At the beginning of 2015 your company buys a 31600 piece of

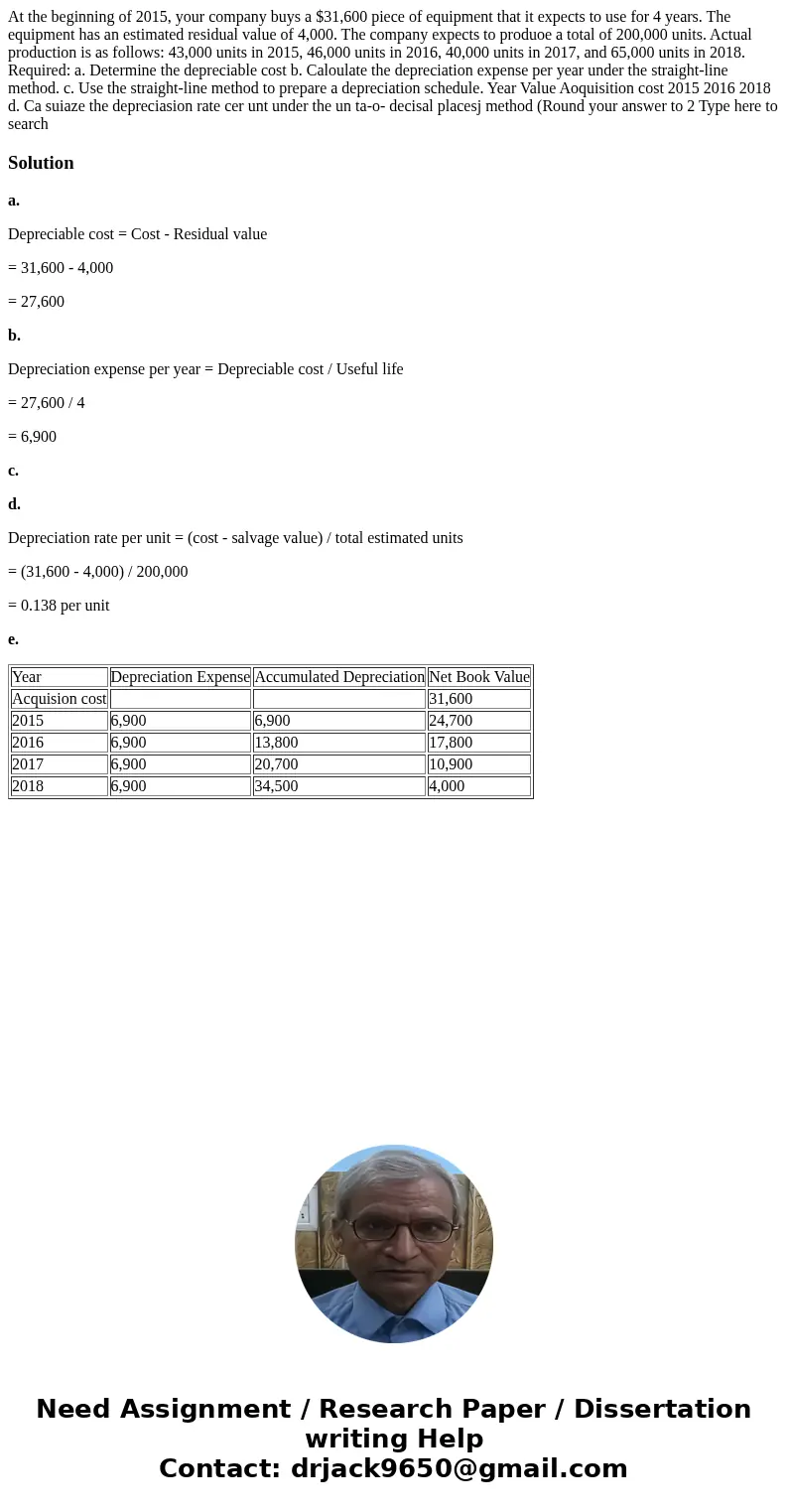

At the beginning of 2015, your company buys a $31,600 piece of equipment that it expects to use for 4 years. The equipment has an estimated residual value of 4,000. The company expects to produoe a total of 200,000 units. Actual production is as follows: 43,000 units in 2015, 46,000 units in 2016, 40,000 units in 2017, and 65,000 units in 2018. Required: a. Determine the depreciable cost b. Caloulate the depreciation expense per year under the straight-line method. c. Use the straight-line method to prepare a depreciation schedule. Year Value Aoquisition cost 2015 2016 2018 d. Ca suiaze the depreciasion rate cer unt under the un ta-o- decisal placesj method (Round your answer to 2 Type here to search

Solution

a.

Depreciable cost = Cost - Residual value

= 31,600 - 4,000

= 27,600

b.

Depreciation expense per year = Depreciable cost / Useful life

= 27,600 / 4

= 6,900

c.

d.

Depreciation rate per unit = (cost - salvage value) / total estimated units

= (31,600 - 4,000) / 200,000

= 0.138 per unit

e.

| Year | Depreciation Expense | Accumulated Depreciation | Net Book Value |

| Acquision cost | 31,600 | ||

| 2015 | 6,900 | 6,900 | 24,700 |

| 2016 | 6,900 | 13,800 | 17,800 |

| 2017 | 6,900 | 20,700 | 10,900 |

| 2018 | 6,900 | 34,500 | 4,000 |

Homework Sourse

Homework Sourse