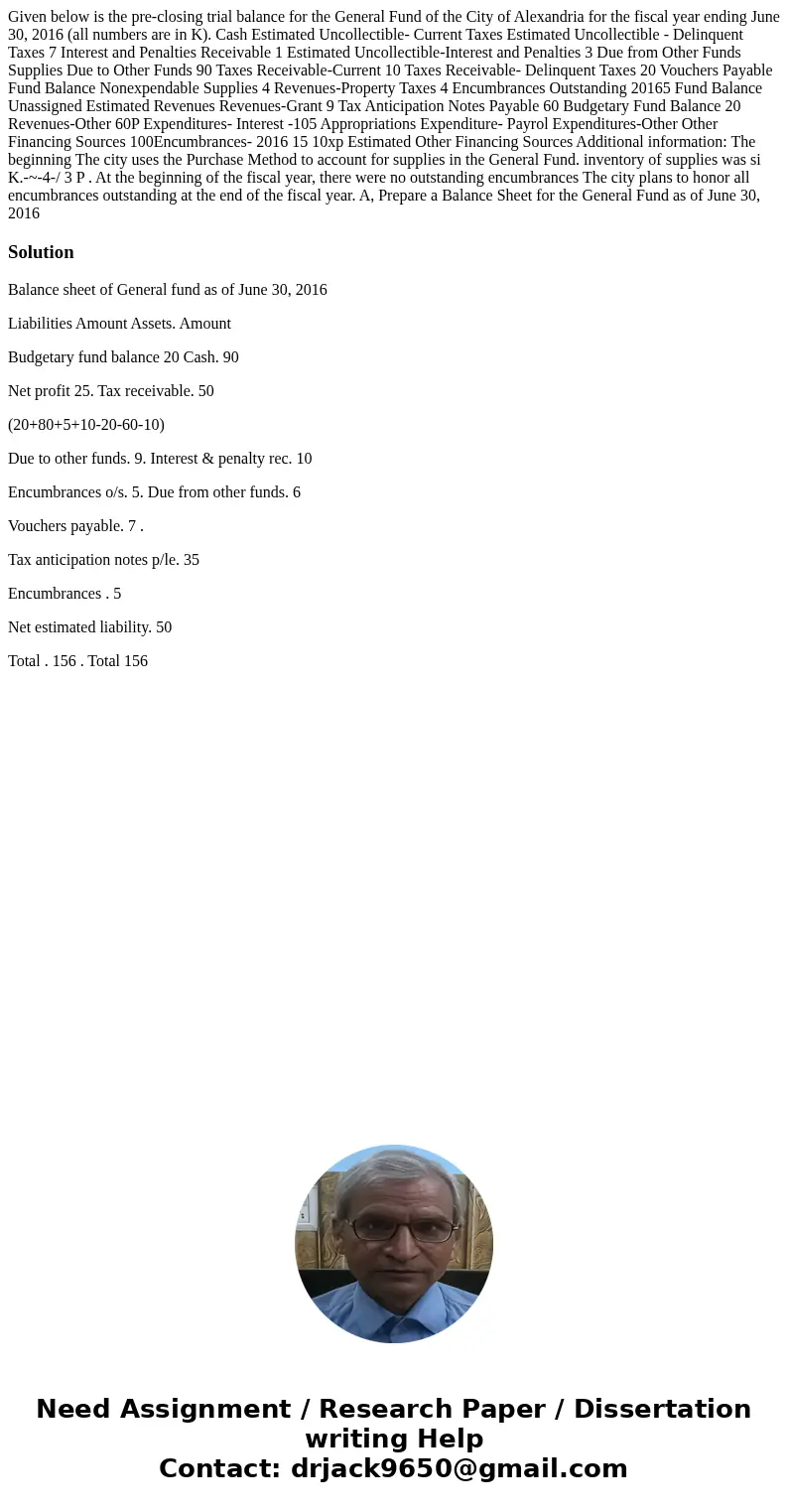

Given below is the pre-closing trial balance for the General Fund of the City of Alexandria for the fiscal year ending June 30, 2016 (all numbers are in K). Cash Estimated Uncollectible- Current Taxes Estimated Uncollectible - Delinquent Taxes 7 Interest and Penalties Receivable 1 Estimated Uncollectible-Interest and Penalties 3 Due from Other Funds Supplies Due to Other Funds 90 Taxes Receivable-Current 10 Taxes Receivable- Delinquent Taxes 20 Vouchers Payable Fund Balance Nonexpendable Supplies 4 Revenues-Property Taxes 4 Encumbrances Outstanding 20165 Fund Balance Unassigned Estimated Revenues Revenues-Grant 9 Tax Anticipation Notes Payable 60 Budgetary Fund Balance 20 Revenues-Other 60P Expenditures- Interest -105 Appropriations Expenditure- Payrol Expenditures-Other Other Financing Sources 100Encumbrances- 2016 15 10xp Estimated Other Financing Sources Additional information: The beginning The city uses the Purchase Method to account for supplies in the General Fund. inventory of supplies was si K.-~-4-/ 3 P . At the beginning of the fiscal year, there were no outstanding encumbrances The city plans to honor all encumbrances outstanding at the end of the fiscal year. A, Prepare a Balance Sheet for the General Fund as of June 30, 2016

Solution

Balance sheet of General fund as of June 30, 2016

Liabilities Amount Assets. Amount

Budgetary fund balance 20 Cash. 90

Net profit 25. Tax receivable. 50

(20+80+5+10-20-60-10)

Due to other funds. 9. Interest & penalty rec. 10

Encumbrances o/s. 5. Due from other funds. 6

Vouchers payable. 7 .

Tax anticipation notes p/le. 35

Encumbrances . 5

Net estimated liability. 50

Total . 156 . Total 156

Homework Sourse

Homework Sourse