1 Marginal tax brackets Aa Aa The amount of federal income t

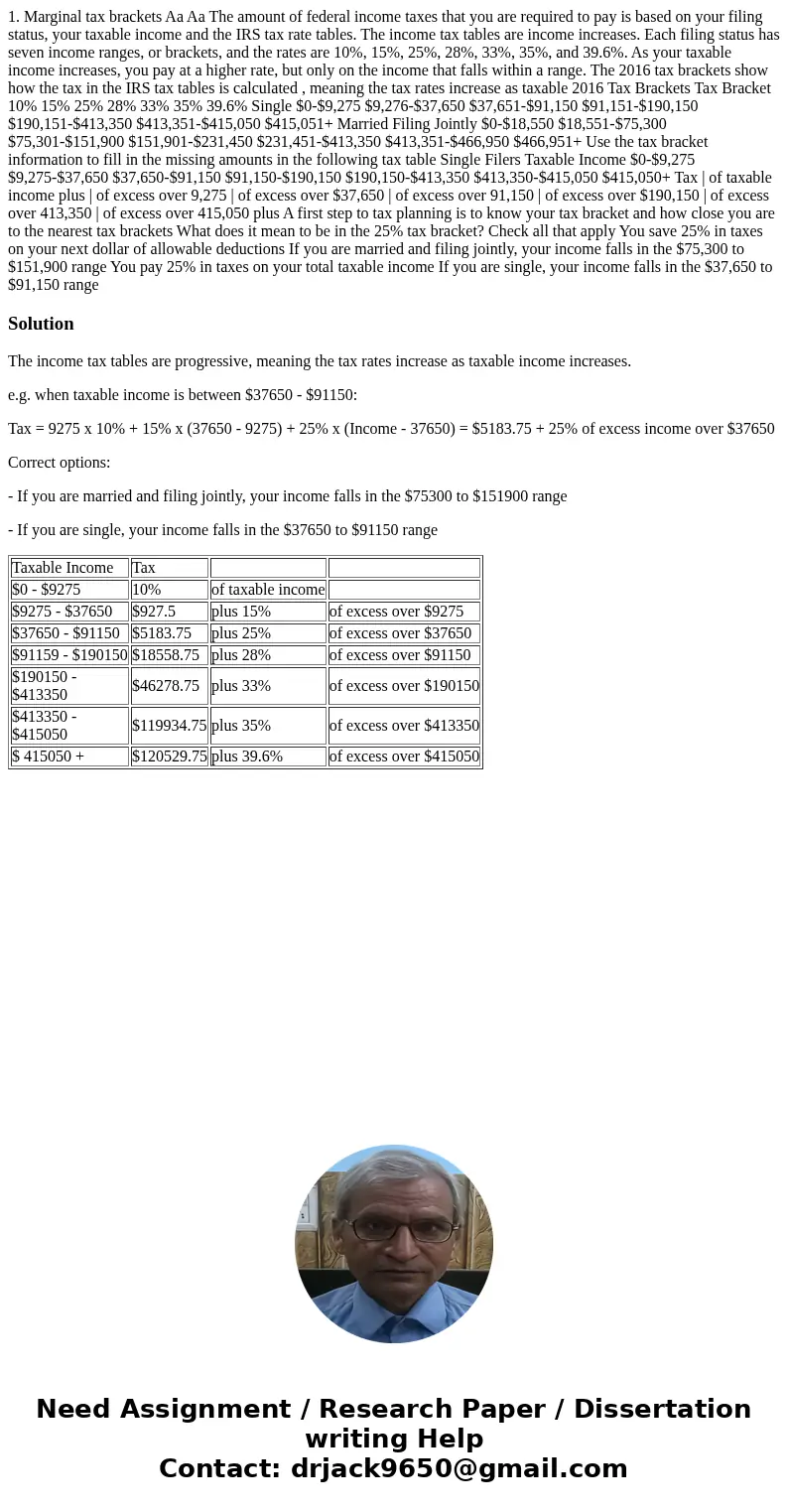

1. Marginal tax brackets Aa Aa The amount of federal income taxes that you are required to pay is based on your filing status, your taxable income and the IRS tax rate tables. The income tax tables are income increases. Each filing status has seven income ranges, or brackets, and the rates are 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. As your taxable income increases, you pay at a higher rate, but only on the income that falls within a range. The 2016 tax brackets show how the tax in the IRS tax tables is calculated , meaning the tax rates increase as taxable 2016 Tax Brackets Tax Bracket 10% 15% 25% 28% 33% 35% 39.6% Single $0-$9,275 $9,276-$37,650 $37,651-$91,150 $91,151-$190,150 $190,151-$413,350 $413,351-$415,050 $415,051+ Married Filing Jointly $0-$18,550 $18,551-$75,300 $75,301-$151,900 $151,901-$231,450 $231,451-$413,350 $413,351-$466,950 $466,951+ Use the tax bracket information to fill in the missing amounts in the following tax table Single Filers Taxable Income $0-$9,275 $9,275-$37,650 $37,650-$91,150 $91,150-$190,150 $190,150-$413,350 $413,350-$415,050 $415,050+ Tax | of taxable income plus | of excess over 9,275 | of excess over $37,650 | of excess over 91,150 | of excess over $190,150 | of excess over 413,350 | of excess over 415,050 plus A first step to tax planning is to know your tax bracket and how close you are to the nearest tax brackets What does it mean to be in the 25% tax bracket? Check all that apply You save 25% in taxes on your next dollar of allowable deductions If you are married and filing jointly, your income falls in the $75,300 to $151,900 range You pay 25% in taxes on your total taxable income If you are single, your income falls in the $37,650 to $91,150 range

Solution

The income tax tables are progressive, meaning the tax rates increase as taxable income increases.

e.g. when taxable income is between $37650 - $91150:

Tax = 9275 x 10% + 15% x (37650 - 9275) + 25% x (Income - 37650) = $5183.75 + 25% of excess income over $37650

Correct options:

- If you are married and filing jointly, your income falls in the $75300 to $151900 range

- If you are single, your income falls in the $37650 to $91150 range

| Taxable Income | Tax | ||

| $0 - $9275 | 10% | of taxable income | |

| $9275 - $37650 | $927.5 | plus 15% | of excess over $9275 |

| $37650 - $91150 | $5183.75 | plus 25% | of excess over $37650 |

| $91159 - $190150 | $18558.75 | plus 28% | of excess over $91150 |

| $190150 - $413350 | $46278.75 | plus 33% | of excess over $190150 |

| $413350 - $415050 | $119934.75 | plus 35% | of excess over $413350 |

| $ 415050 + | $120529.75 | plus 39.6% | of excess over $415050 |

Homework Sourse

Homework Sourse