6 Delley Inc is considering the acquisition of equipment tha

6. Delley Inc. is considering the acquisition of equipment that costs $340,000 and has a useful life of 6 years with no salvage value. The incremental net cash flows that would be generated by the equipment are: 9 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Incremental Net Cash Flows $94,000 $133,000 $96,000 $116,000 $115,000 $87,000 The payback period of this investment, rounded off to the nearest tenth of a year, is closest to: A) 3.9 years B) 3.6 years C) 3.1 years D) 5.0 years

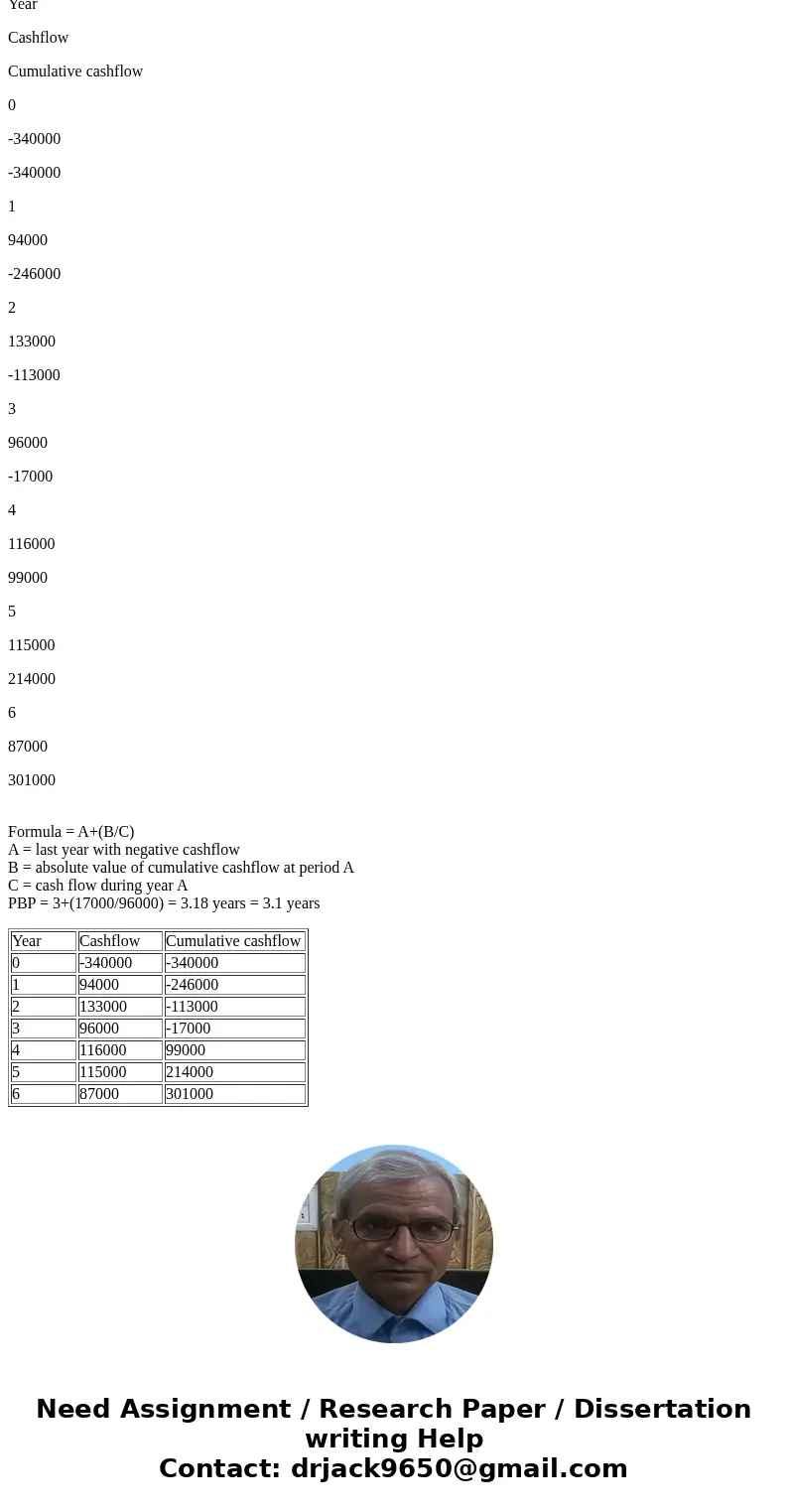

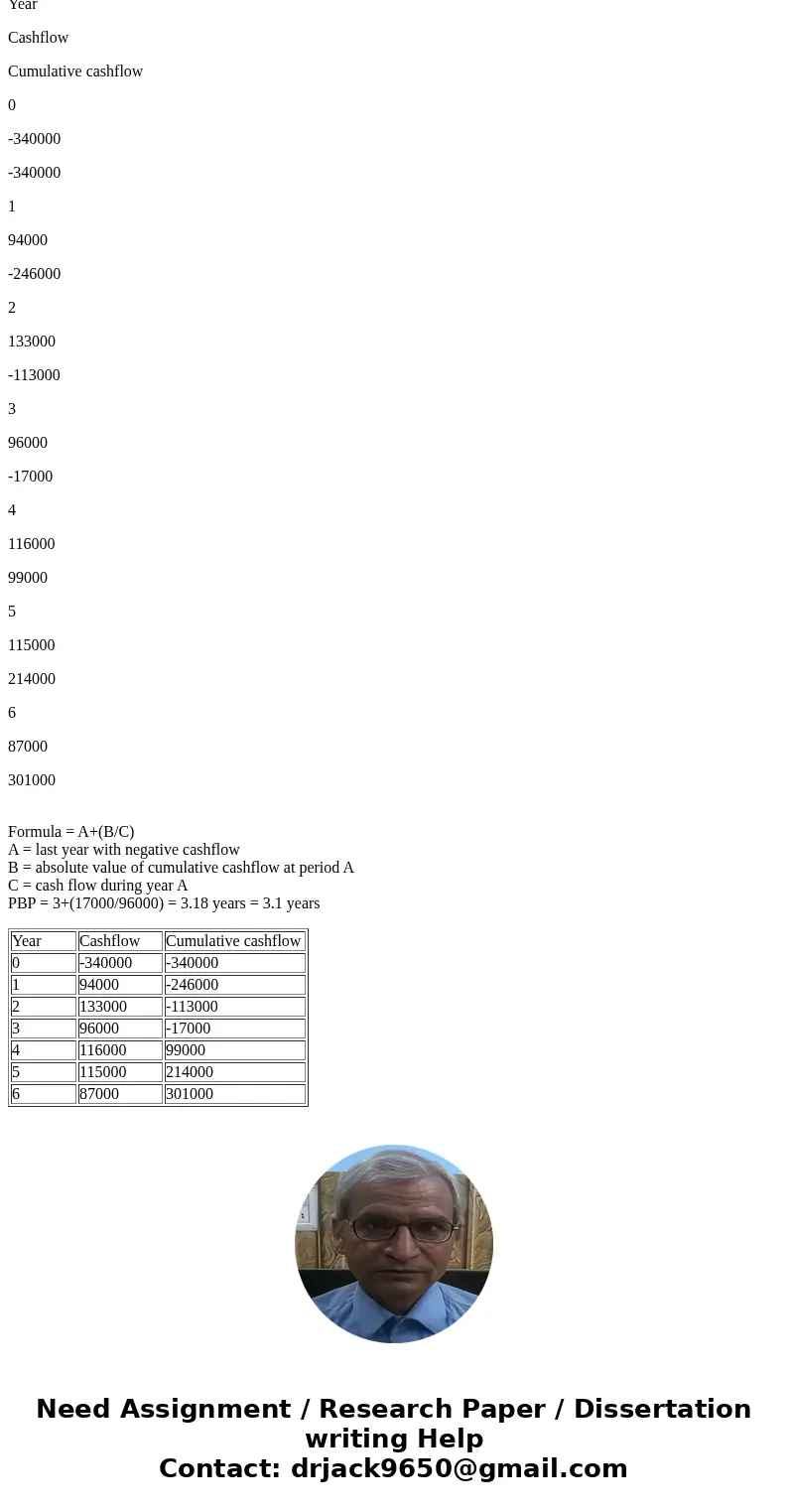

Solution

Option C)

Year

Cashflow

Cumulative cashflow

0

-340000

-340000

1

94000

-246000

2

133000

-113000

3

96000

-17000

4

116000

99000

5

115000

214000

6

87000

301000

Formula = A+(B/C)

A = last year with negative cashflow

B = absolute value of cumulative cashflow at period A

C = cash flow during year A

PBP = 3+(17000/96000) = 3.18 years = 3.1 years

| Year | Cashflow | Cumulative cashflow |

| 0 | -340000 | -340000 |

| 1 | 94000 | -246000 |

| 2 | 133000 | -113000 |

| 3 | 96000 | -17000 |

| 4 | 116000 | 99000 |

| 5 | 115000 | 214000 |

| 6 | 87000 | 301000 |

Homework Sourse

Homework Sourse