ABC Co issues a 10 Year 8 Bonds the face value is 100000 and

ABC Co. issues a 10 Year, 8% Bonds, the face value is 100,000 and market rate is 10%, it is compounded semi-annually.

1. Will the bond be issued at a premium or discount? Why?

2. Calculate the Bond Price upon issue.

3. Prepare the Amortization Table using the Effective method

Solution

1. The 8% bonds issued when the market interest rate is 10% will be issued at a discount. The lower interest rate makes the bonds less attractive in the market due to which investors will pay lesser to acquire them.

2. Bond Price: $87539

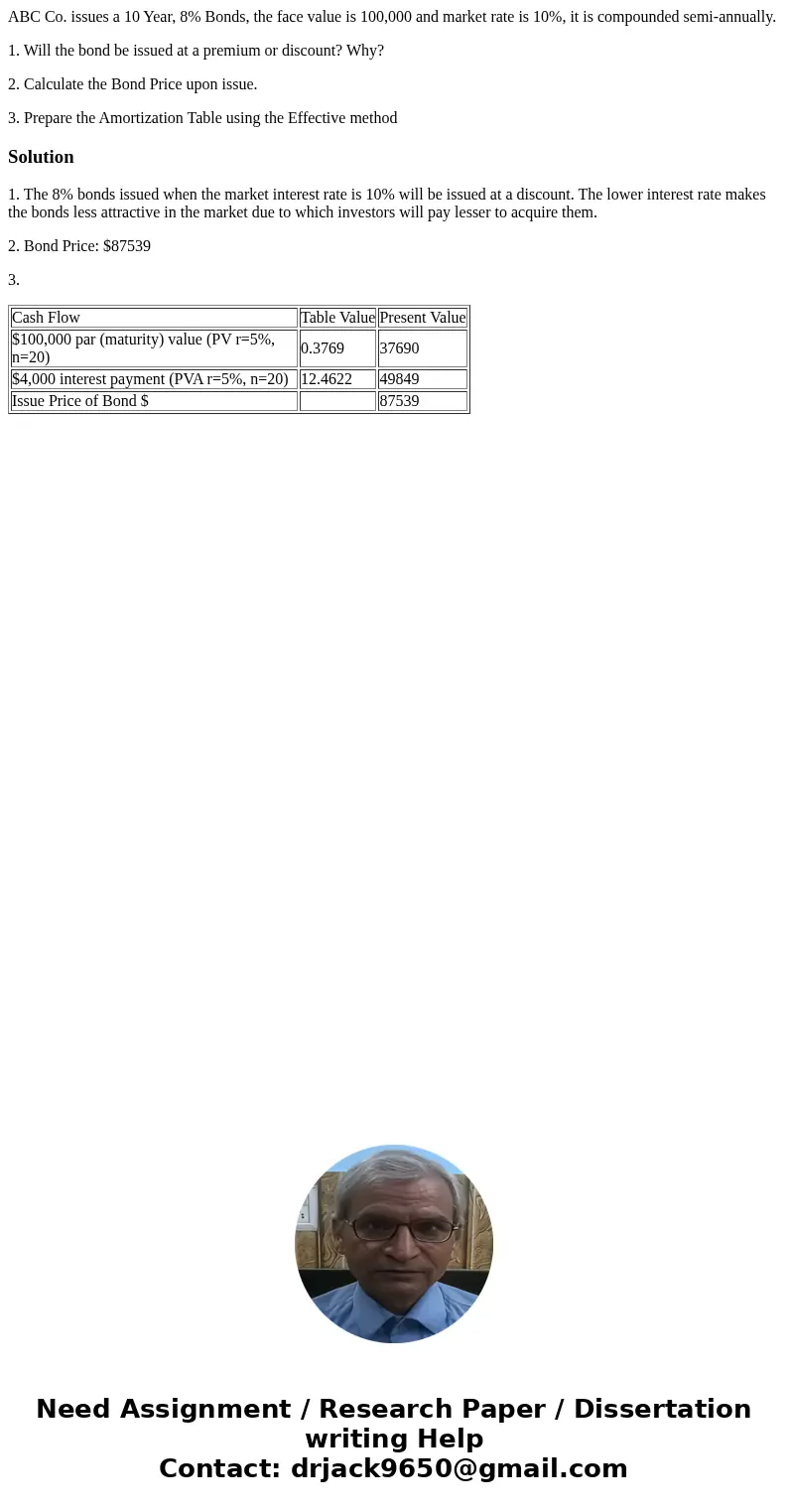

3.

| Cash Flow | Table Value | Present Value |

| $100,000 par (maturity) value (PV r=5%, n=20) | 0.3769 | 37690 |

| $4,000 interest payment (PVA r=5%, n=20) | 12.4622 | 49849 |

| Issue Price of Bond $ | 87539 |

Homework Sourse

Homework Sourse